- Kenyan Manufacturers Raise Objections over Finance Bill 2024 Proposals

- How COMESA project seeks to accelerate horticulture sector growth across East Africa

- 2024 Economic Survey: Kenya sparks growth with 848,200 new jobs in a year

- Kenya’s economy posts 5.6 per cent GDP growth in 2023

- The Crucial Role of Private Capital Africa’s Economic Development

- Kenya’s Marine Potential: Fostering Sustainable Blue Economy

- American nationals arrested in foiled attempt to overthrow President Tshisekedi

- The role of financial services in achieving financial inclusion in Rwanda and beyond

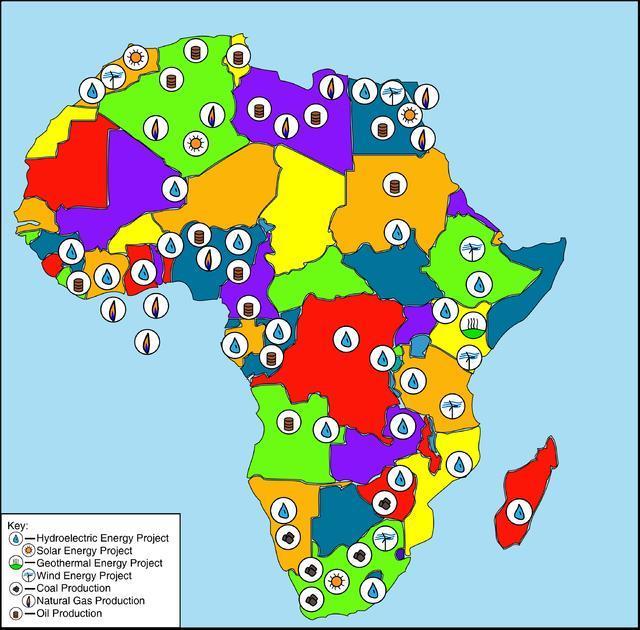

Extractive and Energy

- South Africa has adopted a number of measures aimed at boosting the country’s critical mineral industry.

- In January 2023, mining production experienced its twelfth consecutive month-to-month decline, recording a decrease of 1.9 per cent.

- According to the Minister of Mineral Resources and Energy Gwede Mantashe, the industry needs to advance a commitment to working together as stakeholders on the reconstruction and recovery of the mining industry.

South Africa’s vast reserves of critical minerals present a huge opportunity for the country to accelerate economic growth and boost employment creation, while ensuring the energy transition is just and inclusive.

Statistics South Africa recently released its key findings for the fourth quarter of 2022, wherein the real Gross Domestic Product (GDP) decreased by 1.3 per cent. According to the report, the mining and quarrying industry decreased by 3.2 per cent and thus contributed -0.1 per cent to the GDP growth.

Key to

The rapid snowballing of Africa’s rare earths metal production is set to become the world’s alternative source in 2023 and beyond, as global demand surges and world powers seek to wean off their dependence on China amid a new geopolitical multipolar world order. Africa’s vast reserves of rare earth metals have come under the radar of world powers fueled by the devastation emanating from the climate change crisis and calls for a drastic reduction in the growth and operations of extractive industries.

Furthermore, the race to net-zero emissions compounded by increased climate-induced natural disasters has intensified the green energy transition, instigating another scramble for Africa’s resources rare earth metals are at the heart of the race to green energy as well as providing opportunities for massive economic growth by injecting much-needed revenues to finance core socio-economic objectives in the continent.

Rare earth elements (REEs) refers to a group of 17 …

Africa has been hailed as the next frontier in the provision of global oil and natural gas resources, especially now in the wake of the ongoing Russia-Ukraine war.

This crisis has not only altered the global energy landscape, but also instigated an inflation in gas prices, given the former’s position in the hierarchy of major global producers. As sanctions continue to soar, Europe has embarked on a quest to find contingency energy supplies, as it seeks to minimize its dependency on Russia; which has already cut off gas supplies to countries like Finland, Poland and Bulgaria, over energy payment disputes.

Consequently, Africa’s gas resources have gained a newly found prominence, pertinently by the European Union (EU); owing to the continent’s rich endowment of oil and deep gas reserves. The mounting global demand for gas, has been pushing international energy companies to reconsider African projects. The numerous ongoing and upcoming oil …

The extractive industry in Tanzania is prone to substantial operational and management changes.

Since President John Magufuli took leadership, several mining sector advancements have been made in the course of 3 years, proving billions in return at a rather intriguing socio-political cost.

The latter can be reflected, in a recent development ushered by Ministry of Mining (on September 19th 2019) directing all gold produced from Biharamulo gold mine, operated by STAMIGOLD company a subsidiary of the State Mining Cooperation (STAMICO), to be sold within Tanzania, primarily in the newly established Biharamulo gold market, by December 2019.

During the first quarter in 2019, the mining sector saw a 10 per cent growth, which was attributed by increased gold production.

However, the mining industry contributed over 5.07 per cent to Gross Domestic Product (GDP) by 2018, this being a significant increment attributed by the ongoing reformation in the sector, compelling wider …

Armadale Capital, a London Stock Exchange’s AIM-listed investment company focussed on resource projects in Africa has secured an MOU with a China-based technology company CoolRU Information Technology for 5,000tpa of graphite concentrate produced at Tanzania’s Mahenge Liandu over an initial five-year period.

Armadale’s wholly-owned Mahenge Liandu Graphite Project is located in a highly prospective region, with a high-grade JORC compliant indicated and inferred mineral resource estimate announced February 2018 – 51.1Mt at 9.3% TGC. This includes 38.7Mt Indicted at 9.3% and 12.4Mt at 9.1% TGC, making it one of the largest high-grade resources in Tanzania.

Armadale acquired a 100% interest Mahenge Liandu in July 2016.

CoolRU was established in 2006 and is registered in WangJing Science Park in Beijing China. It is working closely with Geek+, the world’s leading provider of advanced robotics and AI technologies, to offer truly comprehensive intelligent logistics solutions to customers.

CoolRU is developing various applications …

Ethiopia rejected a proposal by Egypt to operate on the $4 billion hydropower dam Ethiopia is building on the Nile.

This rejection is further deepening the disputes between the two nations over the project being conducted by Ethiopia.

In a press conference in Addis Ababa Ethiopia’s capital, Sileshi Beleke, minister for water, irrigation and energy described Egypt’s plan, which includes the volume of water it wants the dam to release annually as “inappropriate”

He further said that the proposal from Egypt was unilaterally decided and did not consider their previous agreements.

“We can’t agree with this…we will prepare our counter-proposal.”

In 2011, the Grand Ethiopian Renaissance Dam (GERD) was announced, it is designed to be the centrepiece of Ethiopia’s bid to become Africa’s biggest power exporter, generating more than 6,000 megawatts.

The dam has been the center of disagreements between Ethiopia and Egypt as the two countries disagree over the …

Russia and Uganda have agreed to work together in the field of nuclear energy, Rosatom the Russian nuclear agency said on Wednesday.

Russia’s state-owned companies have been the key part of the strategy to bolster Moscow’s presence in Africa, as it seeks to strengthen its influence in Africa.

Ugandan President Yoweri Museveni is seeking to use his country’s uranium deposits to develop nuclear power.

The two countries signed an intergovernmental agreement to cooperate in the peaceful use of nuclear energy. The agreement was signed on the sidelines of the 63rd General Conference of the International Atomic Energy Agency, in Vienna, Austria, on Tuesday.

The agreement was signed by Nikolay Spassky, Deputy Director General – Director of international activities of Russian State Atomic Energy Corporation Rosatom, on behalf of Uganda by Eng. Muloni Irene Nafuna, the Minister of state for energy and mineral resources of the Republic of Uganda.

Also Read:

…Songas limited has paid the government TZS8.8 billion in dividends as a result of its shareholding in the Tanzanian gas-to-power company.

Songas is a strategic partner with the Government in meeting the growing demand for energy and includes ownership by Tanzanian sector entities, Tanzania Petroleum Development Corporation (TPDC), Tanzania Electric Supply Company Limited (TANESCO) and Tanzania Development Finance Company Limited (TDFL) as well as Globeleq, a leading independent power producer solely focused in Africa.

Songas Chief Financial Officer, Anael Samuel said TANESCO will receive about TZS2.2billion while TPDC will receive an estimated TZS6.6billion, both amounts will be subjected to withholding tax. The amounts are determined by each entity’s shareholding in Songas.

Additionally, the government also benefits from its 32% shareholding in TDFL, which receives about TZS 1.8 billion in dividends and also through the Tanzanian Revenue Authority from the withholding tax on dividends.

Since 2012 the company has paid TZS121.6 …

For over 20 years, Acacia and its forerunner mining companies including African Barrick Gold, Barrick Gold, Placer Dome, Pangea Minerals and Afrika Mashariki have been operating in Tanzania in three gold mines, Bulyanhulu, Buzwagi and North Mara, found in the north-west region of Tanzania.

Acacia-Tanzania’s largest gold producer was recently cleared by the Magufuli government and resumed its metal concentrates exportation after a series of regulations led by The Mining Commission of Tanzania Ministry of Minerals that impeded the export of the mineral.

In a press release published by Acacia on 15th August, export permits are now received by Acacia that noted to have missed 30 percent of sales since the ban went live.

Despite the latter, Acacia and Tanzania could mutually benefit form the mining industry which has grown by 10 percent in the first quarter, according to Tanzania’s National Bureau of Statistics (NBS) 2019 first quarter highlights.…