- History beckons as push for Kenya’s Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

- Empowering the Future: Humanity Protocol’s Dream Play Initiative

- TikTok Community Guidelines update aims to curb hate speech and misinformation

- Rwanda sees 39% surge in bank borrowers as Sacco and MFI loan uptake declines

- Kenya Ports Authority wins dispute case over cargo release

Money Deals

- A key component of successful cryptocurrency investment is utilizing cryptocurrency exchanges effectively.

- The USDT/SOL exchange pair refers to the trading of Tether (USDT) against Solana (SOL) on a cryptocurrency exchange.

- Solana, on the other hand, is a blockchain platform designed for decentralized applications and crypto-native projects.

Cryptocurrency investments have gained significant popularity in recent years, providing individuals with opportunities to grow their capital in the digital asset space. One of the key components of successful cryptocurrency investment is utilizing cryptocurrency exchanges effectively. In this blog, we will explore the concept of using exchanges to grow your capital, with a specific focus on the USDT/SOL exchange pair.

What is the USDT/SOL exchange pair?

The USDT/SOL exchange pair refers to the trading of Tether (USDT) against Solana (SOL) on a cryptocurrency exchange. Tether is a stablecoin pegged to the value of the US dollar, providing investors with a stable and reliable cryptocurrency …

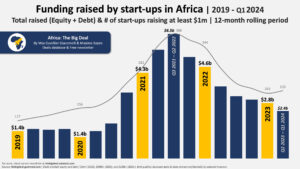

- 121 African startups secured $466M, marking a 27 per cent drop from the previous quarter; women-led startups got 6.5 per cent of the capital.

- About 87 per cent of startup funding in the three months to March went to entities in Nigeria, Kenya, Egypt, and South Africa.

- Gender imbalance persists as only 6.5 per cent of the financing went to female-led startups in Africa.

The big four economies of Nigeria, South Africa, Kenya, and Egypt continue to attract the highest share of funding going to startups in Africa, even as the ecosystem suffered a 27 per cent drop in financing to $466 million in the three months to March 2024.

The latest analysis from Africa: The Big Deal shows that 87 per cent of startup funding in the three months to March went to upcoming entities in Nigeria, Kenya, Egypt and South Africa.

Attracting $160 million, Nigeria’s economy accounted for …

- mTek, an insurtech innovation platform, has secured a $1.25 million investment from Verod-Kepple Africa Ventures and Founders Factory Africa to fuel its expansion across East Africa.

- The firm aims to streamline the insurance process, enhance customer experiences, and improve operational efficiency.

- This investment and expansion plans underscore mTek’s commitment to making insurance more accessible and affordable.

The insurance sector across East Africa is poised to experience intense activity following plans by the digital platform mTek to revamp the industry. mTek, a pioneering digital insurance platform, has secured $1.25 million (approximately Sh167.8 million) in funding from Verod-Kepple Africa Ventures (VKAV) and Founders Factory Africa (FFA) to spearheaded this investment, which is poised to catalyze its strategic expansion across East African region.

This capital infusion will strengthen mTek’s position as a leader in insurtech innovation, using state-of-the-art technology to revolutionize the uptake of cover services.

At the heart of mTek’s mission is …

- TransCentury Plc’s right issue is set to be reopened following approval from the Capital Markets Authority (CMA) after the initial issue failed to hit a 50 per cent threshold.

- Unfortunately, the rights issue performed below expectations, and as a result, CMA has invoked its powers under Section 14 of the Public Offers and Listings Regulations to allow TransCentury to reopen the issue.

- The rights’ issue will be open from March 20 -30 this year with additional information provided in the secondary prospectus to be issued by March 17 as the firm seeks shareholders’ approval to enable the conversion of shareholder loans to ordinary shares as a mode of payment for rights.

TransCentury Plc’s right issue is set to be reopened following approval from the Capital Markets Authority (CMA) after the initial issue failed to hit a 50 per cent threshold.

TC shareholders had until January 23, 2023 to take …

- I&M Group PLC has appointed East African Breweries Limited Group Chief Financial officer Risper Genga Ohaga as an Independent Non-Executive Director of the Company.

- Ohaga is a seasoned finance professional with over 23 years’ experience in Financial Management, Strategy, Audit and Risk Management spanning multiple countries.

- She holds a Bachelor of Commerce (BCom) from University of Nairobi, is a Certified Public Accountant of Kenya (CPA-K) and a Certified Internal Auditor (CIA).

I&M Group PLC has appointed East African Breweries Limited Group Chief Financial officer Risper Genga Ohaga as an Independent Non-Executive Director of the Company.

Ohaga is a seasoned finance professional with over 23 years’ experience in Financial Management, Strategy, Audit and Risk Management spanning multiple countries. She holds a Bachelor of Commerce (BCom) from University of Nairobi, is a Certified Public Accountant of Kenya (CPA-K) and a Certified Internal Auditor (CIA).

“The Board is pleased to welcome Ms. Ohaga …

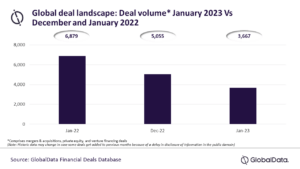

- Global deal activity down 27.5 percent Month-on-Month (M-o-M) and 46.7 percent Year-on-Year (Y-o-Y) in January 2023.

- All the deal types under coverage witnessed massive double-digit decline

- According to the data, a total of 3,667 deals* were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 percent Y-o-Y (Year on Year) decline over January 2022.

Mergers and acquisitions, private equity, and venture financing deal activity is off to a slow start in 2023 globally as the first month of the year itself saw a significant contraction in deals volume according to the latest data from GlobalData, data and analytics company.

According to the data, a total of 3,667 deals were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 …

- Equity Bank (Kenya) Limited (EBKL), has completed the acquisition of certain assets and liabilities of teachers-owned Spire Bank Limited following regulatory approvals.

- With completion of the transaction, customers holding deposits in Spire Bank, other than the remaining deposits from Spire Bank’s controlling shareholder, and specified loan customers will now transition to become EBKL customers, having new Equity Bank accounts.

- The decision to acquire Spire Bank’s certain assets and liabilities was inspired largely by the banks’ history with teachers who have continued to support the Bank over the years.

Equity Bank Kenya Limited (EBKL) has completed the acquisition of certain assets and liabilities of Kenyan teachers’ owned Spire Bank Limited following receipt of regulatory approvals.

The bank had to get approvals from the Cabinet Secretary Treasury and Planning under Section 9 (1) of the Banking Act, the Central Bank of Kenya under Section 9, ( 5) of the Banking Act, the …

- Female-led and female-founded ventures attracted even less funding in 2022 than they had in 2021.

- Female-led start-ups in Africa have raised $188m (4%) in 2022, while male-led ventures raised $4.6bn (96%).

- The number of $100k+ deals announced by female-led start-ups has also seen a YoY decrease, (128 in 2022 vs. 141 in 2021) and relatively (13% vs. 16%).

Female-led and female-founded ventures attracted even less funding in 2022 than they had in 2021, latest data from Africa’s The Big Deal shows.

According to the report, female-led start-ups in Africa have raised $188m (4%) in 2022, while male-led ventures raised $4.6bn (96%). In other words, 25x times less funding has been invested in female-led start-ups in 2022, compared to their male-led counterparts.

“Year-on-year, the amount of funding raised by female CEOs has decreased between 2021 and 2022, both in absolute ($188m in 2022 vs. $290m in 2021) and relative numbers (3.9 …

- Agriculture deals worth $25Mn will be struck next month as investors throng the Kenyan capital for the 6th edition of Africa Agri Expo (AAE) in February 2023.

- Over 100 investors and potential business leads in the agriculture value chains from 35+ countries, are keen on setting up businesses and distribution set-ups in Kenya.

- The agricultural 2-day event will happen on 8th February to 9th February at the Kenyatta International Convention Centre (KICC) and is designed to provide solutions to Farmers, Agribusiness professionals, Agronomists, Government representatives to improve their yields and revenue.

Agriculture deals worth $25 million are expected to be struck next month as investors throng the Kenyan capital for the 6th edition of Africa Agri Expo (AAE) in February 2023.

TAB Group Chief Executive Officer Tahir Bari said over 100 investors and potential business leads in the agriculture value chains from 35+ countries are keen on setting up businesses …