South Africa’s economic performance during 2022 was mixed.

The country that has been plagued by sluggish economic growth managed to break with the negative news flow. The country’s national statistics agency reported that the country’s inflation rate was slowing down. Stats SA reported in September that inflation had cooled for the second month.

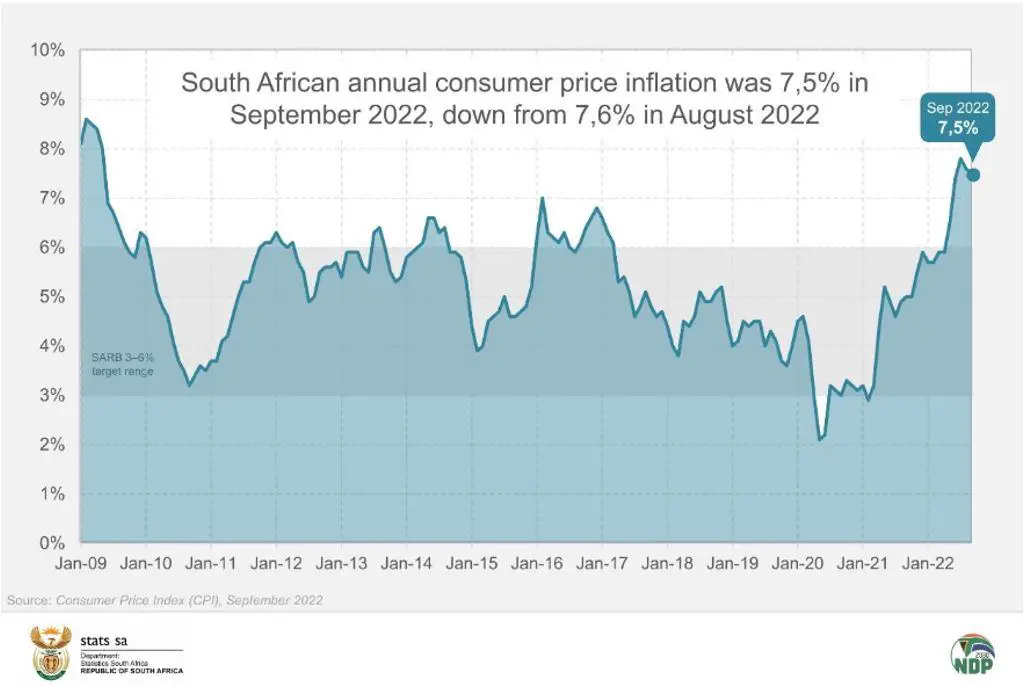

“Annual consumer price inflation slowed to 7,5 per cent in September from 7,6 per cent in August, edging further down from the 13-year high of 7,8 per cent recorded in July. Fuel prices declined for a second consecutive month, contributing to the softer headline rate,” the agency’s website notes.

- South African economic growth was sluggish in 2022. The macroeconomic fundamentals and indicators showed inflation slowing during the third quarter of 2022.

- The slowdown in South Africa’s inflation metrics contrasts the general inflation trend prevailing worldwide.

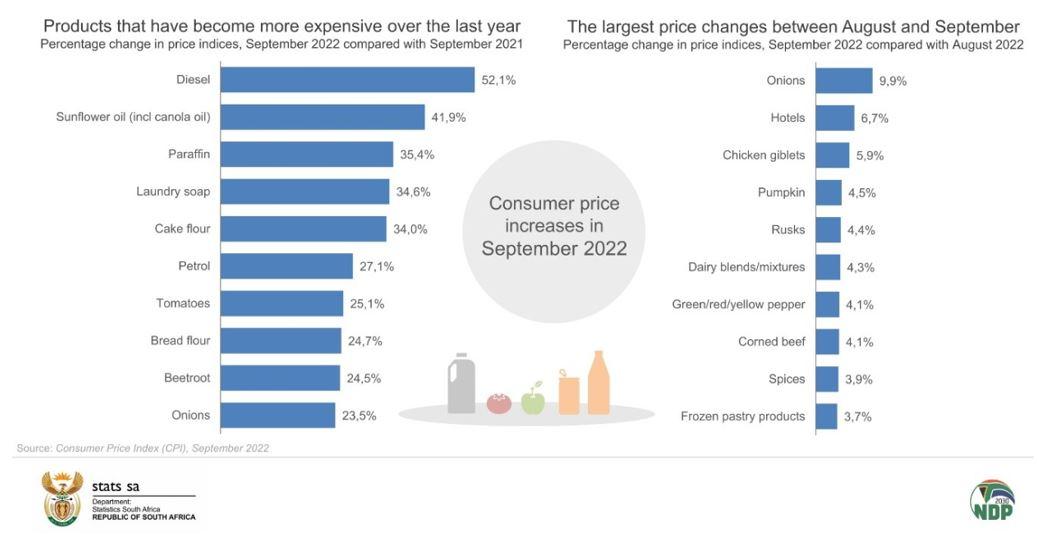

- South African inflation like the rest of the world, however, was driven by increases in food prices which were themselves driven by the rise in the cost of inputs.

This positive development is in contrast to what typically fills newspaper space in the media. Globally inflation is on the rise and it is coupled with low growth resulting in stagflation. For South Africa to report slowing inflation is exemplary.

According to Stats SA, during 2022 inflation in South Africa was driven by sharp increases in food, non-alcoholic beverages, and fuel prices. This position is consistent with the global narrative of inflation being driven by demand pull factors like excess liquidity creating more demand than there is supply. Inflation worldwide is being driven by cost push factors from disrupted supplies and rising costs of raw materials namely energy, fertilizers, and food.

The South Africa government agency went on further to state that, “The CPI excluding these two categories registered an annual increase of 4,9 per cent, up from 4,6 per cent in August, indicating that higher inflation has spread beyond these two groups.” Softening inflation is the result of declining fuel prices which decreased by a significant 6.4 per cent between August and September. The government through its agency acknowledges that although price levels for goods continue to increase, they softened during the August September period of 2022.

Mozambique: Defying debt trap to become Africa’s South Korea

Bread, cereal and meat inflation showed a similar pattern. The annual rate for bread & cereals accelerated to a 13-year high of 19,3 per cent in September. The monthly rate was 1,3 per cent, softer than the 3,1 per cent reading in August. Annual meat inflation increased from 9,2 per cent to 9,9 per cent, while the monthly reading slowed from 0,7 per cent to 0,5 per cent. Although fuel prices have reduced which should give some reprieve to consumers other cost of living categories are still expensive.

- Sovereign debt levels for the South African economy are worryingly high despite the positive traction that country achieved in other areas of the economy.

- South Africa’s public debt stock stands at 71.4% of GDP against IMF recommended levels of 40%. This is macroeconomic trend is common with several countries in Africa which have unsustainably high levels of debt.

Food prices have like the cost of fuel started to slow down, however, increases in rentals, clothing, accommodation services and personal care have experienced notable price increased across the board. This continued increase in these cost categories impacts the consumer directly and in an adverse manner.

This is where the country stands with respect to inflation. The minister of finance Enock Godongwana presented the Mid-Term Budget Statement last month and struck a strong optimistic cord during the presentation. This is according to an article carried by Investec, the boutique investment bank titled, “Medium term budget: Godongwana strikes an optimistic tone”.

The article written by the bank’s chief economist Annabel Bishop highlighted the major themes from the MTBS which were an improved GDP and lower borrowings. The article notes that gross debt is projected to now peak at 71.4 per cent of GDP in 2022/23, more quickly now than the previous peak estimated at 75.1 per cent of GDP in 2024/25.

Read: Cabo Verde sovereign debt and economic profile

What this means is that South Africa managed to reduce the debt it has on its books relative to the size of its GDP. It must be noted that despite this positive economic development the proportion of debt relative to GDP is still quite high but it is not as high the ratios of other countries on the African continent.

The IMF recommends that sustainable levels of debt should be about 40 per cent of GDP and South Africa regardless of the positive traction on this front, overshoots the optimal debt to GDP ratio by at least 31 percentage points.

The amount of debt a country has on its books can become inflationary when a number of factors occur. The first is when the debt is foreign currency denominated and the currency of the borrowing country begins to depreciate or weaken in value or interest rates in the borrowed currency begin to rise.

This causes the cost of borrowing and servicing that debt to rise. To be able to service their financing obligations countries would then have to increase taxes which have the effect of reducing consumer income and increasing the cost of goods and services. If the debt is in local currency like that of Eritrea the same government can simply defer the maturity of its debts to the future in perpetuity.

If the said government has to repay its debts in local currency, it can simply pull the money out of thin air by increasing the level of money supply in the economy. So, the debt to GDP ratio of a country is always an important indicator to watch for stakeholders. South Africa is on the right path in that it is paying down its debts.

“The declining ratios are due to some drop in borrowings and a revenue overrun, but key is the upwards revisions to its GDP forecast by National Treasury in order to account for higher inflation, with both the gross loan debt and deficit ratios lower as a percentage of GDP. The 2022/23 budget deficit is now projected at -4.9 per cent of GDP versus the -6.0 per cent of GDP estimated for this fiscal year in February,” Investec said.

- Excessive public debt can have an adverse impact on certain economic indicators like inflation especially in a cost push inflation and weakening local currency environment. This is a macroeconomic vulnerability South Africa cannot afford.

- In its favor, South Africa has been paying down its debts and its debt to GDP ratio is set to decrease.

In terms of the fiscus, South Africa expects to run a deficit of -4.1 per cent in 2023, however, the deficit is expected to narrow for the next 3 years closing 2026 at -3.6 per cent. This demonstrates significant fiscal consolidation.

Over the next 3 years the South African government expects to consolidate its public finances and reduce its deficit by inter alia increasing revenues and or managing or containing costs. According to Investec, “The current fiscal year (2022/23) has seen a substantial boost to nominal (actual) GDP due to high inflation, which has eased both the fiscal debt and deficit projections as a per cent of GDP, although does not boost real GDP, which is the measure of the country’s growth and has the distorting effect of inflation removed.”

Among countries in Africa, South Africa is getting its public financial act together. The country is paying down its debts, inflation has been showing a strong downward trajectory. What remains to be seen is whether this decreasing inflation rate will continue.

The government is consolidating its fiscal position as evidenced by the reducing fiscal deficit which is projected to narrow in the next few years. Inflation has played an important role in reducing the amount of debt on the books of government.

On the trade front, South Africa due to its mining industry and the elevated prices of minerals is enjoying a very healthy in flow of foreign exchange from mineral exports. The currency has been weakening however reaching lows of ZAR 18.15 against the United States dollar.

It must be noted however, that the weakness of the Rand is not entirely symptomatic of poor macroeconomic fundamentals but rather the resurgent strength of the United States dollar.