- Banking industry in South Africa staged a strong come back in 2021 in report by PWC.

- Banks enjoyed supportive credit conditions in the economy of South Africa.

- Banking industry is widely seen as a proxy of the general economy in South Africa

- South African economy has returned to pre-pandemic levels as evidenced by the financial performance of banks according to PWC

The banking industry in South Africa is in for good times according to a report by PWC. The banking industry sector analysis and report by the global management consulting firm published in March 2022 reports that the major South African banks delivered strong financial performance against what PWC described as “supportive conditions”.

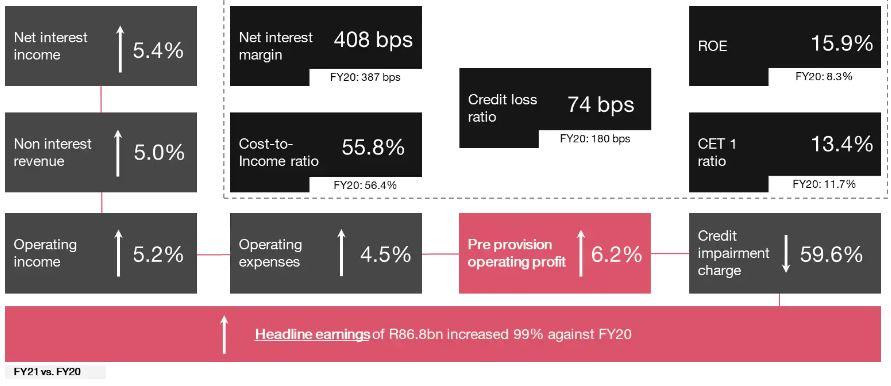

The banking industry had combined headline earnings of ZAR 86.8 billion which represented a 99% increase from 2020 financial year levels. Banks had a combined return on equity (ROE) of 15.9% compared to 8.3% achieved in 2020, net interest margins were 408 basis points (bps) compared to 387 bps in 2020, the cost to income ratios in 2021 stood at 55.8% compared to 56.4% the previous year.

Read: PwC Revenues Increase By 10 Percent Globally

These strong financial fundamentals point to a strong resurgence in the sector. The state of the banking sector is often taken as a proxy for the state of the general. Taking this line of thinking would lead stakeholders to believe that the South African economy is generally on the mend and that the COVID-induced recession is now in the rear view. For the banking industry according to the PWC report, the year 2020 began with a brief period of normality and then the pandemic dominated the entirety of that year into 2021.

Having to learn how to navigate the extreme uncertainty during the early stages of the pandemic together with shifts to new ways of working and delivering financial services helped the major banks to sharpen their focus on stability, innovation, and digitally led operational excellence.

https://www.salesforce.com/eu/customer-success-stories/standard-bank/

Banks in South Africa generally delivered in 2021, strong results attributed to a rebound in economic activity and increased consumer confidence, increased client engagement levels and gains from digital centric strategies, the PWC report said. The PWC further notes that the following themes and or factors will be responsible for enhanced financial performance of the banking sector:

PwC paints a rosy picture for Kenya’s, Tanzania’s Hotel industry

Supportive economic conditions and an improved credit cycle. This is said to have provided the basis for an unwind in risk provisions across loan portfolios. Put simply this means that in 2021 banks became more comfortable with lending to their clients than they were in 2020.

Credit impairment charges stood at 59.6% on a year-on-year basis which means that that quality of the loans banks had underwritten, or advances improved with significantly lesser loans being written off because they had either become delinquent or bad. This improved credit quality of the loan books of the banks spurred the headline earnings of the sector to levels that were last recorded prior to the pandemic.

One would be tempted to think with the good times that the banking industry is enjoying that banks have now dispensed with risk provisions. This is not the case the banks generally are still taking a prudent stance to managing macro risks which are still prevalent in the South African economy.

Bank results for 2021 reflect positive credit performance, heightened or increased client transactional activity which combined to produce the resilience that the sector experienced in operating profit growth. Revenues enjoyed strong contribution from broader financial services in addition to financial services like insurance, asset management in terms of non-interest income.

Risk appetite management and disciplined approaches to credit management remain observable and will remain in place going forward. Presently, South Africa is in a low interest rate environment economically. These conditions together with pent up consumer demand will have the impact of driving up growth. A caveat is in order here however, low interest environments have historically been known to lead to inflationary pressures on the economy in the best-case scenarios.

In the worst of cases a low interest rate environment can lead to speculative behavior among banks and borrowers. This speculative behavior can in the worst of instances lead to negative economic externalities like an economic crash or slump. What comes to mind in this case is the subprime mortgage crisis in the United States which them negatively impacted the rest of the world. The origins of this crisis according to general economic scholars was traced back to the monetary authorities’ decision to reduce interest rates to near zero in 2001.

Read: https://theexchange.africa/investing/africas-development/uber-partners-with-pwc-nigeria/

Credit quality is on the rise and is characterized by declining non-performing loans. The evidence of this according to the report are the efforts to collect on debts, improving client repayments and what the report calls the migration of credit to lower bands. Banks will continue to focus on and invest in digital banking capabilities resulting in positive client satisfaction scores and experience sentiment. These efforts, the report said were responsible for the increase in digitally active clients which it says grew by 8% in 2021 against 2020 and 22% against 2019.

Capital and liquidity provisions were consistently maintained and increased in 2021. Tight cost control and growth in expenses are said to have been kept below the general inflation level. PWC expects that cost reductions will come from productivity increases as banks double down on their digital strategies.

Changes in the scope and delivery of financial services will continue to shape banks across the African continent. Africa is the largest adapter of mobile money transfer systems accounting for 70% of global money transaction according to research by the Brooking Institute. Closely related to this and equally critical is that data is now a strategic asset because of its potential to inform product innovation and to scale new business areas. This has led and will continue to lead to investments in new skills from data scientists to engineers.

https://theexchange.africa/countries/south-africa/driving-force-brains-capitec-bank-holdings/

Banks will partner with players in the tech space in their efforts to accelerate cloud adoption and the use of emerging technologies. Standard Bank Group, the largest lender in Africa by assets announced 2 years ago its partnership with US based giant tech firm Salesforce to aid its transition and evolution from being a financial services firm to a tech enterprise. It is in partnerships like these that the greatest competitive advantages for banks will emerge. Artificial intelligence will be foundational in terms of customer experience and digital change.

Banks like other sectors are giving priority to regulatory and social issues. Climate change and ESG issues are taking centerstage. Banks going into the future will play a key role in facilitating the transition to net zero as economies, markets, and companies adapt to evolving climate policy. Innovations like the green bonds and related ESG products will make up a good portion of bond issuances going forward.

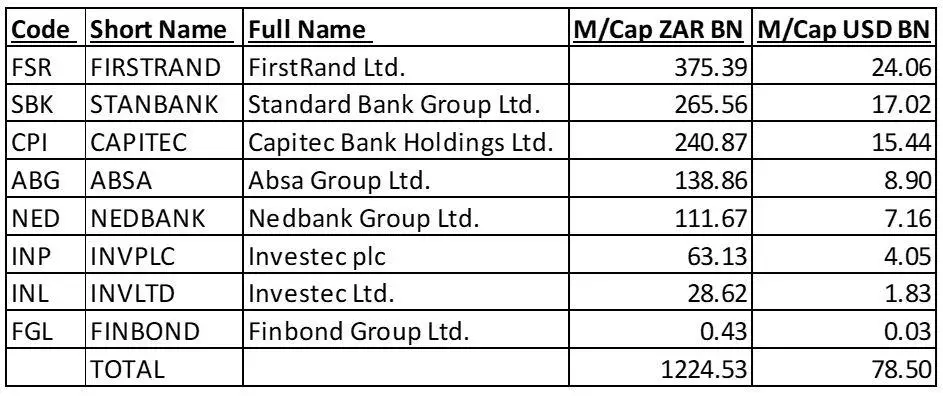

Stocks to watch…

https://theexchange.africa/investing/the-jse-an-emerging-markets-treasure-trove/