The International Monetary Fund (IMF) which has so far lent about $491.5 million to Uganda said that it is a misconception to assume that Uganda’s debt is unsustainable.

Uganda’s public debt levels are within a manageable threshold in the long term, noted Izabela Karpowicz the IMF Resident Representative for Uganda.

“We used to rate Uganda at low risk and now it will be moving to medium risk and this is due to Covid-19. It is not correct to say the debt is not sustainable over the medium and long term.” Ms Karpowicz said on the sidelines of a policy dialogue on Uganda’s economy, which was organised by the Civil Society Budget Advocacy Group (CSBAG) and the Advocates Coalition for Development and Environment (ACODE).

She noted that how resources that are being borrowed now and in the future will be deployed productively should be what Ugandans should be worried about and not the debt levels. She also said that Uganda can naturally grow out of debt as long as the funds borrowed can spur growth.

Speaking on how Uganda can navigate the tough economic situation as a result of the pandemic, Ms Karpowicz said “We would like to see strong budget allocation in the social sector going forward.”

She asked Uganda’s to spend more on social sectors such as health and education on which spending had decreased sighting that investments in the sectors will trigger and drive the recovery process.

The IMF representative said that Uganda’s economy can be put on a sustainable growth path through a balance between infrastructure and social development.

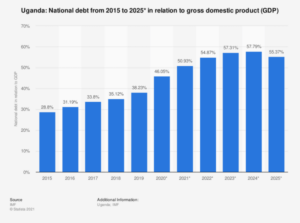

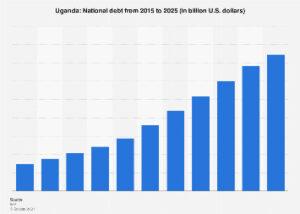

In 2019/2020 FY Uganda’s stock of public debt grew by 21 per cent to $15.27 billion which is equivalent to 41 per cent of the annual GDP and 31.8 per cent in present value terms. The country’s domestic debt is at $4.82 billion which presents 31.6 per cent while its external debt is at $10.45 billion which represents 68.4 per cent.

Debt has increased in a bid for the government to cover for the covid-19 related expenditure, revenue shortfalls and to support economic recovery.

“The medium-term outlook for Uganda has worsened considerably due to the impact of COVID-19, and risks are tilted heavily to the downside. If the impact of COVID-19 lasts longer globally, or the virus spreads more widely in Uganda, this could deter the recovery in Uganda’s exports, adversely impact a rebound in foreign direct investment (FDI), tourism and remittances, and further, depress productivity and hence the domestic economic recovery. Such developments could lead to more severe social and economic impacts and amplify external and fiscal imbalances.” The World Bank noted in its outlook for Uganda.

According to the African Development Bank (AFDB) Uganda is currently classified to have a low risk of debt distress as the country has managed its debt.

However, with the economic slowdown in 2020, the government increased its spending. Due to this, the gross financing needs are expected to reach 11.4 Per cent of GDP in 2021. The rising financing needs are expected to drive the debt to GDP to 48.8 per cent by June 2021 and to just above 50 per cent in June 2023, the bank noted.

“These levels are sustainable but leave little room to accommodate adverse shocks. Relatively strong foreign reserves of 4.9 months of imports cover could be deployed to support short-term financing needs. A key concern is a rise in interest payments, 22% of domestic revenue in 2020–21, driven by an increase in non-concessional borrowing.” The report read in part.

The bank said that Uganda must prioritize concessional financing and limit non-soncessional financing to high return projects in order to maintain debt sustainability.

“In the medium term, authorities will need to strengthen domestic resource mobilization and continue to improve the business environment to make the country attractive to foreign and local investors. If the economy does not provide the required upswing, the authorities should cut spending to reduce the primary deficit, estimated at 4.5% of GDP in 2021, to a sustainable level.” AFDB said.

Also Read: Business activities in Uganda continue to rise