- Zimbabwe earned more foreign exchange income and receipts than it ever has in its history

- Zimbabwean exports generated US$6.2 billion dollars which was 66% higher than in the previous period

- earns a lot from diaspora remittances of individuals who left the country to go and work in other countries in the region and overseas

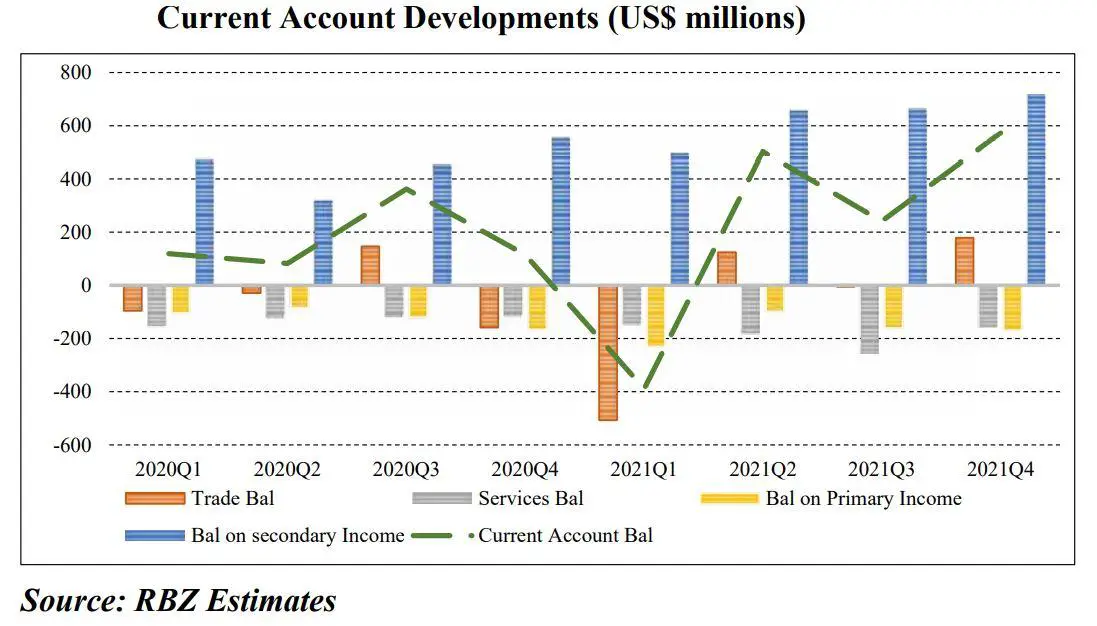

The state of the current account is impressive by world standards

Monetary authorities reported the country’s buoyant performance in international trade. The RBZ during its monetary policy statement delivered a good set of results in the southern African country’s current account. .

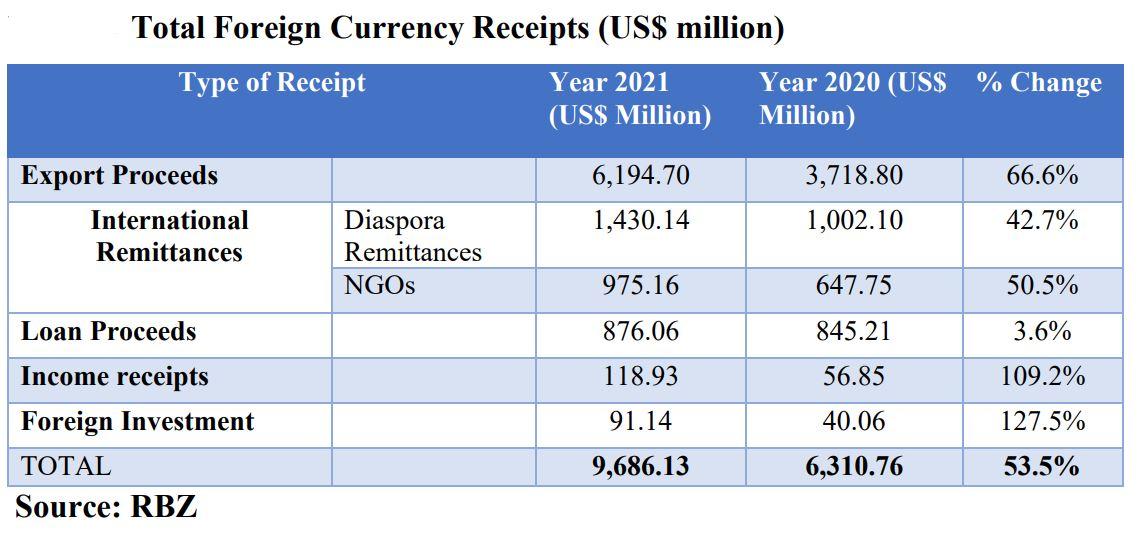

In 2021 the country earned more foreign exchange income and receipts than it ever has in its history. The said foreign exchange receipts came in at US$ 9.7 billion which was significantly higher than the previous highest record attained in 2013 of US$ 7.6 billion.

The central bank called this performance resilient. The policy document went on to state that the country was on track to achieve a trade surplus if US$ 926.8 million. So significant was this current account development that it got its own special mention in the policy document. Below is an excerpt of the current account.

Secondary income flows and strong merchandise export growth is what underscored the current account surplus in 2021 according to the central bank. Zimbabwean exports generated US$6.2 billion dollars which was 66% higher than in the previous period. The country recorded substantial increases in its income right across the board. The most notable increases come from the foreign investment and income receipts categories. These categories increased by 127.5% and 109.2% respectively.

This kind of performance in a country’s current account is not commonplace. Many countries of the world seldom run current account surpluses and for Zimbabwe which is known for poor economic performance achieving this kind of show is indeed commendable.

Looking closely at the current account reveals issues not immediately obvious

The country earns a lot from diaspora remittances of individuals who left the country to go and work in other countries in the region and overseas who then send money back home to support the family members they left behind.

This growth of this number although on the face of it is good news shows that overall, the economy of Zimbabwe is still plagued by very serious underlying issues. Zimbabwe has one of the highest unemployment rates of any country in the world. At one point it was said to be well over 90% of the population. The economy of Zimbabwe is not growing fast enough to provide its citizens with opportunities for gainful employment and to get ahead to the extent that they do not consider leaving the country’s shores for better opportunities.

The growth of this number is therefore indicative of the growth in the rate of brain drain of the country. US$ 1 billion was received into the country in the form of diaspora remittances in 2020 and this number grew to US$ 1.4 billion.

It would be unreasonable to assume that this money came only from the people who had left the country and decided to remit more money home to their loved ones. Fundamentally this could not have been the case as the world during 2020 coming into 2021 was in lockdown which was lifted gradually.

The effects of the lockdown and the economic slowdown would have made it much more difficult for the Zimbabweans living in other parts of the world to simply remit more money home. Most Zimbabweans in the diaspora work menial and low paying jobs which are the most vulnerable in the event of an economic downturn like the kind that the world is starting to emerge from.

The increase in this income line can only be accounted for by the increase in the number of people who have left Zimbabwe.

The increase in foreign exchange from diaspora remittances was sponsored therefore by brain drain. This phenomenon has negative long-term implications for the country like economic stagnation because of the mass exodus of skills to build other countries which would otherwise be employed to build the local economy.

The US$ 6.1 billion export figure is comprised mainly of natural commodities exported in their raw form. Zimbabwe’s biggest exports are made up of mineral commodities with platinum leading the way and followed closely by gold. Immediately after minerals are agricultural produce. Tobacco is the chief export produce.

Now the country is enjoying a windfall of foreign exchange because of the high prices of commodities. Gold and platinum have reached recorded prices on the world markets and the outlook for these metals is that their prices will remain strong at least in the medium term. Zimbabwe can therefore expect to earn increased income from these resources.

What is not immediately obvious looking at the current account are two things that expose a vulnerability to the Zimbabwean economy. Firstly, the bulk of the exports reported in the monetary policy statement is as mentioned natural commodities and raw materials.

They are sold on the global markets with minimal to no value addition. Value addition greatly increases the scope and capacity of a country to earn foreign exchange. The fact that value addition is not part of Zimbabwe’s overall landscape means that the country could have earned more than it did in the period under review. Value addition presupposes that there is an active manufacturing sector and the monetary policy statement itself stated that exports of manufactured goods from Zimbabwe were largely subdued.

If Zimbabwe had the capability to effectively add value to its leading exports one is only limited by their imagination of how much greater the exports figure disclosed in the policy document would have been.

The second issue which is not immediately obvious from the export receipts but is closely linked to the first is that the economy is not diversified. Its ability to generate foreign exchange is disproportionately concentrated on a few natural commodities. During the 1990s to about the turn of the century, the golden goose in terms of foreign exchange was tobacco. When the agriculture sector collapsed due to the fast-track land reform program the golden goose turned literally into gold, platinum, and diamonds to a certain extent. Tobacco and these minerals have earned the country a lot of money. It cannot be disputed.

The vulnerability in this area emanates from the fact that the country is a price taker for these commodities. In other words, does not determine the price of the products on which it is most dependent on the world markets.

Africans tend to be poor students of history. What this shows also is that efforts to diversify a country away from its reliance on the production and export of raw materials have largely been unsuccessful. There are risks in being reliant on a few products for a country’s income. Ghana during the 1950s and the 1960s was reliant on the production and export of cocoa.

When the prices of cocoa collapsed their economy followed suit because there were no other means of income. The same thing happened with Zambia. The country built itself upon its natural endowment of copper and when a single innovation made the use of copper almost obsolete the global prices collapsed sending the fortunes of Zambia with them.

The possibility of global commodity prices falling should make the monetary authorities sit up and take note since there are significant precedents on the worst that could happen if an economy does not diversify.

Zimbabwe urgently needs to diversify its economy by developing its manufacturing capability and most importantly becoming a knowledge and service economy. The country spent a total of US$ 636 million dollars on services in 2021. Now services are where the country can turn its fortunes around and emerge as an economy. There is tremendous scope and potential in this aspect. The services Zimbabwe paid for range from software, to professional and technical services like mining exploration, servicing of complex machinery, expatriate medical aid schemes and so on.

If the country was able to develop the capability to provide these services, it would not only save on the expenditure of foreign exchange it would also earn foreign exchange.

There are 16 countries that make up the Southern African Development Community of which Zimbabwe is a part. All these countries use and pay for the same services that Zimbabwe is paying for. If Zimbabwe were to become an exporter of services to all these countries in the SADC region alone and they spent on services roughly what Zimbabwe spends on services.

The country could potentially earn (15 member states multiplied by US$ 636 million) US$ 9.5 billion annually. Adding this figure to the foreign exchange earnings reported in the monetary policy statement gives a perspective of potential Zimbabwe could realize. Developing the services sector requires substantial investment in education, tourism, information technology, and healthcare. All of these are in a sad state presently.

Non-governmental organizations or NGOs provided the country with a total of US$ 975 million which is strikingly like the funding the country received in special drawing rights (SDRs) from the International Monetary Fund as its allocation for restarting the economy.

The country received US$ 876 million in offshore loan proceeds. These were marginally higher than the previous year’s 3.6%. The governor of the central bank attributed these to tobacco merchants and farmers who are known to secure funding for their operations from offshore loans.

Income receipts doubled as mentioned earlier and these the governor categorized as funds from the investments the country made in other countries.

What is most worrisome is the figure relating to foreign investment. Granted it increased by 128% which is spectacular. It was however coming off a very low base. Among its African peers, the ability to generate only US$ 90 million of foreign investment is very telling.

During the same period, South Africa attracted US$ 3.1 billion in foreign investment which was 39.4% lower than in 2020 and the DRC attracted US$ 4 billion which was 19% higher than in 2020. What this is shows is that Zimbabwe’s business landscape is not yet conducive to attracting foreign investment compared to its regional peers.

The only way to modernize an economy is through foreign investment. A healthy economy is indicated by large sums of foreign investment. Zimbabwe’s foreign investment is marginal, to say the least. It should have at least been as much as the figure for exports. So important is a foreign investment that in the future it can determine how much a country can export and how much a country can add value to its exports and how much in services it can provide local and for export. Where foreign investment is attracted economic progress and prosperity follow.

Congratulations to the monetary authorities in Zimbabwe. The state of the current account shows that the country is no longer in isolation. It is trading in a beneficial manner somewhat with the rest of the world. The authorities however have their work cut out for them in terms of dealing with the economic vulnerabilities underlying the nature of the items shown in the current account.