One of the main reasons why people eat organic food is because they believe it is healthier for them. For this segment of the market, the primary objective is healthy eating.

They may also believe that organic food is more nutritious because it is grown in more natural conditions.

Organic food is grown without the use of synthetic chemicals, such as human-made pesticides and fertilizers, and does not contain genetically modified organisms (GMOs).

- With the new global realignment Africa is poised to tap into the EU organic food market, the continent already has organic food producers.

- The global organic food and beverages market size was valued at US$188.35 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.0 per cent from 2022 to 2030.

But who makes up the target market for organic products? Is it just a niche group of people interested in healthy eating, or is the target market much broader?

Read: AI shows potential in climate-smart agriculture mechanization in Africa

The global organic food and beverages market size was valued at US $188.35 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.0 per cent from 2022 to 2030.

According to Grand View Research, fruits and vegetables emerged as the market’s leading sector and accounted for a 40 per cent share of the organic food revenue in 2021. The trend of organic vegetables was initiated in developed regions, including North America and Europe and has extended to emerging economies such as India and China. North America and Europe are the largest consumers of organic foods. Nonetheless, organic meat, fish and poultry consumption is estimated to register the highest CAGR of 14.9 per cent by 2030.

The demand for organic ingredients has grown over the past few years, owing to the desire for improved overall health among consumers and the awareness regarding the harmful effects of synthetic ingredients.

According to FiBL survey 2022, in 2020 the EU imported a total of 2.8 million metric tons of organic agri-food products. The biggest were the Netherlands, followed by Germany and Belgium. Compared to 2019, organic imports declined by 1.9 per cent Imports of tropical fruit (fresh or dried), nuts and spices represented the single biggest category, totalling 885’930 tonnes or 27. (https://compassionprisonproject.org/) 3 per cent of total imports, followed by oilcakes, cereals other than wheat, as well as rice, and wheat. China was the biggest supplier of organic agri-food products to the EU, with 433’705 tonnes; this corresponds to 13.4 per cent of the total organic import volume.

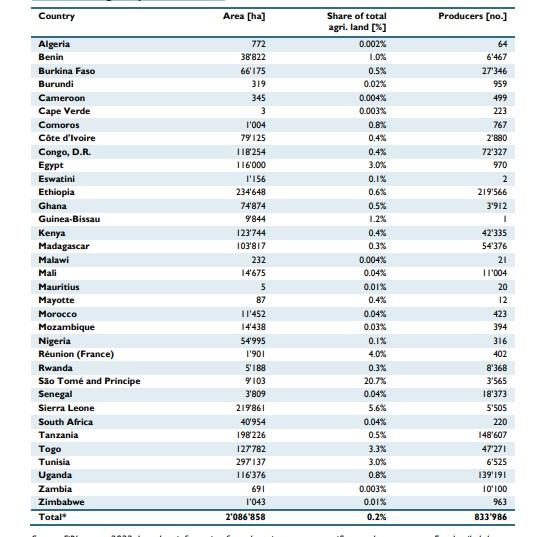

With the new global realignment, Africa is poised to tap into the EU organic food market, Africa already has organic food producers. In 2020, there were nearly 834’000 organic producers in Africa. The countries with the highest number of organic producers were Ethiopia (almost 220’000), Tanzania (nearly149’000), and Uganda (over 139’000).

Read: Will Dangote’s fertilizer factory promote improving Africa’s food productivity?

The latest report by the European Union shows that Ethiopia, Tanzania and São Tomé and Príncipe are some of the African countries found in the list of producing organic foods.

Ecological Organic Agriculture (Initiative for Africa), EOA(-I), certification in Africa has gained leverage through a Memorandum of Understanding (MoU) signed between the AU-led EOAI Continental Secretariat hosted by Biovision Africa Trust (BvAT) and the African Organisation for Standardisation (ARSO) aimed at developing a common continental EOA standard. The partnership will additionally link the EOAI with the African Continental Free Trade Area (AfCFTA) Secretariat to engage further on strategies of boosting EOA trade on the continent.

In West Africa, Burkina Faso, Ghana, Mali and Togo reported an increase in Participatory Guarantee Systems (PGS) certified producers and hectares. 2021 was the last year of the implementation of the Organic Markets for Development (OM4D) project, which supported the development of PGS initiatives in Burkina Faso, Ghana Togo, and Sao Tomé and Principe, according to FiBL survey 2022.

Participatory Guarantee Systems (PGS) are locally focused quality assurance systems. They certify producers based on the active participation of stakeholders and are built on a foundation of trust, social networks, and knowledge exchange.

African countries have continued to foster a policy-enabling environment for the development of organic agriculture.

Read: Harnessing mobile technologies growth to drive smart agriculture in Africa

Madagascar

In Madagascar, the first law on organic agriculture was promulgated in 2020. Based on this work, the first National Strategy for Organic Agriculture (SNABIO) will soon be adopted according to FiBL survey 2022. Madagascar’s ambition is to establish a policy to support organic farming for both export and the domestic market, to democratise access to healthy and sustainably produced food and leverage all the benefits of this. The main focus of the law and the SNABIO is supporting the growth of exports, promoting the development of the national market, and guaranteeing the organic nature of products without hindering the sector’s growth.

Burkina Faso

In Burkina Faso, the Ministry of Agriculture, Hydro-Agricultural Development and Mechanisation is leading the development of a national strategy for agroecology and an accompanying action plan. A commonly-defined objective is to support a consistent vision to make agroecology the engine of ecological, sustainable, competitive agro-sylvo-pastoral production, creating jobs and ensuring food security for all. A recent assessment led by FAO on agroecology in Burkina Faso identified three key strengths: the political will, the dynamism and commitment of civil society and the development of technologies and approaches by grassroots actors.

In parallel, a new version of the national programme for the rural sector (PNSR 3) is also in progress. This programme is planned to be the main federal strategy and action plan for sectoral policies, including agriculture, food security, value chains, land management and water management. Synergies between the national strategy for the development of agroecology and the PNSR 3 will offer a unique opportunity to align the structural investment in the productive sectors with agroecological principles.

Uganda

In 2019, Uganda’s Ministry of Agriculture, Animal Industry and Fisheries (MAAIF) launched the National Organic Agriculture Policy (NOAP). Since then, steps have been taken towards implementing the NOAP by consolidating a roadmap that prioritises scaling up agroecology and organic at the farm level, supply chain and market development and strengthening the policy framework and the stakeholder platform built according to FiBL survey 2022. Further, the NOAP asks partner nations to integrate organic agriculture into their national strategic frameworks and assist in policy and technical issues as well as in the design, implementation, management and financing aspects of organic programmes.

Togo

According to FiBL survey 2022, the Government of Togo published their National Development Plan in 2018 (2018- 2022 with a vision to 2030), which includes provisions for the development of the organic sector in the country. These documents indicate a political will to support organic agriculture with the primary objective of exporting but also building the domestic market.

In 2019, the Ministry of Agriculture, Animal Production and Fisheries (MAPAH) published a “concept note for the national conversion of the agricultural sector to organic” outlining the programme’s key elements. Within this context, in 2020, MAPAH published the national strategy for developing organic and ecological agriculture for the period 2020-2030.