- Beijing tightens China-Africa grip as trade rivals US, Russia seek bigger slice

- Exploring the Forex CFD Trading Landscape in Africa in 2024

- Webb Fontaine’s single window: paving the way for future trade with new AI features

- Inside Africa’s 2024 engineering innovation showcase eyeing £50,000 prize

- Tanzanian inches closer to clean cooking dream with a $1.7 billion plan roll out

- Why the planning of new cities must embrace a visionary approach to succeed

- First Saudi WoodShow in Riyadh attracts over 8,000 visitors

- Kenya Apparel Exports Targetting $1 Billion by 2025

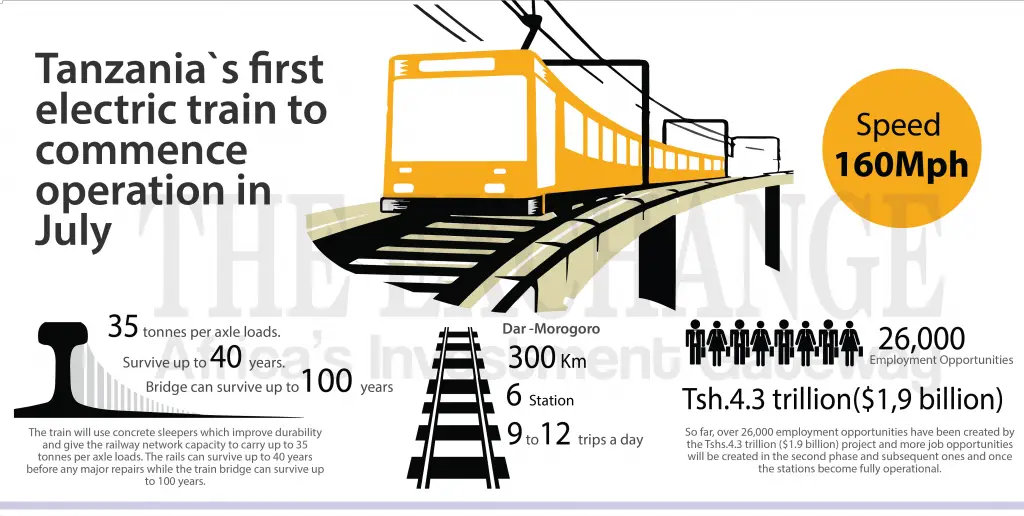

Tanzania is set to test its first, maiden, cheaper and very superior own funded electric train. The train is tipped to be one of Africa`s high speed trains with projected speeds of up to 160 mph.

Speaking at a historic event to launch the flash butt welding of the Standard Gauge Railway (SGR) exercise that took place at Soga in Coastal region outside Dar es Salaam, the Minister for Works, Transport and Communications, Eng. Isaac Kamwele said first trials for speedy electric train will be conducted in July this year to cover a section of the SGR.

The first 300 kilometers phase running from Dar es Salaam to Morogoro with 6 stations in between will commence its operations in December this year. This will be three passenger trains in phase one at the starting point that will be taking daily round trips between the two cities. Each passenger train is …

East African countries are set to attend the ninth East African Petroleum Conference and exhibition to discuss investment opportunities to enhance socio-economic transformation.

This year`s conference is themed:` East African Region – the destination of choice for Oil and Gas Investment Opportunities to enhance Socioeconomic Transformation.`

Chairperson of the organizing committee, Marin Heya said over the weekend that over 1,000 local, regional and international delegates will be attending the three-day conference that will be in Mombasa from May 8.

`The conference will help attract investors on oil and gas into the region given the potential in the region, ` Heya said.

He revealed that the Chinese geo-spatial and survey firm BGP and CNOOC are among the companies that are expected to attend the three-day conference.

The official also stated that the East African Community (EAC) member states, including Kenya, Uganda, Tanzania and Rwanda will exhibit at the conference alongside international …

The World Bank has increased emergency support for the three Southern African countries affected by a devastating cyclone that killed hundreds in March to Tshs.1.6 trillion ($700 million), the lender said on 3rd May, 2019.

More than 1,000 people were killed across Mozambique, Zimbabwe and Malawi after Cyclone Idai, the worst cyclone in decades, lashed the Eastern Indian Ocean coast bringing heavy winds and rains.

New World Bank President David Malpass, who is in Africa for his first foreign trip, toured the affected areas in Mozambican port city of Beira on 3rd May, 2019. The bank said it was activating the International Development Association`s (IDA) Crisis Response Window (CRW) to provide up to Tshs.1.2 trillion ($545 million) in total for the three countries.

“This is in addition to the nearly Tshs.345 billion ($150 million) in resources that have recently been made available from existing projects. Together, total …

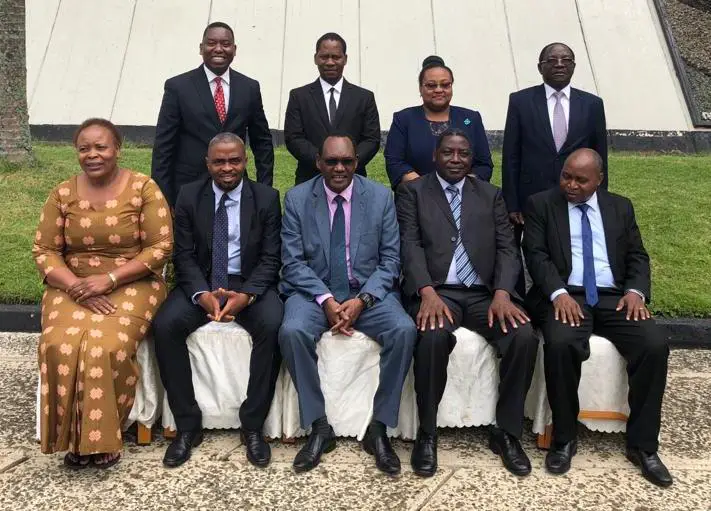

Permanent Secretaries responsible for social, economic, environment, foreign affairs and international cooperation from Tanzania and Uganda have signed agreement to strengthen ties in the specific areas and for the protection of boundaries.

The agreement was signed in Dar es Salaam on 2nd May 2019 after a two days meeting attended. Tanzania was represented by the Permanent Secretary, Ministry of Foreign Affairs and East African Cooperation, Dr. Faraji Mnyepe while Alfred Ollot, His Ugandan counterpart, led the other delegation.

Officials who participated in the meeting included permanent secretaries for ministries of livestock and fisheries, housing and settlements development, energy and water.

Experts from the ministries met prior to the meeting whereas they discussed on collaboratively working on the challenges facing Uganda and Tanzania, especially people living near the border. Their suggestions were submitted to permanent secretaries.

Major issues discussed during the conference were safeguarding the Tanzania/Uganda border and protection of …

NSE 20 share Index which tracks top listed companies at the bourse was down 16.21 points

Trading at the Nairobi Securities Exchange (NSE) opened the week with low activities as shares traded close Monday at a total of 10 million, valued at Ksh302.5 million (USD 2.9 million).

This was down compared to 19.8 million shares valued at Ksh560 million (USD5.5 million) posted on Friday before the market took a break for the weekend.

On Monday, the NSE 20 share Index, which tracks blue chip companies was down 16.21 points to stand at 2783.01. All Share Index (NASI) shed 2.40 points to settle at 157.79 while the NSE 25 Share index dropped 52.07 points to settle at 3886.48.

Banking

The banking Sector had shares worth Ksh148 million transacted which accounted for 49.16 per cent of the day’s traded value. Equity Group Holdings was the day’s biggest mover with 1.9 million shares …

It targets agricultural,building,construction and waste management sectors in the country

Leading construction and building equipment supplier, Ganatra Plant & Equipment Ltd and NIC bank have partnered to finance purchases of new JCB Back-hoe Loaders in Kenya.

This is in the wake of a credit crunch in the market occasioned by the interest rate cap law, which has lowered the purchasing power of majority of investors.

READ:Why Kenya’s Central Bank has retained minimum lending rate at 9%

The partnership is seeking to reduce the financial load from the customers by offering them flexible financing terms including a cost reduction of 20 per cent.

In the financing partnership signed in Nairobi this week, NIC will offer an 80 per cent financing, thus offering small medium enterprises and corporate organisations the opportunity to acquire the Back- hoe Loader through asset financing.

The move will therefore free up cash that can be directed …

33% of manufacturers in the country plan to reduce the number of full time employees

Only 48 per cent of manufacturers in Kenya have expressed optimism that the sector would grow this year, a latest survey has revealed, as investments in the country continue to face headwinds.

According to the Q1 ‘Manufacturing Barometer’ by the Kenya Association of Manufacturers (KAM), the biggest worry by industry players over the next six months (61 per cent) is the high cost of raw materials, which is making their products uncompetitive both locally, regional and in the international markets.

About 57 per cent are worried about pressure from increased wages, 54 per cent are concerned over decreasing profitability while 48 per cent fear that taxation policies in the country will affect their businesses.

Oil and energy prices which have remained high worries 43 per cent of the surveyed manufacturers in the country, the study …

Equity Bank says branches are making it easy for SMEs to access products that are right for them

Equity Bank continues to enhance its Small and Medium-sized Enterprises (SME) offering through its supreme banking branches, as the bank embraces new technology and ways of working to meet the retail customer needs.

Thanks to the growing adoption of digital banking which has seen banks shift from brick and mortar expansion (branches), the space at banking halls has enabled SMEs to largely access supreme banking which has been targeting high net worth individuals.

Currently, 96 per cent of transactions at Equity are being done on digital platforms, the Nairobi Securities Exchange (NSE) listed lender has reported.

READ:Banks in Kenya battling for digital lending space

“This has allowed the bank to transform the branches into advice-giving arms. This branch based venture offers preferential services customized banking solutions with exclusive privileges and unrivalled …

The two have agreed to implement a Single Customs Territory (SCT) to enhance clearance of goods and promote trade

After close to two years of a trade tension between Kenya and Tanzania on free market access of locally produced goods, the two neighbours have agreed to call a truce.

Back-to-back trade talks have seen the two agree to open their borders for trade while they move to jointly implement a Single Customs Territory (SCT), as agreed, to enhance the process of clearance of goods.

The SCT is a step towards a full customs union, achievable by the removal of restrictive regulations and reducing internal border controls on goods moving between partner states. The ultimate goal is the free circulation of goods.

The tiff

The two East Africa Community (EAC) member states have recently been entangled in a trade raw on local content which led to a tit-for-tat ban on some …

How Kenya is banning gambling advertising

The Kenyan government has banned outdoor advertisement of gambling as it moves to introduce a raft of new measures to tame growing addiction and expansion of the lucrative multi-billion industry, which has found a strong foothold in Africa.

Advertisement of gambling on all social media platforms has also been banned in Kenya, dealing a blow to gambling firms which have been spending billion—cumulative—on adverts to lure millions into their businesses.

In a notice to betting, lotteries and public gaming license holders dated April 30, the Betting Control and Licensing Board (BCLB) has also banned adverts between 6am and 10pm, which means all adverts on television and radio will run during watershed hours(after 10pm), a move it says is intended to protect consumers from effects of gambling.

“We wish to remind you that gaming is a demerit good and all demerit goods have the potential …