- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Browsing: Foreign Direct Investment

Tanzania Investment Centre (TIC) targets to register 1,000 investment projects in 2024 The government of Tanzania is also revising the…

Economic experts have a bearish forecast on the US dollar, citing that it is likely to “consistently weaken” throughout 2024…

Kenya seeks to attract $10 billion in Foreign Direct Investments (FDI) in the next four years despite dwindling inflows over…

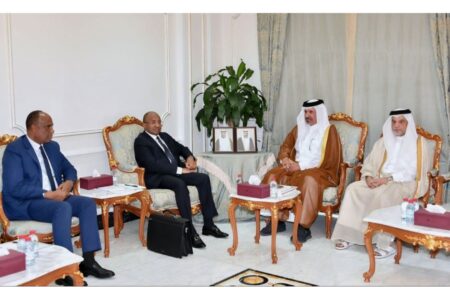

A recent meeting between the President of Zanzibar, Dr Hussein Ali Mwinyi and Qatar’s First Vice-Chairman, Mohamed bin Twar Al Kuwari highlighted these figures. The two high-ranking officials met in Qatar. The Zanzibar president called on investors from the rich United Arab Emirates to invest in the island.

Should a common currency in the EAC come to fruition, the trade will be fueled by a reduction, albeit limited,…

Southern Africa, East and West Africa saw their flows of FDI rise in 2021. It was only in Central and North Africa that flows of foreign direct investment were flat or declined, respectively. Flows to North Africa fell by 5 per cent to $9.3 billion.

Egypt saw its FDI drop by 12% as large investments in exploration and production agreements in extractive industries were not repeated. Despite the decline, Egypt has the second highest flows of FDI in 2021 on the continent.

UNCTAD reports that it expects FDI flows to increase in North Africa owing to pledges of as much as US$ 22 billion to the region from Gulf states. In Egypt, according to the UNCTAD World Investment Report 2022 tripled green field projects of US$ 5.6 billion and real estate projects of US$ 1.5 billion.

In Morocco, FDI flows increased by 52% to US$ 2.2 billion. This was driven by a large international project finance deal announced in that country to finance the construction of a power line.

It is critical to strengthen a professional, independent supervision secretariat to make the AfCFTA agreement’s promise a reality. A strong secretariat can assist states in developing strong domestic institutions to administer, monitor, and enforce the AfCFTA. The moment for change has arrived. The conventional development models have failed Africa. The AfCFTA, on the other hand, signifies that Africa is open for business.

AfCFTA will be a game changer for Africa, but its success depends on certain enablers being present. The first and most obvious impediment and an obstacle to the initiative will be mustering the political will of the signatories to implement the necessary reforms to enable its success. This may not always be politically feasible or possible.

The less obvious enablers and the financial institutions on the African continent. Their presence and activities have a direct and strong bearing on the success of AfCFTA. One of the foremost bankers on the African continent, Sim Tshabalala, the chief executive of the continent’s largest banking institution by assets, is fond of saying that banking is a derived business. This means that banks butter their bread from the activities of economic agents.

If AfCFTA is to succeed in its quest to merge the various comparative advantages of the countries that constitute Africa it will need champion banks to support the intra and intercontinental trade activity from there being a single market and all participants, both local and foreign looking to make money. Africa will need champion banks to facilitate the flow of capital to worthwhile projects and ensure that the capital deployed into various activities earns the best returns for its providers.

Interestingly, of the US$1.5 trillion in foreign direct investment recorded in 2021, 53% of that money was channelled towards developing economies. Africa made a very strong showing in terms of foreign direct investment in 2021.

According to the report, Africa attracted US$ 83 billion in foreign direct investment compared to the US$ 39 billion it achieved in 2020. Of the global investment flows that landed on African shores in 2021 US$ 41 billion went directly to South Africa.

Despite the positive developments that occurred in 2021 in foreign direct investment, the UNCTAD report concludes by stating that the growth and momentum in FDI flows in 2021 will not be sustainable given the adverse economic developments that have occurred in 2022.

UNCTAD expects these developments will either put downward pressure on the flow of FDI or flatten the curve.

The movement of exchange rates on the parallel market has been caused by the government itself. Firstly, the government introduced a currency that economic agents have no confidence in because it did not have the macroeconomic fundamentals to give it credence. There was no parallel market for foreign currency during the years that the country made use of a basket of currencies.

The parallel market only emerged when the government introduced a surrogate currency called the bond note which was said to be at par with the United States dollar. No sooner than the surrogate currency had been introduced that the parallel market emerged, and United States dollars started trading at a premium.

Secondly, the government reportedly purchases foreign exchange on the parallel market. Through the central bank, the government issues new currency and then purchases foreign currency on the parallel market and drives up the exchange rate. It has been documented and widely reported that this is taking place on a grand scale, that the central bank is creating money supply and using it to purchase foreign exchange.