- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

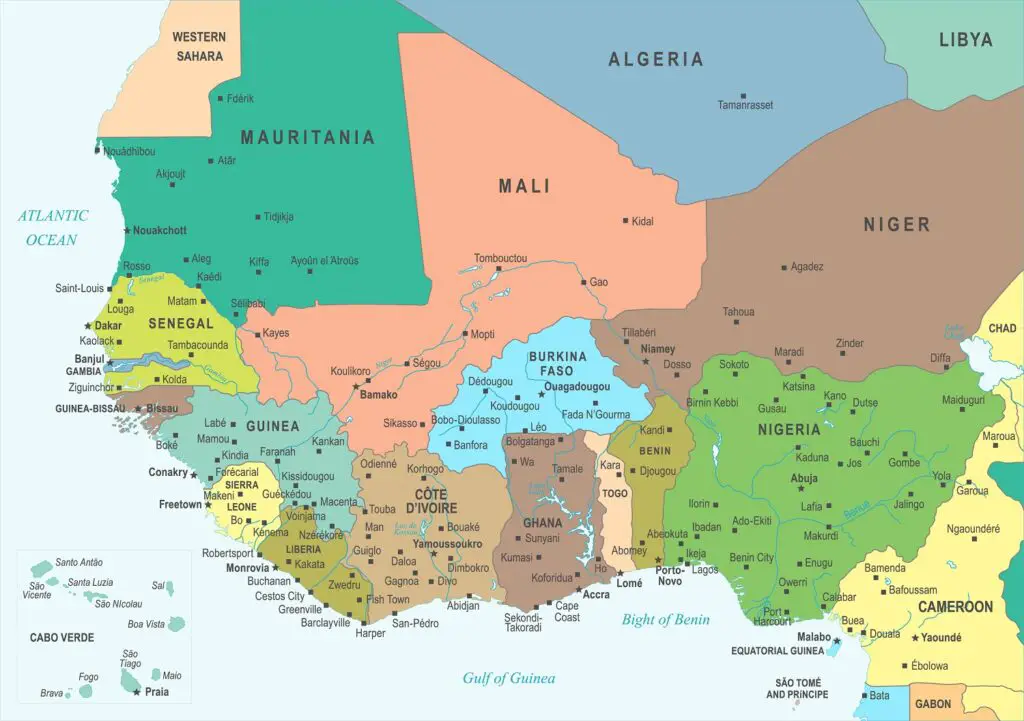

Browsing: Ghana

Whether Nigeria and Ghana will abandon their digital currencies and jump on the Eco train is an unclear narrative, but it appears unlikely because of the significant investments put into them and the optimism by the governments to embrace digital transformations.

Nigeria had banned cryptocurrency transactions in February last year which increased the popularity of the eNaira as an alternative for cross-border trade and remittance inflows.

eNaira critics say that the solutions being offered by the digital currency are already existing in online banking and bank card transactions. …

In 2020, total transaction values climbed by 22% to hit US$767 billion. or the first time, and in a pandemic, the industry is processing more over US$2 billion per day which has more than doubled since 2017.

The GSMA predicts that by the end of 2022, this value will be in excess of US$3 billion every single day. Some of the innovations that will help propel this growth include APIs and regulation initiatives like tightening transaction and balance limitations which could bolster the industry’s transaction values growth.

Transaction costs remain a big concern for many with users calling for a review of this in countries like Kenya. When the pandemic was announced in Africa, Kenya and Ghana- which also happen to be the continent’s two biggest mobile money markets– were swift to scrap fees on small person-to-person transactions. …

Tanzania hopes to plant an ambitious 1.5 million cashew nut trees annually across some 535,000 acres of land in a new revitalized effort to grow output and increase revenue from the protein-rich nut.

Tanzania hopes to plant an ambitious 1.5 million cashew nut trees annually across some 535,000 acres of land in a new revitalized effort to grow output and increase revenue from the protein-rich nut.

Tanzania is already one of Africa’s largest cashew growers coming third after Nigeria and Ivory Coast. It is the world’s eighth biggest producer and if all goes to plan, the country wants to move up the ranks.

In a recent press communiqué, the Cashew nut Board of Tanzania (CBT) released projections that show that Tanzania would produce one million tonnes of the nuts in the 2023/24 harvest season.

The plan is a multiple-year scheme that would see the country increase output year after year as follows; 600,000 tonnes for the 2021/22 farming season, 800,000 tonnes were to be produced in the 2022/23 farming season and the 1 million mark would be met in the following farming season.…

Mergers and acquisitions worth US$52B were completed in South Africa during the first half of 2021, with the value of deals growing by 958% from 2020 with the tech sector in the lead according to Refinitiv Data that provides financial markets and infrastructure data . According to Digest Africa, the value of mergers and acquisitions in the African tech ecosystem in 2018 was US$504M with 24 out of the 39 deals taking place in South Africa making it the country with the most mergers, acquisitions and exits among the KINGS countries. …

Financial technology (FinTech) is a major force shaping the structure of the financial industry in sub-Saharan Africa. New technologies are being developed and implemented in sub-Saharan Africa with the potential to change the competitive landscape in the financial sector.

In an area that traditionally suffered limited access to financial services such as Credit, insurance, and banking Financial technology [FinTech] has aided in accelerating financial inclusion in this sub-Saharan Africa region.

While the bell has long been chiming for businesses to rapidly adapt, harness the power of data and streamline their digital processes, COVID-19 reprioritized the need for these capabilities. It made these elements of digital strategy essential, and at a frightening pace.

The Fintech sector in Africa has since rapidly emerged with more and more startups coming up as compared to other years. As consumers avoided touching cash or point of sale devices, digital payment usage increased dramatically and continues …

Deposits formed the bedrock of the source of funding for assets, notwithstanding impacts associated with the pandemic, DT-Saccos were still able to mobilize deposits at a near similar rate as the growth in their assets’ portfolios.

Gross loans increased by 13.16 per cent in 2020 to Kshs 474.77 B compared to Kshs 419.55 B of 2019.

Net loans and advances increased markedly by 12.60 per cent to reach Kshs 450.58 B in 2020, compared to Kshs 400.16 B in the previous year. …

The Spanish on demand delivery platform Glovo is on course to conquer Africa’s online delivery business space as it continues to become a major thing.

This is after the company announced its plans of expanding Glovo services and operations to include Ghana and Tunisia, bringing its current operations to a total of seven countries on the continent.

Earlier this year, the Spanish on demand delivery platform launched its service operations in Accra in Ghana, and in the following month it saw extending the service to the city of Tema, and it expects to launch in Tunis in Tunisia next month [October].

Also Read: Glovo expands in Kenya

we take it completely for granted that you can push a button on your smartphone and something happens nearly instantly in the real world.

This trend is fast expanding to all sorts of use cases due to our ever growing need for instant …

Ghanaian government calls for strategic partnership with USA to see Covid-19 economic transformation

The Ghanaian government is calling for a strategic partnership with the United States of America to set up a post Covid-19 economic transformation agenda which will mutually benefit the two countries.

This is according to the Ghanaian Trade and industry minister Alan Kyerematen, who says that this will enable the country to attract more investments from the USA to take advantage of the African Continental Free Trade Area

Ghana is currently USA’s 83rd largest goods trading partner with $1.8 billion in total (two way) goods trade during 2019. Goods exports totaled $840 million; goods imports totaled $943 million. The U.S. goods trade deficit with Ghana was $103 million in the same year.

The Ghanaian Trade minister also explained that the country’s economy was being diversified from cocoa, gold and oil to pharmaceutical, energy and telecommunications, amongst others.

Speaking at the virtual 2021 US Ghana Business Forum which opened yesterday, Mr. …

It is indeed good news to the Petroleum and other Industry players after Muhammadu Buhari, Nigeria’s President finally appended his signature into law the Petroleum Industry Bill after twenty years of deliberation and revision.

The signing of this historic Petroleum Bill comes barely a month after the Petroleum Industry Bill (PIB) 2021 was voted by both chambers of the National Assembly.

After so many questions surrounded the bill after it was passed by the two houses, major one being whether the PIB was going to be the game changer for the industry, pending the President’s signature, it is now the proverbial saying of only time will tell after the President gave the bill a green light.

The new legislation which aims to Overhauling and transforming the Nigerian Oil and Gas is anticipated to drive investment in the sector by providing a framework for almost all aspects of oil and gas …

South Africa has a market-oriented agricultural economy that is highly diversified and includes the production of all the major grains (except rice), The agricultural sector contributed around 10 percent to South Africa’s total export earnings in FY 2019 at a value of $10.7 billion. The grain industry (barley, maize, oats, sorghum and wheat) is one of the largest agricultural industries in South Africa, contributing more than 30% to the total gross value of agricultural production. The industry is comprised of a number of key stakeholders including input suppliers, farmers, silo owners, traders, millers, bakers, research organizations, financiers, etc but with increasingly severe weather, growing political volatility, cyber concerns and other threats, farmers need to continue to invest in their risk preparedness.

As the farming industry is disrupted by digital, insurers and intermediaries must anticipate emerging risks to remain relevant and be the partner that farmers need. Now’s the time for …