- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

Browsing: IFC

Africa is now more connected, technologically savvy, and focused on enhancing its economic systems compared to 30 years ago. The narrative has changed, from civil unrest and extreme donor-dependent economies, to those with record-high tax collections such as in Tanzania, and information communications and technology (ICT) transformation ones such as Rwanda, Kenya and South Africa. The African GDP has grown to over $2 trillion from about $587 billion in 2000.

Despite the youngest continent’s nations being driven by agriculture—which has also sustained major development, in terms of technology input, funding and research and development, still the continent’s manufacturing industry holds vital potential to stimulate the economy and offer decent livelihood to its vast young human capital, who number over 226 million and who are expected to increase by 42 per cent by 2030 according to the United Nations (UN).

According to Brookings—an American think tank, the future of the manufacturing …

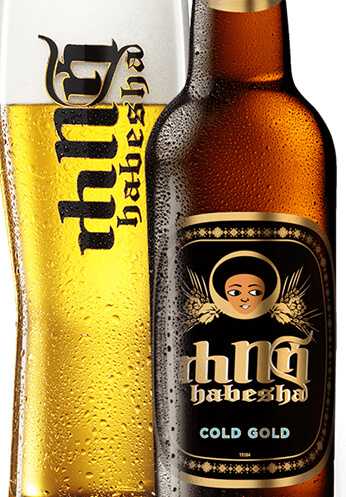

International Finance Corporation (IFC) has unveiled an investment of up to EUR050mn in Habesha Breweries S.C. to help the company expand its operations in Ethiopia and increase local barley sourcing from smallholder farmers.

The loan is co-funded by the Dutch development bank (FMO) and Dutch banks Coöperatieve Rabobank U.A. (Rabobank) and ING Bank N.V. (ING Bank).

Habesha was initiated by a group of local Ethiopian investors in 2009 and it has grown to be the sole supplier of inflight drinks at Ethiopian. The company is currently owned by Swinkels Family Brewers Holding N.V. (60%), 8,000 local shareholders (30%), and Linssen Participations B.V. (10%).

Ethiopia’s brewing industry is fast growing and an important contributor to economic growth, but the sector imports as much as 90 percent of its malt barley needs. In addition to the financing, IFC and FMO will help Habesha support farmers’ access to improved seed varieties and other …

IFC and IFHA-II Coöperatief U.A., a private equity fund focused on health care in Sub-Saharan Africa, have launched a $115 million holding company to acquire and integrate targeted health care service businesses in East and Southern Africa.

The project will boost access to quality health care services to help improve lives and achieve universal health coverage across the region. IFC is investing $22 million in the Hospital Holdings Investment (HHI) holding company, an investment platform set up by IFHA-II, which is also supported by the European development finance organizations Swedfund, Proparco, Finnfund and IFU, Danish Investment Fund for Developing countries. HHI will be IFC’s largest equity investment in health care in Sub-Saharan Africa, outside of South Africa. IFC also mobilized $43.2 million from other investors.

“HHI is filling a critical gap in the health care sector by providing secondary and out-of-hospital care for middle to lower middle income patients in …

Thirty-eight emerging market economies, including five countries in Africa, have initiated key banking reforms to drive development and fight climate change, according to the second Global Progress Report of the IFC-facilitated Sustainable Banking Network (SBN).

The SBN Global Progress Report shows that regulators and banking associations in countries in Africa are adopting national sustainable finance policies and voluntary principles as well as advancing green bond markets and innovative green lending policies.

“African countries will be among the hardest hit by climate change and Africa already faces daunting challenges around job creation and inequality,” said Kevin Njiraini, IFC’s Regional Director, Southern Africa & Nigeria. “Advancing sustainable finance is critical to help the region build competitive and resilient financial services that support inclusive economic development.”

In addition to providing practical resources for countries undertaking sustainable finance reforms, the report also highlights the knowledge shared by SBN members – a hallmark approach of …

Cameroon plans to increase access to power to 88 per cent of all people in electrified areas by 2022. …

The initiative marks a rare move to apply global quality certification to food products destined for the domestic, rather than the export market.…

In July last year, Equity Bank and Orb Energy partnered to offer tailor-made loans to enable homes, institutions and industries acquire solar water heating systems.…