- Powering Africa: Africa’s Path to Universal Electricity Access

- Global investment trends at AIM Congress 2024: a spotlight on the keynote speakers

- South Africa’s deepening investment ties in South Sudan oil industry

- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

Browsing: IMF

The question is, what if one day you went to pay for expenses with your card or mobile app and it returned an error message? Or was your service provider that issues your money declared bankrupt? Scary, right?

Recently, customers have been converting their regular traditional money into e-money. Service providers have enabled the transfer of electronic money to banks, from person to person, and for making payments.

For regulators and supervisors that control the protection of consumers’ e-money and digital currencies, coming up with legal bindings and restrictions in the fast-changing sector has become very challenging. These regulators and supervisors must devise ways to protect customers from a possible system failure and ultimately prevent them from losing their funds.…

The lender stated during the conference that the country’s economic objectives were still under threat from unsustainable debt.

The government announced last week that external debt grew to US$13.7 billion in September, up from roughly US$10.7 billion the previous year.

Zimbabwe’s debt accounts for more than half of the country’s GDP.…

The government of Kenya’s involvement has borne fruit. This Christmas week, KQ has increased the frequency of flights to the United States from two to four a week.

Bookings have picked up and the cost of a one-way ticket has risen from US$ 900 (KSh90,000) to US$10,00 (KSh101,305). This comes as a relief to the Kenya Airways Chairman, Michael Joseph, who had earlier said in an interview with a local station in Kenya last year that the pandemic would continue to affect demand for air travel for the next two to three years.

The airline said they had increased the number of direct flights to New York to enable families to reconnect and unite during this festive season.…

This year’s current account surplus was replaced by a deficit of 1.8 per cent of GDP and a budget deficit of 2.9 per cent in 2020, respectively.

A depreciation of ZWL2.5 to the US dollar was recorded in February 2019 before stabilizing at ZWL82 in December 2020. Unemployment remained high in 2019 at over 21 per cent, with poverty at 70.5 per cent and unemployment at 70.5 per cent respectively.

Currently, the banking sector is sound. …

For the five years since 2002, Kenya registered its golden period in terms of economic growth. This was during President Mwai Kibaki’s first five-year term which ended in 2007. The Kenyan economy blossomed with the growth noticeable in both industry and tourism as well as in improved livelihoods.

At this time, the growth attracted the attention of the International Monetary Fund (IMF) and the World Bank because Kibaki’s government was not keen on funding from the Bretton Woods institutions. The government largely financed its budget from the revenues it collected which was unheard of in the previous regime. President Daniel Moi, Kibaki’s predecessor had deeply entrenched corruption in the country which wrecked the economy to almost collapse.

But today, the economy is worse than it was under Moi with the Jubilee government overseeing the worst job cuts, company closures and distressed livelihoods due to corruption. While the Covid-19 pandemic has …

Yet for SME and corporate lending, credit decisions remain an extended process as information is gathered manually and appraised over, sometimes, weeks, to establish the creditworthiness of the borrower.

The need to abandon such cumbersome processes has recently seen leading banks adopt technology, such as our CreditQuest, to automate credit origination, and manage credit workflow, appraisals, documents, customer ratings and credit decisions.

This kind of technology draws all current and historical credit data onto a unified platform, giving the bank’s analysts a true single customer view of credits and collaterals.…

Special Drawing Rights (SDRs) are a reserve asset created by the International Monetary Fund (IMF) to supplement its member countries’ reserves.

According to the IMF’s website, a total equal to US$943 billion in SDRs has been allocated to date from the time they were created in 1969. This figure is inclusive of the SDR456 billion approved on the 2nd of August 2021. This most recent allocation was made necessary by the need to help countries around the world to cope with the effects of the COVID-19 pandemic. The value of the SDR is based on a basket of five currencies which include: the US dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound. …

The International Monetary Fund (IMF), an organization which includes 190 countries, working to foster global monetary cooperation, in a blogpost titled, ‘Cryptoassets as National Currency? A Step Too Far’, believes that the adoption of cryptocurrencies as national currencies has more risks and cost that outweighs potential benefits.

Cryptocurrencies had an exceptional year in 2017. Both the technology and the value of virtual currencies have experienced historic breakthroughs. At the same time, the rise of these digital currencies is causing serious concerns in the world of cybersecurity.

The IMF blogpost starts by acknowledging the potential benefits of digital currencies saying that new digital forms of money had the potential to provide cheaper and faster payments, enhance financial inclusion, improve resilience and competition among payment providers, and facilitate cross-border transfers.

ALSO READ Zimbabwe’s energy sector to drive agenda at African energy week in South Africa

However, according to the post, the IMF …

The Executive Board of the International Monetary Fund (IMF) has approved a three-year arrangements under the Extended Credit Facility and the Extended Fund Facility for the Cameroon for SDR 483 million which is equivalent to about US$ 689.5 million, or 175 percent of Cameroon’s quota to support the country’s economic and financial reform program.

The Approval of the ECF/EFF enables immediate disbursement of about US$ 177.2 million, usable for budget support.

This latest movement follows a Fund emergency support to Cameroon under the Rapid Credit Facility (RCF) totaling SDR 276 million, of about US$ 382 million or 100 percent of Cameroon’s quota.

Cameroon faces significant development challenges heightened by the pandemic. An upsurge in COVID-19 cases since January 2021, has raised concerns about growth prospects and the external and fiscal positions. Additionally, security risks in parts of the country persist. The pandemic could reverse improvements in poverty reduction and development …

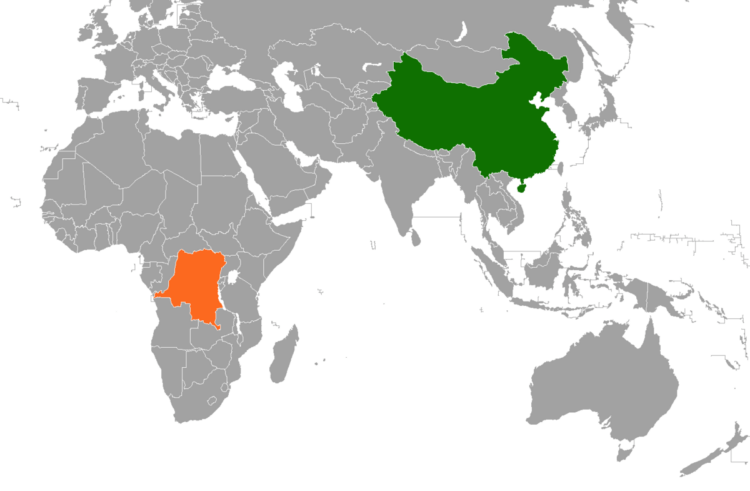

Chinese President Xi Jinping on Monday agreed in principle to a restructuring of Congo’s vast debts, an issue that was blocking negotiations with the International Monetary Fund, a minister said.

Acknowledging this Congolese Prime Minister Anatole Collinet Makosso on moday June 21 said that the financial difficulties his country has faced, delayed servicing of the debt and promised to reduce a debt that has recently increased.

The prime minister says the health crisis brought about by the Covid-19 led to an increase in borrowing that was aimed at cushioning its citizen without the ability to service it and thus it was time to make their debt sustainable going forward.

“Our debt currently stands at nearly $10,892,454,000 as of 31 December 2020, or 98% of GDP. Our objective is to bring it down to below the CEMAC community standard set at 70% of GDP,” Anatole Collinet Makosso said to the National …