- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

Browsing: Nairobi Securities Exchange (NSE)

Kenya’s leading telecommunication company-Safaricom on Wednesday marked 19 years since the company launched.

During the celebrations, the Nairobi Securities Exchange (NSE) listed telco unveiled a new strategy and renewed its commitment to its customers.

Under the new structure, Safaricom is committing to be ‘simple, transparent and honest’ across all its products and operations.

READ ALSO:Majority of Kenya’s job-seekers dream of working at Safaricom

As part of its efforts to simplify its products, the company has unveiled a new data plan, and a new calling and SMS plan that will respectively offer data bundles and calling minutes with no expiry.

Both data bundles, calls and SMS with no expiry are immediately available on *544#

“Over the last 19 years, we have come a long way together with our customers. As we celebrate our anniversary, it is a unique opportunity to reevaluate our operations to ensure that we remain relevant to …

The company’s board says this is part of the ongoing organisational turnaround strategies…

Kenya Airways management has fallen out with its pilots over continued losses at the airline, in the latest of many stand-offs between the two groups.

This is in the wake of a Ksh8.5 billion (US$81.9 million) half year 2019 (January-June) net loss as the carrier remains in the red.

READ:Kenya’s national carrier sinks into Ksh8.6 billion loss

The latest performance is a dip compared to the Ksh4 billion (US$38.6 million) net loss reported in a similar period last year.

This is despite a slight growth in total income during the period which went up to Ksh58.9 billion compared to Ksh52.2 billion same period last year.

Management has blamed the losses to high operating cost occasioned by an expanded network.

During the period, KQ, as it is known by its international code, saw its operating costs edged up to Ksh61.5 billion compared to Ksh53.2 billion last year, which eroded gains …

For the first time in 70 years, an African will next week become the head of the global standards body, the International Organization for Standardization (ISO).

Mr. Eddy Njoroge, a board member at the Kenya Bureau of Standards (KEBS) and a former Chairman at the Nairobi Securities Exchange will be confirmed as the 1st President of ISO from Africa, during the organization’s 42nd General Assembly Meeting that begins on Monday 16th September in Cape Town, South Africa.

Njoroge, 66, who missed the appointment by one vote in 2016 on his first attempt at the Beijing elections, brings to ISO over 10 years of experience in the field of standards.

He served as the CEO of Kenya Electricity Generation Company (KenGen) where he spearheaded its transformation from a parastatal to a publicly listed company. Most significantly, he led KenGen to become the first Kenyan public body to be …

Kenya’s banking industry has witnessed a myriad of changes in the last four years as lenders adjust to remain profitable since the capping of interest rates.

Mergers and acquisitions have become a norm in the country as the rate cap law, which came into place in September 2016, continues to weigh on banks’ earnings and loan growth.

READ:Why banks in Kenya will lend at a maximum 13%

The latest is the KCB Group PLC (KCB) take-over of National Bank of Kenya (NBK), which now sets the stage for the integration of the second tier lender into KCB.

In an announcement approved by the Capital Markets Authority (CMA) and published on Friday September 6, 2019, KCB confirmed that it had received consent to acquire NBK from shareholders holding 297,130,033 issued ordinary shares out of 338,781,200 issued ordinary shares, representing 87.7 per cent by the offer closure date on August 30, …

Nairobi Security Exchange’s top share index-NSE 20 shed some 43.09 points or 1.67 per cent to stand at 2543.59 on Friday, even as volumes rose from the previous trading.

The index that tracks blue chip companies at the bourse has been on a downward streak in recent weeks, affecting other indices, amid a continued decline in large cap stocks.

READ ALSO:NSE dips as 2018 ends on a bear market territory

During the last day of the week trading, All Share Index (NASI) shed 0.28 points to stand at 148.05. The NSE 25 Share index ended 9.25 points lower to settle at 3572.56, market data shows.

Market turnover for Friday however stood at Ksh332 million (US$3.2 million) from the previous session’s Ksh179 million (US$1.7 million) as the number of shares traded rose to 12.5 million against 9.9 million posted the previous day.

Week on week turnover however retreated to Ksh1.16 …

In her quest to pursue more renewable energy, Kenya has injected an additional 79 megawatts of geothermal power to the national grid.

This follows the completion of Unit 1 of Olkaria V Geothermal Power Plant by the Kenya Electricity Generating Company (KenGen) PLC.

The Unit was first synchronized to the grid on the June 28 and thereafter subjected to commissioning tests. It was then taken through a series of load tests until it attained its full design output of 82.7MW.

Commenting on the milestone, KenGen Managing Director & CEO, Mrs. Rebecca Miano, said the additional capacity would play a significant role in supporting Kenya’s power needs while enhancing the amount of green energy in the national grid.

“We are delighted to announce the completion of the first unit of Olkaria V Geothermal Power Plant and subsequently injecting 79 MW to the national grid. This brings to 612MW the total amount …

Kenya’s capital markets performed dismally in the second quarter of the year, latest data shows, despite political stability and growing interest from foreign-based investors.

The Capital Markets Authority (CMA) report for the quarter ended June 2019 shows secondary equities market registered slow activity during the review period.

Equity turnover for Q2.2019 stood at Ksh32.89 billion (US$316.3million), compared to Ksh45.25 billion(US$435.1million ) registered in the previous quarter; a 27.31 per cent decrease.

Similarly, market capitalization recorded a 3.46 per cent decrease to Ksh2.278 trillion (US$21.9billion) from Ksh2.360 trillion(US$22.7billion)in Q1. 2019.

READ ALSO:NSE dips as 2018 ends on a bear market territory

Traded volumes followed the same trend, falling by 3.46 per cent to 1.39 billion during the period under review.

Other composite indicators such as the NSE All Share and NSE 20 Shares indices likewise recorded decreases of 5.11 per cent and 7.51 per cent closing the quarter at 149.61 …

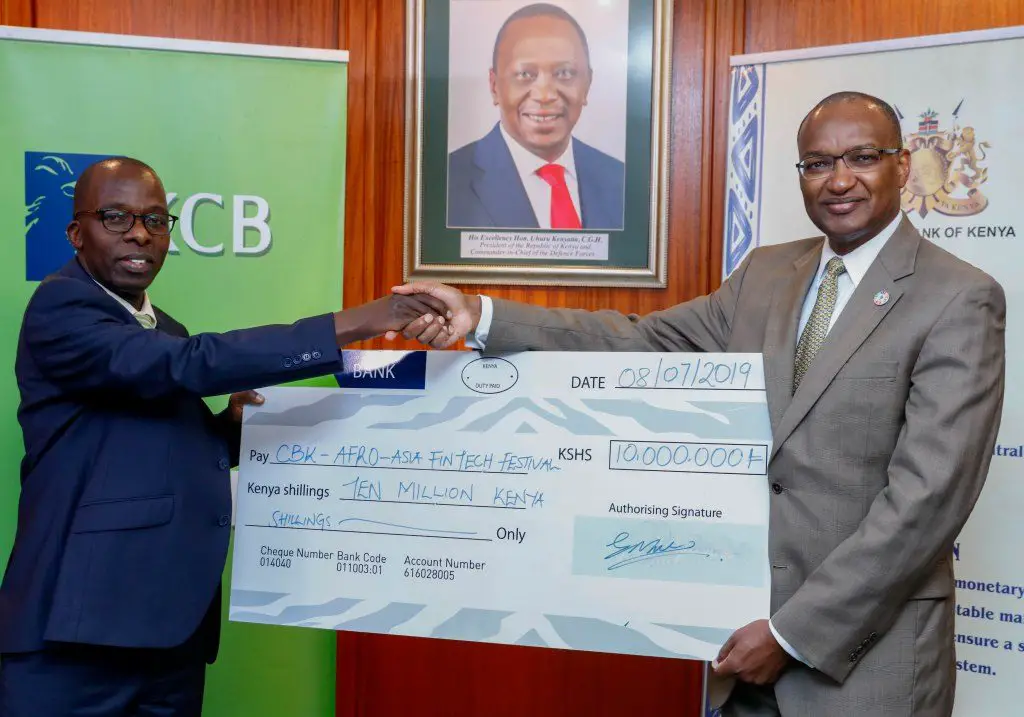

KCB Bank Kenya has committed Ksh10 million (US$97,448) to the Afro-Asia Fintech Festival 2019, a first of its kind in the region which will be held next week.

The funds will go into supporting the mega financial technology (Fintech) summit being hosted by the Central Bank of Kenya (CBK) and the Monetary Authority of Singapore.

The forum will take place between July 15–16 and is themed, ‘Fintech in Savannah’, modeled along the Singapore Fintech Festival.

KCB backing is informed by the need for Kenya to continue driving innovations in the banking sector to boost financial inclusion, the Nairobi Securities Exchange (NSE) listed lender has noted.

Speaking during the cheque handover to the CBK, KCB Group Chief Operating Officer Samuel Makome said: “For the past five years, we have made significant investments in financial technology in the realization that the future of banking is in digital finance. We will therefore remain …

Investors are keen on new developments at the Nairobi Securities Exchange (NSE) as the market opens its counters for derivatives trading.

The NSE Derivatives Market (NEXT) futures start trading today with the official launch of the market slated for Thursday, July 11, 2019.

“NEXT provides new opportunities to investors, enabling them to better diversify their portfolios, manage risk, and deploy capital more efficiently,” NSE Chief Executive Geoffrey Odundo said.

Futures contracts provide investors with risk management tools in the wake of unexpected volatility in asset prices.

READ:NSE gets green light for Derivatives Market

NEXT will also enable Kenya to consolidate its position as a leading financial services hub offering a wide variety of investments products.

The NEXT will commence with index futures and single stock futures on selected indices and stocks respectively, the bourse’s management said.

The Exchange will initially offer index futures contracts on the NSE25 Share Index …