- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

Browsing: Oil

The $3.5 billion and 1,443 km crude oil pipeline project, stretching from Lake Albert in Uganda to Tanzania’s port in Tanga, will be fast-tracked to commence the implementation of the project, which was put on hold last year.

Tullow is a recognised independent oil & gas, exploration and production company based in Africa and South America The company has interests in over 70 exploration and production licences across 15 countries.

According to information from The Citizen, a Total delegation led by President, Exploration and Production Arnaud Breuillac held talks with Energy minister Dr Medard Kalemani on Friday. The talks aimed at updating the Tanzania government on the new development.

“We are now enabled to fast track finalisation of legal and commercial agreements to pave the way for the Final Investment Decision (FID) before commencing implementation of the Project,” he said.

However, as both partners—Tanzania and Uganda face-off COVID-19 challenges, Mr …

Withholding Tax (WHT) is an advanced payment on income tax deducted directly from source by a service provider. The taxpayer could be a company or an individual and the rate of WHT ranges from 2.5% to 10%, depending on the nature of the transaction.

WHT is not a separate tax but serves as a credit against the tax liability of the taxpayer. For example, companies are required to pay Companies Income Tax (CIT) at the end of their accounting year and after their audited accounts have been filed. At the point of the assessment of their CIT liabilities, the WHT deducted from their invoices to service providers during the year would be deducted from the CIT payable for that financial year.

WHT and Non-Resident Companies

Non-resident companies are companies not incorporated in Nigeria. Under the Companies Income Tax Act (CITA), non-resident companies which have a “fixed base” in Nigeria are …

Total Uganda has bought out the financial struggling Tullow Oil for a whopping USD575 million as the latter gears up to leave the East African market.

The buyout will be paid in part by a USD 500 million initial payment payable upon completion and another USD75 million payable when the project pact is finalized.

With completion of the sell, Total Uganda will now own Tullow’s assets on the humongous Lake Albert Development project and the even larger East African Crude Oil Pipeline project. Tullow, a British owned conglomerate has been struggling and the just inked Uganda buy out will help improve its liquidity.

The move is not due to the ongoing global coronivrus pandemic, it is rather a strategic plan that was on the table long before the pandemic begun. At the start of the year, the sale and purchase agreement had already been signed, well before the Covi-19 virus …

Even as share values for US futures on crude oil prices hit rock bottom, spotting a worrisome negative figure (-4.0 USD) there are still several functions that claim the crush of oil prices in the US and around the World will have no effect on stock shares in Tanzania, the numbers are giving a different story. Lets start with the optimistic side.

As US futures for oil price continue to free fall some are of the view that it will have no effect on Tanzania’s sole bourse, the Dar es Salaam Stock Exchange (DSE). Why? Well, simple, most African countries, Tanzania included, are oil importers so, the fall of oil prices will mean positive balance of payments.

In turn, favourable balance of payment means good exchange rates of the shilling for the dollar, again another plus for the shilling. Good exchange rates translates to higher value of the shilling and …

Last week we saw negative oil prices hurt energy markets enormously, and we have the global pandemic—coronavirus (COVID-19) to blame for that, as nearly the entire globe is on lockdown, that sucks the life out of energy-consuming spheres.

Reports indicate mixed feelings as Bloomberg noted that, oil prices could go down again, as storage shortage becomes another nagging factor to the problem, and yet—we have seen people paying to get rid of their stock.

“The last trade of the May WTI futures was on April 21, and on April 20, as financial traders with long positions scrambled to get out of the contract, the price fell to negative $37.63 per barrel. Then on April 21, it was fine again, and the contract finished at $10.01. Even on April 20th, most trades in the May futures happened at positive prices. But toward the end of the day, panic—or something—set in, …

The price for crude oil is down 60 percent since the year started and it is only tumbling further, global oil news reports.

On the one hand, analysts blame the ongoing coronavirus pandemic and on the other the price war between Saudi Arabia and Russia is said to have contributed to the sharp drop.

Even the movers and shakers are feeling the pinch, oil in the US plummeted 34%, crude oil falling by 26%, and brent oil falling 24%. Associated Press reports that prices this week dropped to an 18 year all time low of under USD20 a barrel for the US.

Speculators say it is the best time to invest, pessimists would have you shy away from taking the risk.

The idea is a simple business law, buy when prices are low and sell when prices peak, so technically, the advice to buy into the oil business now is …

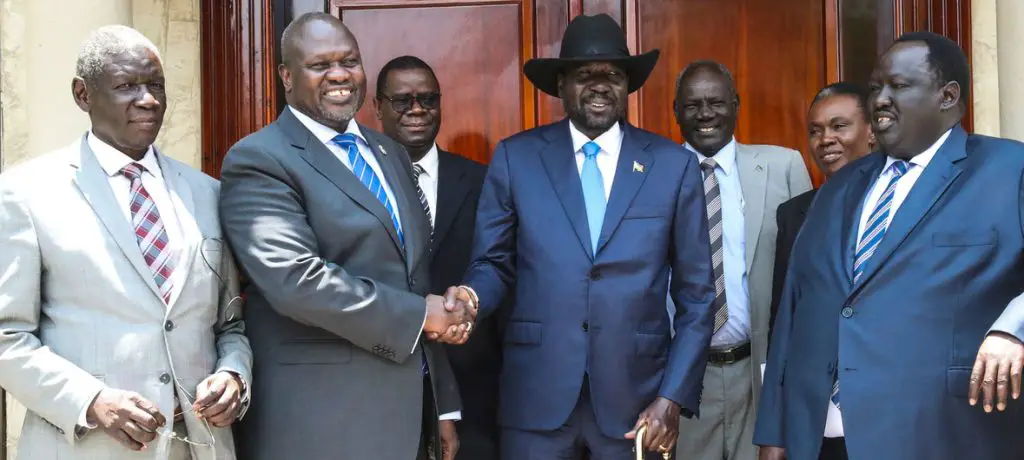

South Sudan’s handshake’ has been welcomed by economists who say the deal resonates with the demands of the economy, which according to the World Bank and IMF, expects it to be one of the fastest-growing in the continent.

Last week, a new government of national unity was unveiled with Dr. Riek Machar joining the government as a vice president ending six years of civil war that has killed about 400,000 people and displaced millions. The war has also led to massive looting and wastage of oil and the proceeds of the natural resource leaving the country impoverished.

According to the World Bank, Africa’s top performers in 2020 will be led by South Sudan (8.2%). This coupled with the new peace agreement is expected to overturn the negative tide the country has faced in the last few years.GDP Annual Growth Rate in South Sudan averaged -3.46 percent from 2009 until 2018, …

Ahead of this week’s African Union meeting (Feb 9-10), more than 25 organisations, networks and community resistance groups from Africa and around the world have called on African governments to prevent the proliferation of coal, oil and gas in Africa and to ensure efforts to address fossil fuels match those which have helped reduce the danger from nuclear weapons, Power Shift statement reveals.

According to the statement, the communique signed by the group criticized the deliberate proliferation of coal, oil, and gas in Africa, contrary to scientific evidence and highlighted the contradiction between planned fossil fuel expansion and globally agreed climate targets.

They also condemned the way some African governments were avoiding scrutiny from civil society groups and even violently targeting environmental activists and human rights defenders in some places.

Representatives from the different NGO groups who attended an Africa Energy Leaders Summit on Climate Change, Energy, and Energy Finance …

The East African Community (EAC) is regressing with Kenya, Uganda and Tanzania leading the pack.

It is gross discouragement to hardworking East Africans who are seeing their countries’ economies continue on a downward trend despite the much-hailed talk of GDP growth.

Coupled with unfavourable economic conditions globally, the EAC economies are degenerating, leading to chaotic disruptions of livelihoods of the majority poor.

Kenya’s debts, theft of public resources

Kenya is East Africa’s economic hub but with the goings-on lately, it seems like the centre is no longer holding.

A Gallup International annual End of Year Survey released in 2002 showed that Kenyans were the most optimistic people on earth and in 2019 the Global Optimism Outlook Survey found that 70 per cent of Kenyans viewed themselves as optimists.

This average was above the global standing at 56 per cent and continental Africa’s average of 64 per cent.

For a country …

East African countries are set to attend the ninth East African Petroleum Conference and exhibition to discuss investment opportunities to enhance socio-economic transformation.

This year`s conference is themed:` East African Region – the destination of choice for Oil and Gas Investment Opportunities to enhance Socioeconomic Transformation.`

Chairperson of the organizing committee, Marin Heya said over the weekend that over 1,000 local, regional and international delegates will be attending the three-day conference that will be in Mombasa from May 8.

`The conference will help attract investors on oil and gas into the region given the potential in the region, ` Heya said.

He revealed that the Chinese geo-spatial and survey firm BGP and CNOOC are among the companies that are expected to attend the three-day conference.

The official also stated that the East African Community (EAC) member states, including Kenya, Uganda, Tanzania and Rwanda will exhibit at the conference alongside international …