- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Pwc

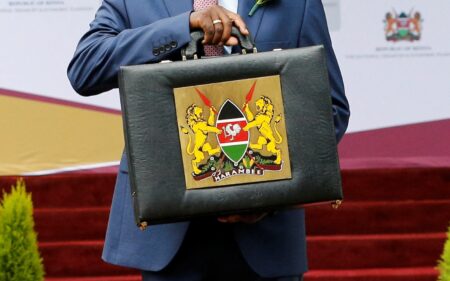

- Efficient public spending in Kenya has been elusive over the year with the East African country forced to borrow to meet its budget

- Further the firm is recommending more performance based incentives for industries by the government to enable grow the jobs offering.

- PwC adds that Proposed allocation of Sh4.5 billion for County Aggregation and Industrial Parks (CAIPs) will help to reduce post-harvest losses.

Experts are warning Kenyans to brace for a tough 2024-25 financial year as the government moves to ramp up revenue measures to finance the recently released budget.

A post budget analysis by Audit firm Deloitte has revealed that the new year will be a hard one for Kenyans and will require fiscal discipline to navigate.

Doris Gichuru, partner for tax and legal at Deloitte says that Given the Finance Bill 2024 there is going to be a challenge in private consumption from the various measures though …

- Most East African family businesses believe that it is essential to be trusted by customers, employees and family members.

- Among those who consider trust among each group important: 56% are fully trusted by customers, 47% are fully trusted by employees and 77% are fully trusted by family members.

- East Africa’s level of trust is slightly higher than global survey on family businesses.

Family businesses in East Africa demonstrated robust performance over the past financial year, with 64 percent experiencing growth, compared to 46 percent in 2021, as indicated by a survey conducted by the advisory firm PwC. The PwC’s East Africa Family Business Survey 2023 affirms the resilience of family businesses, consistently overcoming geopolitical challenges.

Despite their success, experts emphasize that these businesses must adopt new priorities to ensure the longevity of their legacies. The landscape of building trust in business is undergoing a fundamental and rapid transformation. Environmental, Social, …

Banks in Africa generally and in South Africa especially weathered the perfect storm caused by the COVID-19 pandemic.

This is testament to their resilience and confirms the findings of a study that was commissioned in 2015 by the African Development Bank titled, “The Banking System in Africa: Main Facts and Challenges”. The report found that while Africa’s banking environment is relatively shallow and less penetrated, it is as competitive as that in other developing and high-income regions.

- Banks in Africa showed their resilience when they weathered the existential threat and headwinds brought on by COVID.

- Banking in Africa is significantly ahead if the rest f the world according to the AFDB in terms of the penetration and adoption of mobile banking.

- Banks in South Africa especially have been making money as the economy shed off its last vestiges of COVID controls.

The continent has made improvements in banking technology and …

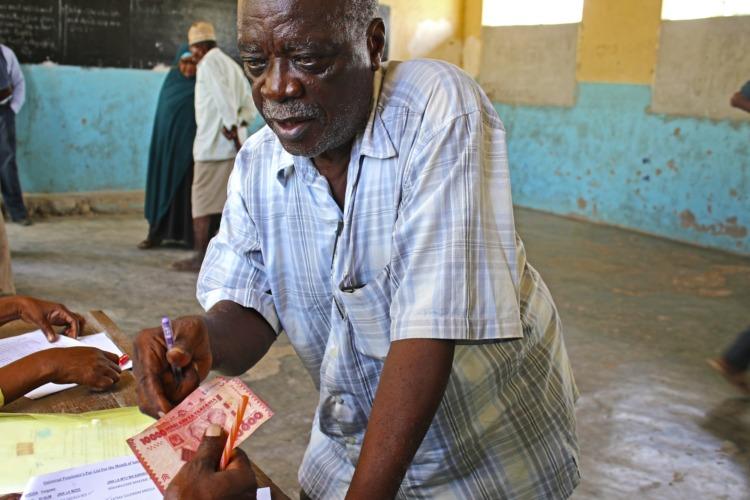

Most Kenyans, 83 per cent, indicated a willingness to increase the amount of money they allocate to savings and investments, but the inability to save due to insufficient funds after fulfilling their obligations that require regular funding and the availability of quick digital loans.

Among their obligations which contribute to Kenyans’ financial strain is supporting their extended family which considerably bites into their savings. 84 per cent of people indicated that they regularly provide some income to their extended family, mostly in case of emergencies, because they feel a sense of obligation to send their extended families money and because their extended family members treat them better when they are sent money.

On their part, the extended family members mostly use the money to cater to recurring expenses like food & transport, school fees and medical expenses at 23 per cent, 19 per cent and 18 per cent respectively. Farm-related …

- The global mining industry is changing minerals that drove mining activity and profits are slowly being eclipsed by the emergence of a new class of resources, PWC reports.

- The pursuit of net zero emissions has altered the global mining industry which is increasingly leaning towards the production of minerals used in renewable energy and away from the production of fossil fuels.

- According to PWC Fossil fuels still contribute substantially to global mining companies despite critical minerals taking center-stage.

- Global mining activity despite the threat of global warming is not slowing down. It is to the contrary on the rise as the world looks for ways of reducing carbon emissions.

- At the turn of the millennium the global mining industry was driven by mass urbanization of emerging market economies like China, Brazil, India and Russia this projected to slow down or lose ground to the pursuit of renewable energy sources.

PWC’s …

- Tanzania has went through significant changes in its pension schemes over the past years

- Pension funds have becomes a useful tool in the wake of the pandemic

- Nigeria,Kenya, Namibia, Bostwana and Mauritius demonstrate serious activity in pension fund growth

Pension funds are now an instrumental tool in the economy across Africa that play a major role in building long-term finance and capital markets, through mobilization and allocation of stable and long-term savings to support investment, according to Making Finance Work for Africa.

In a nutshell, according to Corporate Finance Institute, the pension fund is an endowment that accumulates capital to be paid out as a pension for employees when they retire at the end of their careers.

In countries such as Tanzania, where pension funds are part of government lending, contributing at least 11.4 per cent of total investment by March 31, 2019, there is a glimpse of hope that …

Speaking in Dar es Salaam over the weekend at a press conference to announce the sponsors for this year’s event, the Lavine International Agency Chief Executive Officer Diana Laizer said: “We thank the support from our stakeholders and sponsors for their pledges to ensure that this year’s event goes across the continent with flying colours.”

“The Consumer Choice Awards Africa (CCAA) was originated from Tanzania Consumer Choice Awards (TCCA) which was founded in 2019 under the organization of Lavine International Agency Limited; is a business awarding event that recognizes, enhances and promotes business excellence through consumer’s choice,” she said.…

Blockchain technology has for long been associated with cryptocurrencies but there is so much more that it has to offer. …

Africa Entertainment Industry

Nothing soothes the African plains like heart-pumping beats and the melodious ethos of African instruments playing to cultural tunes intertwined with western influences of hip hop and RnB (Rhythm and Blues).

As Africa poses the world’s youngest population, the continent is not short of excitement. The region has plenty of singers, dancers, musicians and beatmakers, all hungry to produce the continent’s next hit. But it’s not just music that’s driving the continent’s entertainment industry.

The billion-dollar business of entertainment spans across, television, cinema, radio, video games, e-sports, print and online publishing, book publishing, business-to-business, music, out-of-home, and virtual reality.

Currently, only five countries are taking the lead in churning more revenue and putting talents out for the world to see as opposed to its other neighbours in Africa. Nigeria, South Africa, Ghana, Kenya and Tanzania have taken a lead in Africa, leaving much of …

Africa lags behind when it comes to data and privacy protection exposing the continent’s population to threats which could become expensive to them.

A report by the United Nations Conference on Trade and Development (UNCTAD) shows that 107 countries have put in place legislation to secure the protection of data and privacy. 66 of these countries are developing or transition economies.

In this area, Asia and Africa show a similar level of adoption, with less than 40 per cent of countries having a law in place.

Despite the prospective growth in mobile money transfers and e-transactions, Africa is still far behind in legislation to govern the sector. In addition, cybercrime regulations are few in Africa with 39 countries having some legislation and representing 72 per cent of the continent, 2 countries have draft legislation while 12 countries have no legislation and one has no data.