- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

- Powering Africa: Africa’s Path to Universal Electricity Access

- Global investment trends at AIM Congress 2024: a spotlight on the keynote speakers

- South Africa’s deepening investment ties in South Sudan oil industry

- Agribusiness could drive Africa’s economic prosperity

Author: Wanjiku Njugunah

Wanjiku Njuguna is a Kenyan-based business reporter with experience of more than eight years.

Kenya has been lauded for its decision to waive the requirement of obtaining a visa to enter the country by citizens of the Republic of South Sudan who hold valid passports.

In a statement, the East African Community (EAC) Secretary General, Dr. Peter Mathuki, said that the move was in line with the decision announced by the Chair of the EAC Heads of State, President Uhuru Kenyatta, during the 21st Ordinary Summit of the EAC Heads of State held on 27th February, 2021.

“This demonstrates the goodwill among the EAC Heads of State in promoting regional integration and revamping relations, which is set to boost intra-EAC trade,” said Dr. Mathuki.

Other Partner States that have also waived visa requirements for South Sudanese citizens are the Republic of Rwanda and the United Republic of Tanzania.

Dr. Mathuki lauded the Republic of South Sudan, which has in the spirit of reciprocity also …

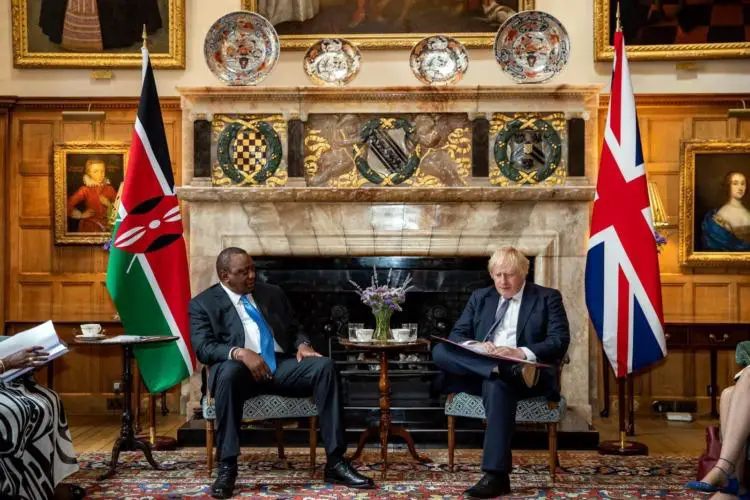

The British High Commission has announced a new programme that will allow unemployed Kenyan nurses to work in the United Kingdom, as part of a new scheme requested by the Government of Kenya and launched by President Kenyatta on July 29 during his visit to London.

The British High Commission says Kenyan health professionals and health managers who are out of work are eligible of working in the UK, before returning to work in Kenya’s health sector.

According to the Commission, the special arrangement for Kenyan nurses to work the UK was part of a request by Kenya to capitalize in those qualified but unemployed health workers in Kenya.

The exact numbers of those who will go to the UK – and the process for visas – will however be confirmed in the next three months, according to the Commission.

Kenya embracing new ways of doing business

UK Health Secretary, …

Kenya has received a coronavirus vaccine donation from the United kingdom, following the meeting between President Uhuru Kenyatta and British Prime Minister Boris Johnson earlier this week.

The East African nation received 410, 000 doses of the AstraZeneca COVID-19 vaccine Saturday, as part of the 817, 000 doses that Kenyatta secured during his three-day visit of London earlier this week.

The remaining doses which were donated through the COVAX facility is expected to arrive in the country in the coming days ahead.

The arrival of the vaccines come days after President Uhuru Kenyatta urged the global community to heighten efforts in promoting equity in the distribution of COVID-19 vaccines.

Speaking to Sky News in London, President Kenyatta underscored that the world can only be save if everybody gets to be vaccinated against the virus.

He noted that Kenya is ready to manufacture the COVID-19 vaccines but regretted that the only …

Kenya’s inflation is expected to remain well anchored within the target range, against the backdrop of COVID-19 shock and its spillover to the economy.

This is according to a new report by Central Bank of Kenya (CBK) which has reveals that a hike in food and fuel prices has been impacting the rate of inflation.

In July for instance, year on year inflation rate, which is measured by the Consumer Price Index (CPI) was 6.44 percent, in July 2021.

The Kenya National Bureau of Statistics attributed the rise in inflation increase in prices of commodities especially food and transport.

“Food and non-alcoholic beverages prices increased by 8.84 percent, while housing, water, electricity, gas and other fuels rose by 6.03 percent,” KNBS noted.

Transport was however the commodity with the biggest hike, after prices shot up by 10.33 percent between July 2020 and July 2021.

The CPI increased by 0.20 …

The tourism industry is unlikely to return to pre-COVID arrival levels until 2023 or later, following the ravaging effect of the coronavirus pandemic.

This is according to the United Nation’s World Tourism Organization (UNWTO) which reveals that nearly half of the experts interviewed see a return to 2019 levels in 2024 or later.

Quoting its World Investment Report 20201, UNWTO says the main barriers of full recovery are travel restrictions, slow containment of the virus, low traveler confidence and a poor economic environment.

Dubbed ‘COVID-19 and Tourism’, the report reveals that travel has adapted to the impact of COVID particularly in terms of travel restrictions.

“Domestic travel has increased, but this does little to help developing countries that are dependent on international travel. Retirees, who tend to spend more per trip, are more likely to stay at home,” the report says.

In Kenya for instance, domestic tourists cut their holiday …

According to the brewer, profit after tax for the period declined 1 per cent to Sh7 billion mainly impacted by cost inflation, tax and foreign exchange impact.

Further, the COVID-19 related tax reliefs in Kenya on corporation tax and VAT ended in December 2020, resulting in higher tax charges for the year as the rates reverted back to pre-COVID levels.

The company said the slower profit growth rate was driven by the impact of cost inflation, adverse foreign exchange and tax charges.…

Over 2,500 Micro, Small and Medium Enterprises (MSMEs) in Kenya have received training on expanding their digital presence courtesy of the Kenya Private Sector Alliance (KEPSA).

The KEPSA E-commerce Booster Program was launched in February this year with a target of training 2,000 MSMEs.

According to the Alliance, the enterprises have been trained on introduction to e-commerce, digital marketing, aftersales, content creation and management.

Of the figure, 1300 businesses were on-boarded onto various ecommerce marketplaces to increase and diversify their revenue streams hampered by the Covid-19 pandemic.

The MSMEs targeted by the program were struggling with their digital brand presence with majority of them reporting they were either unaware of missed opportunities or did not have a digital brand strategy.

“As the COVID-19 pandemic continues to cause disruptions in global and regional value chains, it is clear that e-commerce is an important tool and solution for both businesses and consumers,” …

The top 10 banks in 2020 in Kenya accounted for 77.7 percent of industry assets, 80.7 percent of loans and 78.6 percent of deposits, with the proportions largely unchanged from their 2019 levels.

This is according to a new report by Kenya Bankers Association which reveals that over the same period, the bottom 10 banks accounted for 2.5 percent, 2.2 percent and 2.0 percent of industry assets, loans, and deposits, respectively.

During the period under review, banking sector total assets expanded in 2020 by 12.4 percent, ending the year at Sh5.4 trillion from Sh4.8 trillion in 2019, data from the Kenya Bankers Association has shown.

The 12.4 percent strong growth in assets, compared with 9.4 percent in 2019, was driven by a faster expansion in non-loan assets, mainly investments in government securities, which grew by 18.5 percent, compared to 6.7 percent growth in gross loans and advances.

British insurance company Prudential plc has submitted a letter of Intent to apply to join the newly established Nairobi International Financial Centre (NIFC).

In a statement, the company says the application will position it as one of the NIFC’s anchor clients and support the deepening of Kenya’s financial services landscape.

The letter was submitted at a high-level roundtable at The Mansion House in the City of London, attended by President Uhuru Kenyatta, UK Foreign Secretary Dominic Raab, Kenyan Treasury Cabinet Secretary Ukur Yatani Kanacho, UK Minister of State for Africa James Duddridge, the UK Economic Secretary to the Treasury John Glen, the Lord Mayor of the City of London William Russell and Chairs and CEOs of leading UK financial institutions.

Ukur Yatani, Cabinet Secretary National Treasury & Planning said through collaboration with partners like the CityUK, the NIFC will attract increased investment and financing into the country,

“This will not …

Kenya’s banking industry remains sound and stable despite being buffeted by the effects of the Coronavirus (COVID-19) pandemic.

This is according to a report by the Kenya Bankers Association which indicates that’s the industry’s overall profitability and contributions to the national budget dropped to a nine-year low in 2020.

This was on the back of the COVID-19’s negative impact on the economy, particularly the trade, manufacturing and agriculture sectors where banks have restructured a majority of assets.

Dubbed ‘State of the Banking Industry (SBI) Report 2021’, the report reveals that banks’ profits before tax dropped by 30.9 percent — the lowest level since the year 2012, attributable to a depressed economic performance and quality of assets held by banks during the year.

The report reveals that provisioning for loan losses increased by 47.5 percent to Sh198.1 billion during the period, from Sh134.3 billion in 2019, with loan loss accommodations absorbing …