- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

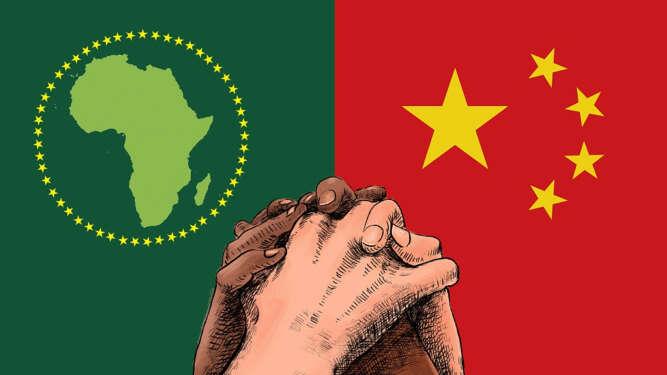

Browsing: Africa China

- Africa is loosing out on bad minerals for loan deals, AfDB warns.

- AfDB is developing initiatives to help countries’ address the bad loans.

- China alleged to be the leader in bad minerals for loan deals with Africa.

Africa’s natural resources are being traded for loans from international lenders and that is why the continent is underdeveloped, the Head of the African Development Bank, Dr Akinwumi Adesina, has decried.

In an interview with The Associated Press in Lagos, Nigeria, Dr Adesina called for an end to “loans given in exchange for the continent’s rich supplies of oil or critical minerals used in smartphones and electric car batteries.”

The Head of Africa’s biggest lending bank, AfDB, said some countries have gained control over mineral mining in places such as Congo and have left some African countries in financial crisis owing to such ‘mineral for loans deals.’

“They are just bad, first …

China’s reduced lending to Africa has raised concerns about the future of Africa’s economic development and its relationship with China. The reduction in lending is due to a combination of factors, including the slowdown in the Chinese economy, the growing debt burden of African countries, and China’s increased selectivity in its lending.

The reduced lending has several implications for Africa’s economic future. African countries must find alternative sources of financing, a shift towards domestic resource mobilization, a change in the balance of power between China-African relations, and a potential slowdown in infrastructure development. African countries must navigate these changes carefully to ensure sustainable economic growth in the coming years.…

- The change in patterns of trade triggered by these two major events is now forcing the MNCs to go back to the drawing board.

- MNCs need to reconfigure their trade routes. They have to re-lobby for assured capital and they have to broker new destinations for their goods.

- With the changing global trade polarities, the MNCs are rethinking China, and eyeing future giants like Africa.

The much acclaimed African Continental Free Trade Area (AfCFTA) that came into being last year may just have saved Africa from a new world trade order.

Thanks to the global pandemic and then the Russia-Ukraine war, the plate tectonic of global trade is shifting. The resulting divergence and convergence are squeezing and pulling in different directions.

Multinational Companies (MNCs) have, for the last three decades or more, controlled trade. These international corporations have enjoyed the fruits of globalization more than any other business entity.

They …

- China’s GDP is central to the global economy and especially in Africa

- The Asian country’s economy is integrated with nearly every sphere of global trade from manufacturing to finance and mining

- This means that when China does well economically so do African countries

The AFCFTA will transform Africa if it can be implemented.

China is an integral part of the global economic matrix. The Asian behemoth is responsible for the economic well-being of a litany of countries in the world.

Much of the economic growth enjoyed by numerous countries owes itself to and is sponsored by China’s economic activity either in whole or in part. China’s mass urbanization gave a spark to producers of natural commodities who continue to rely on the Asian country’s appetite for these natural resources for their income.

China went from being a pure-play communist republic to a hybrid capitalistic society of sorts owing to its …

- China’s ambition is to eclipse the United States as the leading economy in the world

- The Belt and Road Initiative is China’s idea to increase economic cooperation with countries along six economic corridors using resources which will be procured from Africa

- Africa is not among the 6 corridors of the Belt & Road Initiative espoused by China but is the biggest if not the sole supplier of the basic resources necessary for the initiative to succeed

- China has become a globally recognized military super power

- China has the largest reserves of United States dollars of any country in the world.

- Africa needs to become the 7th corridor of the Belt & Road Initiative

- Africa’s resources and China’s nearly insatiable appetite for them present a golden opportunity for African countries to grow their economies and emerge out of poverty

China’s President Xi Jinping’s ambition is to make his country a superpower …

Some 11 sub-Saharan African (SSA) countries are currently at high risk of debt distress according to the latest debt sustainability analyses by the International Monetary Fund (IMF).

Already, six countries are in debt distress and the debt burden is worsening in the region where the public debt ratio to gross domestic product has surged to 65.6 per cent from 56.4 per cent pre-Covid-19 period.

A study conducted by the China-Africa Research Initiative (CARI) at Johns Hopkins University shows that there is a trend where African governments are mortgaging their natural resources to secure loans from China. This has often ignited debt distress when commodity prices collapse.

Read: Why do lenders want “COLLATERAL”?

This mortgaging of resource is referred to as collateralized sovereign debt. This is where a sovereign loan is secured by existing assets or future receipts owned by the borrowing government. The collateral could be commodities, future export revenues, …

Until 2019 Africa and china had an eccentric lending experience. This includes the lending spree featuring more than $10 billion a year from 2012 to 2017, higher than $1 billion in 2001, sadly China lending to Sub-saharan Africa has fallen short due to serious defaulting fears.

A detailed study executed by John Hopkins University’s China-Africa Research Initiative pointed out that, debt sustainability concerns have triggered lending to the African government to drop by 30 per cent in 2019.

China—the world top industrial economy has been a close lender to Africa—the world’s top raw material producer and fastest-growing economy over the past decade.

On the side of the fence, according to China’s 2021 White Paper on International Development Cooperation published in January, China has steadily increased the scale and further expanded the scope of its foreign aid, giving high priority to the least developed countries in Africa (Global Times).

Several media …