- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

Browsing: investing in Africa

Investors are set to pump a total of $8.41 billion into Nigeria’s economy.

According to the Nigerian Investment Promotion Commission (NIPC), more jobs will be created since the investors are targeting various sectors in the country.

NIPC Executive Secretary Yewande Sadiku who made the announcement during a media briefing in Abuja said the country’s unemployment level is the second highest globally.

Sadiku noted that the $8.4billion is pledged for the first quarter of the year, while over 23.19 million Nigerians, according to the National Bureau of Statistics (NBS) report, were unemployed during the fourth quarter of 2020.

However, Sadiku said although investment announcements are not actually investment, it gives an aggregate of investors’ interest in Nigeria and also help to translate those announcements to actual investment.

According to her, the Commission has been honest on the gap between announcement and actual investment demonstrating potential.

“We have also said that a …

Over Sh600, 000 is up for grabs in the new Makueni Innovation Challenge 2021 that is seeking ideas that will bring economic recovery amidst Covid-19.

The challenge targets all youths across the country, individual, groups or institutions aged between 18-35 years with ideas that fall into the thematic area of Agriculture, Health and Trade.

The challenge has been organized by Makueni County in collaboration with other partners that include Association of Countrywide Innovation Hubs, Communication Authority of Kenya, Africa118, Africaistalking, Decoded and Liquid Telkom.

Makueni County Governor Kivutha Kibwana says the aim of the challenge is to catalyze the growth of startups, so as to amplify and consolidate the gains of the country’s digital innovative ecosystem.

Also Read: Innovation Africa: Defining technological change on the continent

“Youths must grasp the opportunities available at their disposal, and utilize them to enhance their skills to become entrepreneurs, employable and problem solvers in …

A survey conducted in 34 African countries between 2016 and 2018 shows that people are chiefly concerned about the future of work, be it job availability, quality, or growth. The gig economy is essential for the people of Africa because of its ability to provide a source of income to the inexperienced and unemployed majority. Formal jobs are only available to a few, while most people work in the informal sector as subsistence farmers, vendors, small-scale traders and numerous other roles.

Africa has a growing youth population that will need to be absorbed into the productive sector. An estimated 122 million new entrants are expected to join the labour market in the next two years, and it is impossible for an equal number of formal jobs to be created for these people.

…

So…..one of the longest bull markets in history; the Covid-19 pandemic; two trillion dollars invested in a digital pyramid scheme (Bitcoin et al); government borrowing on an unprecedented level to deal with the pandemic; real trade tensions between China and the West; post-quantitative easing unemployment set to rocket; the stock markets being manipulated by large groups of retail investors; a new market dynamic caused by digitalisation; markets back to pre-Covid-19 levels……..what is an investor to do?!

The only thing that is certain is that, in the words of Chinua Achebe, “Things Fall Apart”. It is not a matter of “if” but “when”. Most commentators would suggest that the “when” will be within a maximum of 24 months and many think much earlier.

So if there is a global recession/depression on its way and if markets are going to undergo a substantial correction it makes sense to diversify …

For the longest time, Africa took a back seat in the world economy. Albeit for various reasons, some beyond the continent’s control, Africa was not recognized as an active economic participant by developed countries. However, there has been a paradigm shift in the past few decades as Africa has begun to forge its destiny and implement policies that benefit its economic status in the world. Africa has been recognized as the world’s second-fastest-growing regional economy with anticipated annual growth of about 3.9% by 2022. …

African economies thrive on an abundance of natural resources. However, the financial resources needed to exploit these resources remain a major constraint in Africa. Foreign direct investments are playing a critical role in filling the capital gap in Africa as most governments run on budget deficits.

Mozambique, a new investment hub, is booming with capital inflows in its energy sector. With its abundant natural gas resources, the country has positioned itself as a dominant energy investment hub in Southern Africa.

The Prospects

Massive natural gas reserves

Mozambique has a lot of proven natural gas reserves. It ranks 14th in the world in terms of its reserves. However, production for this energy resource is still very low as well as local consumption. This is a result of poor infrastructure development to extract the resource and also proving that the sector is still in its infancy stages. There is increasing interest …

Much of the talk at the moment, and nearly always, is where we should invest in a world of recession, low-interest rates, unpredictable markets and a challenging socio-political climate. As open borders in East Africa close, open, close and re-open again and as Kenya prepares for yet another Covid-19 lock-down our own region is particularly challenging.

I am a member of several international investment groups and so I am fortunate to hear the views, perspectives and experiences of many clever and visionary investors around the world. I have written here before about ESG investing – Environmental, Social Impact and Governance – the “do’s” of impact invest but I haven’t written about the “Don’ts”. And it strikes me that we should be talking just as much, perhaps even more, about where not to invest at the moment and in the future. …

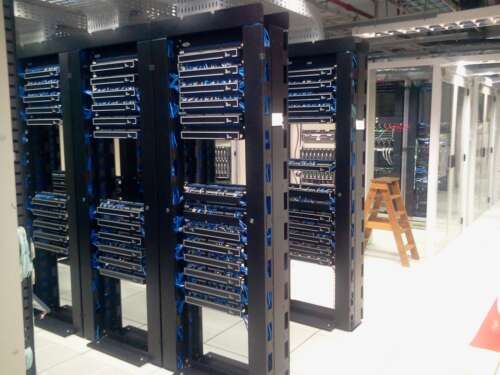

Data centers are Information Technology (IT) facilities responsible for the management of data in an organization. Data centers house state-of-the-art computing infrastructure with very powerful machines. Traditionally, data centers were associated with extensive use of space and a lot of hardware components to support big data storage and management services.

As technology evolves, the use and development of software-based data centers requiring less space are increasingly becoming more common.

Cloud computing, a modern model used for data centers is growing in popularity in Africa. This technological innovation allows for an integrated approach to data management services such as storage, applications, and servers. Cloud-based data centers have lower costs compared to traditional physical data centers. Most cloud computing services are outsourced from well-established companies that have the resources and experience to do so. Companies such as Microsoft, Amazon, and Teraco continue to invest significantly in cloud infrastructure, globally.

High growth

…Are you thinking of investing in Africa, Côte d’Ivoire to be specific?

Well, the best time to invest in Africa is now. However, foreign investors have not moved into the continent as quickly as expected because foreign investment decisions are often methodically overstructured. One of the major factors cited is too much risk.

Africa is the most profitable region in the world. A report by the UN Conference on Trade and Development states that between 2006 and 2011, Africa had the highest rate of return on inflows of Foreign Direct Investment: 11.4%. This is compared to 9.1% in Asia, 8.9% in Latin America and the Caribbean. The global figure is 7.1%.

Investing in Africa is good business and a sustainable corporate strategy for foreign investors. Advanced and emerging countries’ governments and the private sector should leverage these profitable, emerging investment opportunities.

Economic growth prospects

Africa’s economic growth prospects are …

Africa’s financial potential has become an interesting prospect for emerging market investors. Three decades ago a proposal to invest in Africa would have been considered ridiculous, but this is no longer the case. In fact, between 2006 and 2011, the continent was registering the highest returns on FDI at 11.4 percent, even higher than Asia at 9.1 percent, while the global average was 7.1 percent. To add to that according to the World Economic Forum, since 2000 “half of the world’s fastest-growing economies have been in Africa. As western markets mature and foreign investments saturate in Asia, Latin America, Central and Eastern Europe, and India, Africa is fast becoming the most lucrative investment destination. The inefficient African markets are an excellent source of excess returns, given the level of perceived risks. …