- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: recession

African countries looking to anchor their currencies on either gold, or a combination of gold, precious metals, and other minerals would need to start with legislation which would make it legal for the governments of those countries to redeem paper currency with either those minerals or a derivative of those minerals.

Zimbabwe in late August began an initiative where it sold actual gold coins to its citizens which had been minted by that country’s central bank. This move was initiated to halt the slide of the currency on the parallel and official markets. This county’s policy so far has been successful in slowing down the trend of inflation which had begun to run amok.

It would be remiss to attribute the slowdown inflation to the gold coins. The country dramatically tightened its monetary policy by increasing interest rates to over 200 per cent in May 2022 and temporarily banned commercial …

Other reasons that can best explain the origins of stagflation include falling productivity when an economy experience falling productivity. This could be because workers becoming less efficient. The consequence of this will be falling productivity and rising costs. Structural unemployment is another cause in cases where there is a decline in traditional industries.

This creates a tendency for unemployment to rise while productivity falls. Zimbabwe, during its lost decade from 2000 to 2010, experienced this kind of stagflation.

More generally and more contextually, stagflation comes from supply shocks. These result from supply chain disruptions. Where demand for goods and services increases or is unchanged, the result is rising prices and lower productivity.

Stagflation is not desirable in an economy because citizens of a country are generally happy when prices are low and the economy is booming.…

McKinsey’s report notes that the wages of consumers are steadily being eroded. Wages in the largest economies reportedly flatlined; in other words, no significant change in their levels was recorded. Prior to the pandemic, the same wages were said to have increased, giving workers the upper hand in negotiations. The pandemic, however, drastically altered that state of affairs. Wages in developed markets post the pandemic are also related, but the advent of inflation has checked that growth and, in some instances, set the trend backwards.

In the United Kingdom, there have been reports of wages being lower year on year.

The culmination of these factors is that the outlook for global economic growth will be lower this year than last. McKinsey expects central banks to increase interest rates more assertively to deal with inflationary pressure. The risk of recession is becoming more and more prevalent.…

If it so happens that the said stimulus package is financed by increasing the money supply. It may have unintended and unpleasant consequences.

Economists have a phrase that means the same as “in a perfect world”. Economists will often say “ceteris paribus”. In a perfect world, government expenditure would have been all that is necessary to fix the lingering economic problems confronting the world post-COVID. However, reality would beg us to consider that government expenditures of money that they did not have to jump-start economies that were in a prolonged period of stasis would invariably lead to inflationary pressures. The United States has been grappling with the problem of inflation throughout 2021.

Its inflation figures are the highest they have been in decades. The fascinating thing about this current brand of inflation is that it is multi-faceted. Granted, it began when governments decided to spend their way out of an …

Africa is expected to recover from its worst recession in half a century and reach 3.4 per cent growth in 2021.

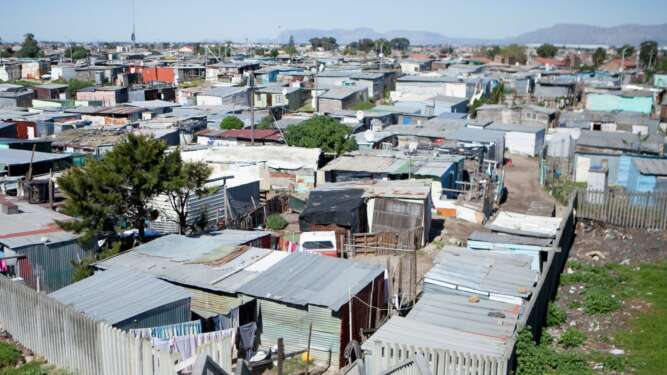

This growth which is expected to defy the effects of increasing debt burden and the Covid-19 pandemic does not however promise to wipe out poverty but instead an estimated 39 million more Africans could possibly slip into extreme poverty this year in addition to the about 30 million who were pushed into extreme poverty in 2020 as a result of the pandemic.…

In Africa, only South Africa and Morocco manage to produce 70 per cent to 80 per cent of their medicines while some Central African countries import close to 100 per cent of theirs.…

With a growing middle class, Africa is now the frontier and the AfCFTA which is already ratified by 30 countries is just an opportunity to enhance investments in the continent.…

Many people have lost their jobs and means of sustenance while industrial production and wholesale-retail sales have plummeted in some sectors.…

We are in a recession!

This is the stark reality that the world is facing and it has come sooner than many have predicted thanks to the covid-19 coronavirus. Already, the world is reeling from shock at the sheer magnitude of effect the virus has had on every aspect of life.

In addition to the lives and man-hours lost, the world will take a long time to recover from the hit. The global economy has suffered massive losses since the WHO announced the threat of the disease which was made public globally on December 31, 2019.

Already, airlines have started manifesting the effects of the coronavirus outbreak with Kenya Airways (KQ) staff taking a pay cut starting with newly appointed CEO Allan Kilavuka who will see his salary whittled down by 80 per cent from the 35 per cent he had announced earlier.

Tala’s next mission after freezing operations in

…[speaker-voice name=”en-GB-Wavenet-A”]

Economies around the world are taking a beating from Corvid-19 as aspects of their production and consumption take a nosedive.

With countries now dependent on each other for trade, sources of raw materials and labour, the coronavirus is bringing an end the approach to doing business globally as we know it. With much more connections through travel, the virus has found a way of stymying growth in several countries- including China, the epicentre of the outbreak- and many others which are still finding ways and means of addressing the challenge.

The worst-hit at this stage are those that depend on goods and services from China.

See: Intra-regional trade could create 2 million new jobs for East Africa

And while Africa is still largely safe from the ravages of the virus, many countries are already feeling the heat since they cannot procure goods from China following the lockdown and …