Global inflation is on the rise and shows no signs of abating.

According to McKinsey Global Publishing, this troubling trend is spilling over into every aspect of the global economy. No day passes without headlines in the news talking about record inflation rates. Four primary themes dominate the news nowadays: the highest inflation since the 1970s, as has been widely reported in the United States.

Central banks aggressively increase the cost of borrowing money or interest rates. Consumer sentiment is hitting record lows, and commodity prices are hitting all-time high levels. The combined interaction of these factors has resulted in an economic phenomenon known as stagflation, where there is low growth and high inflation in an economy.

- Global inflation is on the rise, fueled by soaring energy costs and food price increases. It is what the global economy is seized with for now and the foreseeable future. This has left consumers feeling the pinch as they bear the brunt of a tightening global economy.

- Consumer sentiment is at an all-time low as they have little room to increase their present consumption through borrowing. The cost of living due to rising inflation will most likely cause a recession globally.

- The inflationary pressures McKinsey notes have permeated every aspect of the global economy. Real estate will have reduced activity and mortgage loans will experience increases in non-performing loans from consumers due to the increased interest rates.

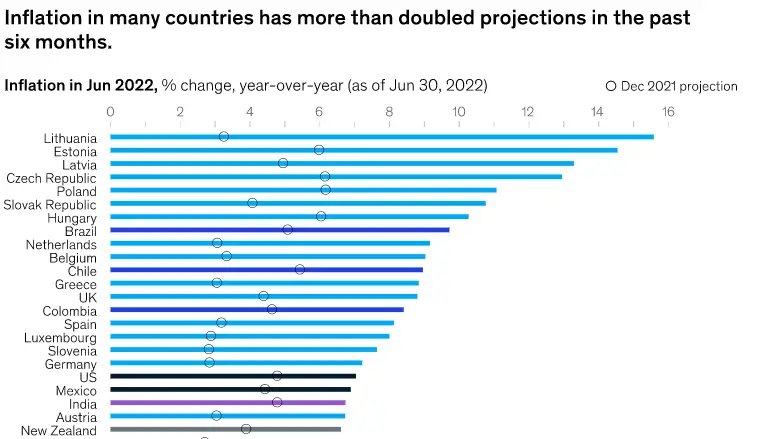

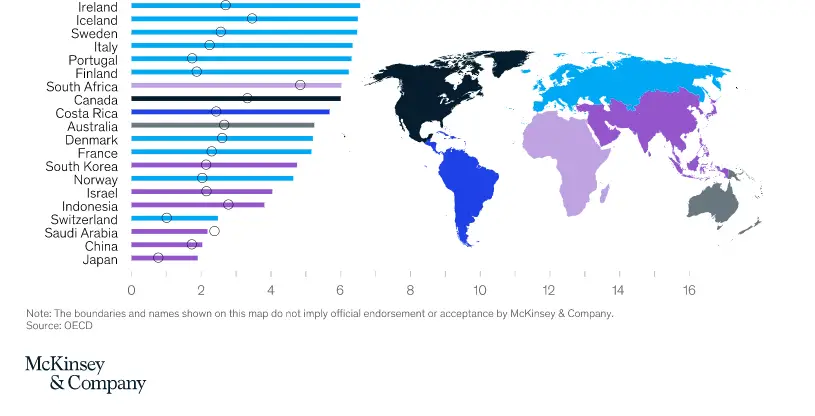

According to a study conducted by McKinsey Global Publishing which reviewed inflation data as of June 2022 and published their findings on their website, inflation has altered the economic mood, and potentially reset the path of global and national economies worldwide for years to come.

This resurgent inflation has far-reaching implications, which will be felt for years to come. The current inflation in the global economy has far exceeded any forecasts made in 2021.

According to McKinsey’s study, there are countries in the world that have recorded actual inflation statistics that are higher and double what was forecast in 2021. South Africa, for example, projects inflation in 2022 would be in the region of 5%, and yet, as of June 2022, records show that inflation is well above 6%. According to the study, Lithuania in Europe has inflation at 15.5%, nearly five times what was projected in the previous year.

The United Kingdom and Poland are said to have inflation rates significantly higher than projected. In Europe, Switzerland is an outlier with inflation rates at 3%, which is above the 1% projected in 2021. Asia, interestingly has managed to keep inflation somewhat in check.

The study reports that central banks worldwide are raising their core lending rates in response to the surging inflation. McKinsey, however, notes that lending rates have not increased to the same extent and by the same margins that inflation has risen.

Therefore, despite the conventional wisdom behind the policy move, it will have a limited impact on getting inflation under control. This monetary policy stance will reduce demand for and lower prices for what the global consulting firm calls the critical components of headline inflation, like housing and commodities such as energy and metals.

Notwithstanding the logic and conventional wisdom behind the policy move of raising interest rates, pursuing this monetary policy makes the likelihood of a global recession inevitable. Raising interest rates will temper demand for housing and commodities in the short run. Still, it will also reverse the gains that the leading economies of the world had made in terms of their respective stimulus programs to jolt their economies back to life from the pandemic-induced recession.

McKinsey believes that the pandemic caused a rise in real estate prices prior to the inflation wave that followed the pandemic. According to the report, “House prices soared well past expectations in a fairly global phenomenon. In Europe, Turkish homeowners saw the biggest gains, followed closely by those in the Czech Republic and Lithuania.”

- These inflation levels currently obtaining have not been seen since the 1970s in the global economy, especially in the case of the United States.

- Central banks have mulled interest rate hikes to cool natural resource demand and energy demand. The global economy has grappled with inflation from excess liquidity. However, soaring energy and food prices and their resulting inflationary pressure will not be mitigated easily by interest rate increases.

- Every region of the globe has recorded higher than projected inflation statistics. In most countries, inflation figures doubled.

- All these economic headwinds will result in stagflation, where an economy experiences high inflation and low growth. Consumers face increasing costs of living in a shrinking economy. A vicious cycle.

Regarding commodities, the McKinsey report acknowledges that during periods of heightened inflation and/or heightened uncertainty, investors will often pile into commodities. This is because commodities are viewed as a proxy for the demand for raw materials that are required for economic expansion. Commodities it is said, “reflated” a global economy that COVID had battered; however, the price increases of commodities have not stopped. Geopolitical tensions with the invasion of Ukraine set prices higher still. It is noteworthy to mention that high commodity prices found their way to fertilizers which recorded its highest rise.

Global investment flows: FDI back to pre-pandemic levels UNCTAD reports

The price of fertilizer has resulted in a perfect storm of sorts. Gas, which is an essential input in the fertiliser manufacturer, was in short supply. This adverse position was made worse by increasing demand from farmers, which meant that the fertiliser price is unsustainably high. When the price of fertilizer increases, consumers can expect the price of food to go up.

It is here that the vicious cycle becomes apparent. Globally, consumers are under pressure from inflationary headwinds and the constant threat of a prolonged recession and economic slump. Central banks are not making it any easier for both consumers and firms by increasing the price of money and interest rates.

The decision to increase interest rates and maintain a contractionary monetary policy will be like a blunt instrument on consumers. They are seized with increasing costs of living characterized by rising prices of basic goods, yet their means are curtailed or constricted by a shrinking economy.

UNCTAD: Africa doubled foreign direct investment in 2021

This is a classic vicious cycle.

McKinsey’s report notes that the wages of consumers are steadily being eroded. Wages in the largest economies reportedly flatlined; in other words, no significant change in their levels was recorded. Prior to the pandemic, the same wages were said to have increased, giving workers the upper hand in negotiations. The pandemic, however, drastically altered that state of affairs. Wages in developed markets post the pandemic are also related, but the advent of inflation has checked that growth and, in some instances, set the trend backwards.

In the United Kingdom, there have been reports of wages being lower year on year.

The culmination of these factors is that the outlook for global economic growth will be lower this year than last. McKinsey expects central banks to increase interest rates more assertively to deal with inflationary pressure. The risk of recession is becoming more and more prevalent.

The Harvard Business Review is of the view that the prospect of recession is likely to put a damper on inflation, but this outcome is not assured. According to the publication, monetary policymakers pose the greatest risk of recession for the United States and the rest of the world. “In fighting inflation, they risk pushing down growth. Hike rates are too fast or too far and deliver a recession. Pulling off a “soft landing” is hard.” The publication said.