- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: zimbabwe

In an interesting development, while demand for gold is on the rise all over the world, gold output in Zimbabwe has fallen 17 percent in the last four months.

Why? Well, because of Covid-19. Strange because it is a result of the pandemic that world demand for gold is on the rise as people try to store the value of their money in gold.

Yet in Zimbabwe, small scale miners in the country are failing to conduct their mining activities because the country does not have the needed cash to buy mining inputs. Well let’s not say the country doesn’t have cash because it does, its just that no one will accept the Zimbabwean dollar.

Also Read: Barrick Gold back to business with Tanzania

So the trouble is that, Zimbabwe relies on other currencies, like the US dollar to make large and small payments alike like explosives among other things. …

Zimbabwe is on the verge of another economic crump that is bound to be far worse than what it has been suffering for the last decade.

Already, the nation has been on an indefinite national lockdown for the third month running, and now, the pandemic is really taking a dire toll on the economy. Well, it is not the coronovirus effect that is bound to doom Zimbabwe into an economic crunch (yet again) rather, it is the country’s tendency to simply print money whenever it deems fit; if only life were so easy!

Zimbabwe, like all other countries is looking to cushion its business sector from the coronavirus crunch. However, the way Zimbabwe is looking to fund its proposed ZW$18 Billion stimulus package is if anything, questionable, if not downright unadvisable, or to be blunt, shall we just o ahead and call it, rudimentary.

Well how else would you …

While all other agricultural exports are suffering reduced demand owing to the Covid-19 global pandemic, that is not the case for tobacco which has recorded remarkable increase in sales at the beginning of the marketing season.

Reports from Zimbabwe say export of flue-cured tobacco is stable and prices are firm, with tobacco sales having increased more than quadrupled over the cause of the last and the present season. Last season closed with sales of USD232 008 but this season has opened with sales of USD1 598 230 that is a 588 percent increase!

As market season opened at the start of the month, an impressive USD1.6 million was sold. With attractive prices that begun above USD 5 per kilogramme, farmers were more than willing to sell. Only three days after the marketing season opened, farmers had sold almost 700 000 kilogrammes of tobacco.

The country’s Tobacco Industry and Marketing Board …

Africa has some of the most expensive mobile data services in Africa. With the increase in connectivity via smartphones, people in emerging markets can use their portable devices for more things each passing day. Most of us have a smartphone with mobile data that we can carry anywhere and as soon as we step home we switch to our Wi-Fi not to overuse our mobile data; which is most of the time unfairly overcharged.

Africa has some of the most expensive mobile data services in Africa. With the increase in connectivity via smartphones, people in emerging markets can use their portable devices for more things each passing day. Most of us have a smartphone with mobile data that we can carry anywhere and as soon as we step home we switch to our Wi-Fi not to overuse our mobile data; which is most of the time unfairly overcharged.

However some people do not have the privilege to afford both mobile data and internet at home, so they opt for the more expensive but more portable mobile data. Everyday, people in emerging African countries are forced to take this decision and are sometimes charged the most expensive prices in the world for mobile data. What is important to know also is the dependency and impact of smartphones in lower income communities.

With a difficulty in …

A Zimbabwean public service officer, the former Chief Executive Officer of the Zimbabwe National Road Administration (Zinara) is allegedly involved in a graft cases that has cost the agency losses in excess of USD40 million.

Mr Frank Chitukutuku, the accused official, is facing a list of economic sabotage cases all surrounding what local media is calling ‘dubious payments’ for supposed public works. The list of irregularities is long, from payments for substandard work to over payment for projects without the agency’s board ever approving.

There are also issues of flouting tender procedures, hand-picking firms, payment for incomplete work and the bias awarding of projects in favour of companies that he has interest in or belonging to individuals in his favour.

Zimbabwe’s Parliamentary Portfolio Committee on Transport and Infrastructural Development deliberated the matter in detail earlier this month and resolved to fire the CEO while legal proceedings are underway.

Among the …

Zimbabwe, an economically challenged southern Africa nation will soon face another economical hard-pinch as the sate power transmission company said on Thursday it intends to increase its electricity tariff by 19.02 per cent, kicking in on March 1.

According to information from Reuters, the utility said that raising inflation and weakening exchange rate were factors being the tariff hike.

Zimbabwe Electricity Supply Authority (ZESA), which is responsible for the generation, transmission and distribution of electricity in Zimbabwe, is also facing challenges meeting power demands in the nation facing worst economic crisis in a decade.

According to the World Bank data, electricity access in Zimbabwe stands at 40 per cent.

Energy advocacy groups such as Sustainable Energy For All noted that—due to economic challenges, Zimbabwe cant explore its renewable energy resources (solar energy in particular), that’s why only 16 per cent of rural dwellers have access to power versus 78 per …

With more than 14 million people in Southern Africa facing acute hunger, non-governmental organisations are calling on the AU Heads of State to address the issue threatening lives in the region.

The NGOs comprising of Oxfam, CARE, Plan International and World Vision are also calling for the implementation of agricultural policies that will enable people to feed themselves in line with the AU’s Malabo Declaration’s commitment of investing 10 per cent of national budgets in agriculture.

In addition, Southern African leaders are being urged to increase investments in early warnings and early action systems on natural hazards and promote agroecological approaches to transition towards more just and sustainable food systems.

14.4 million people facing acute hunger

Severe food insecurity rates across 9 southern African countries are 140 per cent higher now than in 2018 primarily because people are being hit by weather extremes driven by climate change.

Across the Southern …

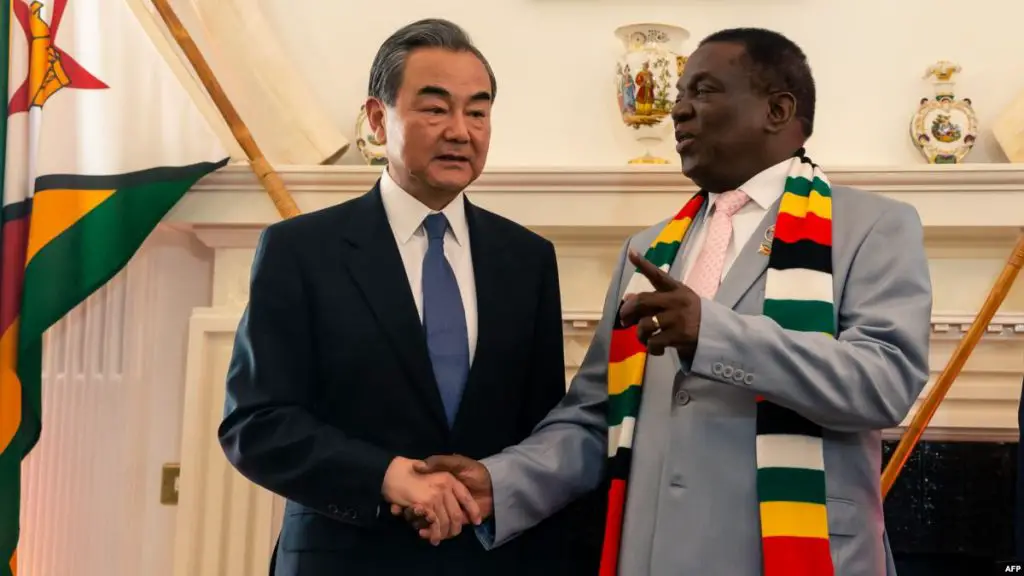

Zimbabwe signed a currency swap deal with China, hoping to stabilise its economy and improve trade.

Mthuli Ncube, Zimbabwe’s Finance Minister met with Chinese Foreign Minister Wang Yi during his five-country Africa tour recently where he said the country was following in the steps of Japan, Nigeria and South Africa.

“What this means is that there are those who will be investing in Zimbabwe from China. Those who require their proceeds to be remitted back to China can now do so,” he said.

A currency swap involves the exchange of principal and interest in different currencies. The purpose of a currency swap is to reduce the cost of borrowing a foreign currency. Mr. Ncube said the currency swap will help Chinese investors in bringing in fresh capital into Zimbabwe. “The idea is that those individuals will then swap currency so that those who are investing in Zimbabwe are able to …

For years, Zimbabwe has faced strict trade restrictions as the international community felt there was a gross violation of human rights and political freedoms. This has left Zimbabwe alienated from the league of nations as well as low international trade.

But now, the political times have changed and Zimbabwe is now declaring that it is open for business. The country is committed to creating conducive conditions and incentives for investors, according to Zimbabwean President H.E. Emmerson Mnangagwa.

Speaking at the just-concluded Global Business Forum Africa 2019 in Dubai, Mnangagwa discusses economic reforms in Zimbabwe and new business opportunities emerging across the country.

During an interactive session on the first day of the forum, H.E. Mnangagwa explained that economic zones are being created in Zimbabwe as the government looks to attract foreign investment. He stressed the importance of developing new initiatives that invest in skills development and human capital.

His …

Distributed Power Africa (DPA), a subsidiary of the Econet Group of companies, and Econet is a Pan African Technology, and Telecommunications group, operating in more than 20 African countries, is installing a 1MW solar system for Africa Data Centres’ facility in Nairobi, Kenya.

According to DPA, this is the third installation it is deploying this year for Africa Data Centre, with the first phase having been completed in May and currently working on phase 2. Africa Data Centre is the continent’s first and largest network of interconnected, carrier and cloud neutral data centre facilities, rapidly expanding across the region. While serving Africa’s largest domestic and international customers, Africa Data Centre has become a leader in deploying sustainable technologies across its facilities in Africa.

Africa Data Centre’s Nairobi is also the first carrier-neutral facility in the East Africa region, and its largest and most connected operation, with a total of 2000 …