- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

- State of journalism survey 2024 shows media houses are lagging in AI adoption

Browsing: zimbabwe

Zimbabwe allows for 100% ownership of medicinal cannabis investments, allows for farming on private land, and has put in an added layer of protection called the Investment Stability Agreement.

Recently, Zimbabwe’s President Emmerson Mnangagwa commissioned a US$27 million Swiss Bioceuticals Limited Medicinal Cannabis Farm and Processing Plant in Mount Hampden, Mashonaland West Province.

Farmers Review Africa on May 12, 2022, said Swiss Bioceuticals limited constructed a state-of-the-art medicinal cannabis processing plant, fitted with the first line of medicinal cannabis oil processing. It is also equipped with a cannabis oil processing line aimed at stimulating bio-medical solutions and pharmaceutical products for both local and international markets.…

Copper production is set to resume at Alaska Mine in Chinhoyi after a US$6 million capital injection by Chinese investors in partnership with the Zimbabwe Mining Development Corporation (ZMDC). The total capital injection required is US$12 million and so far, a Chinese investor, Grand Sanyuan Copper Resources has poured in half the amount.

As far as June 10, 2021, ZBC News said the majority of the funds will be channelled towards the construction and refurbishment of a flotation plant, a smelter, and an electrolysis refinery, with an environmental impact assessment completed.

The Alaska Copper smelting plant has been closed since 2000, but has now been resuscitated and is expected to be fully operational by July this year with a target to produce 300 tonnes of copper per day.…

The president announced in a May 7 televised speech that banks had been banned from lending in a bid to stem the precipitous decline of the local currency inter alia increasing capital holding tax, banning third party transactions on the local bourse, and increasing Intermediated Money Transfer Tax (IMTT).

The move came as the local currency had been depreciated against the United States dollar. This is amid high demand for the greenback which is seen as a store of value.

An executive at an agro-processing firm, name with-held, told NewZimbabwe that his company can’t borrow what it needs to pay 500 farmers for the soy and sugar beans. It contracted them to grow, or fund the purchase of inputs such as fertilizer for the next season’s crop.…

Bilateral relations between the two countries improved after the UAE showed its benevolence. This was by sending aid in response to the Cyclone Idai storm in March 2019. Planeloads of humanitarian assistance were sent to Zimbabwe, which went a long way in helping victims and mitigating the impact of the cyclone. UAE also assisted the Southern African country’s fight against Covid-19 with a consignment of required medical drugs.

Early March, the new dispensation approved the establishment of a commercial consulate in the commercial hub of Dubai. Economic and trade attachés will operate in the consulate. This is an effort to complement investment promotion being done by Zimbabwe’s embassy in the UAE.

In a cabinet briefing published by The Herald on March 17, 2022, Minister of Foreign Affairs and International Trade Ambassador Frederick Shava said the development created an environment conducive to doing business.…

Prices of essential and non-essential commodities will increase as fuel and gas prices skyrocket due to dwindling supplies. Air and marine freight prices have increased significantly. As a result, customers should brace for price increases caused not by the government’s actions but by direct and indirect conflict repercussions.

Numerous businesses have been forced to reduce or halt output due to the economic crisis. Zimbabwe is in danger of exhausting what remains of its productive capability unless drastic measures are taken to pique the interest of foreign investors.

Russia is the world’s second-largest supplier of petroleum products. Now that they are embroiled in a conflict with Ukraine, they cannot supply numerous markets, resulting in supply limits. When supply falls far behind demand, prices tend to rise, which is our situation.…

The services Zimbabwe paid for range from software, to professional and technical services like mining exploration, servicing of complex machinery, expatriate medical aid schemes and so on.

If the country was able to develop the capability to provide these services, it would not only save on the expenditure of foreign exchange it would also earn foreign exchange.

There are 16 countries that make up the Southern African Development Community of which Zimbabwe is a part. All these countries use and pay for the same services that Zimbabwe is paying for. If Zimbabwe were to become an exporter of services to all these countries in the SADC region alone and they spent on services roughly what Zimbabwe spends on services.

The country could potentially earn (15 member states multiplied by US$ 636 million) US$ 9.5 billion annually. Adding this figure to the foreign exchange earnings reported in the monetary policy statement …

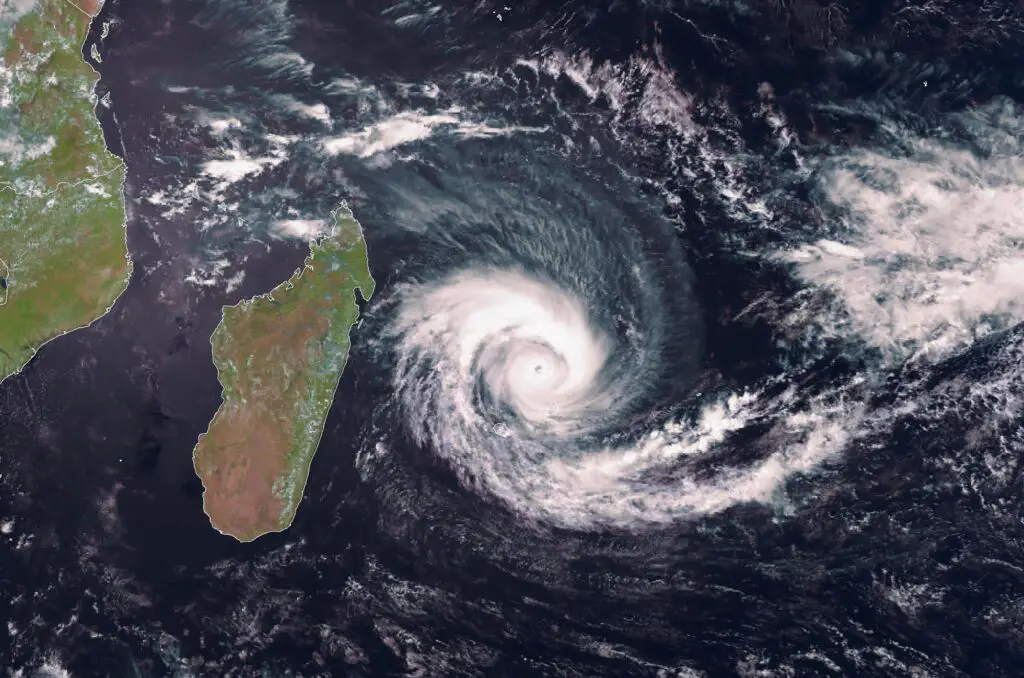

- Tropical storm Ana in January 2022 affected 180,869 people, injured 207 people, killed at least 38 people and flooded a total of 70,982 hectares of land.

- In two weeks, Madagascar, the most cyclone exposed country in Africa, experienced both Ana and Batsirai cyclones.

- The strength of Cyclone Batsirai could increase and spread to other countries in the Southern Indian Ocean.

Several cyclones, from Cyclone Ana, Batsirai, Idai, Eloise, Kenneth and Tropical Storm Chalane, have tormented the southern part of the African continent – from South Africa, Mauritius, Madagascar, Mozambique, Malawi and Zimbabwe.

A cyclone is a tropical storm with heavy winds rotating inwards to an area of low pressure. An anticlockwise circulation occurs in the northern hemisphere, while a clockwise circulation happens in the southern hemisphere.

The frequent occurrence of these storms indicates the heightening effects of climate change in the southern region of Africa and the world at large. …

Once again, Heijin was at the centre of another dispute. This time around, it was displacing more villagers in Murehwa. Murehwa is a village in Mashonaland East province.

This time around, it affected up to 100 families. As with the example above, the company received a special mining grant to mine black granite in the area. The mining claim sits on a densely populated place covering between 200 & 300 hectares.

Due to the presence of granite in the area, Chinese companies are laying siege on the province. All this to get their hands on the rare and lucrative stone. Heijin’s newest intrusion follows another bloody battle between Mutoko and Shanghai Haoying Mining Investments villagers.

They have claims to mine black granite, which was. At the same time, Shanghai Haoying has compensated households who would lose their home due to mining activities. The Chinecompany’sy’s plans to establish operations in the …

If you received your salary on the 1st of January in ZWL, you would struggle to pay for goods and services in February. This volatile situation results in consumers seeing value eroded from their bank balances at an astonishing rate.

We see wages struggle to keep up with inflation, a phenomenon similar to 2008. Most people buy USD from the black market to retain some semblance of value in these balances.

Zimbabwe has a currency crisis, and the Authorities seem to be struggling to deal with it. The rate at which the Zimbabwe dollar is depreciating signifies the state of the economy. Much of this is being blamed on the countries foreign currency auction system.…

- Varun Beverages has become one of the country’s biggest beverage firms in Zimbabwe

- Delta has had a firm grip on the Zimbabwean drinks market and is home to international brands of soft drinks and beers

- Varun is on an aggressive urban assault to capture more market share and challenge the drinks giant.

Varun Beverages has become one of the country’s bigger soft drinks firms in Zimbabwe within a relatively short period.

Bottlers of Pepsi, 7up and Mirinda brands, Varun has established itself as one of the soft drinks companies to reckon with in the soft drinks market.

This is an impressive achievement given it is going toe-to-toe with long-established Delta, Zimbabwe’s most prominent beverage firm with big brands such as Coca-Cola, Fanta and Sprite.

Since the colonial era, Delta has had a firm grip on the Zimbabwean drinks market and is home to international brands of soft …