- Alarming surge in online child exploitation sweeps Africa

- Beijing tightens China-Africa grip as trade rivals US, Russia seek bigger slice

- Exploring the Forex CFD Trading Landscape in Africa in 2024

- Webb Fontaine’s single window: paving the way for future trade with new AI features

- Inside Africa’s 2024 engineering innovation showcase eyeing £50,000 prize

- Tanzanian inches closer to clean cooking dream with a $1.7 billion plan roll out

- Why the planning of new cities must embrace a visionary approach to succeed

- First Saudi WoodShow in Riyadh attracts over 8,000 visitors

Author: Caroline Muriuki

Safaricom, leading communications company in Kenya is eyeing a stake in Ethiopia’s State-owned Ethio Telecom.

Ethio Telecom has announced the sale of shares through a privatisation plan.

Safaricom’s interim CEO, Michael Joseph said that Safaricom is considering buying a stake in the world’s largest telecoms monopoly or might consider setting a shop in Ethiopia from scratch.

Michael Joseph’s comments came when the Ethiopian authorities launched the search for an adviser on the sale of a stake in its national operator. The company is opening the country’s telecoms market to foreign investment for the first time.

Ethio Telecom’s has a subscriber base of 44 million makes it the biggest single-country customer base of any operator in Africa. Ethio Telecom last year generated revenues of about $1.2 billion, which is nearly half the Sh250.9 billion that Safaricom posted in the year to March.

Safaricom’s cash at bank stood at Ksh20 billion …

The Bank of Uganda reduced its interest rates for the first time since February 2018 in a bid to support economic growth.

The monetary policy committee agreed to reduce the central bank rate by 1% to 9%. The rediscount rate and the bank rate were also adjusted by a similar amount to 13% and 14%, respectively.

This rate cut is expected to be of relief to businesses facing cash difficulties in funding operations or expansion. Businesses that are struggling with low sales and reduced household spending, can also get a boost from the rate that is cut through consumer lending.

“This policy move is expected to boost already high liquidity levels in the banking sector and this will eventually accelerate credit growth and real economic activity,” said Adam Mugume, Executive Director for Research at Bank of Uganda (BoU).

Also Read: Bank of Uganda warns of rising cost of debt repayment

…Ethiopian Airlines Group to consider buying a stake in South African Airways (SAA) should South Africa decide to sell equity in the struggling state carrier.

Since 2011 South African Airways has not made profit, the airline delayed the release of its annual earnings due to its precarious financial state.

Group Chief Executive Officer of Ethiopian Airlines, Tewolde GebreMariam said that despite the African National Congress saying it would consider selling equity in the airline, there has been no visible strategy for such a plan.

“We are interested in supporting South African Airways,” he said in an interview at Ethiopian’s head office near Addis Ababa airport.

He added that if South Africa asked Ethiopian to buy a stake they would consider it. Ethiopia and SAA are already partners in the Star Alliance.

Tewolde said that the group had discussions with SAA’s former Chief Executive Officer Vuyani Jarana before his resignation in …

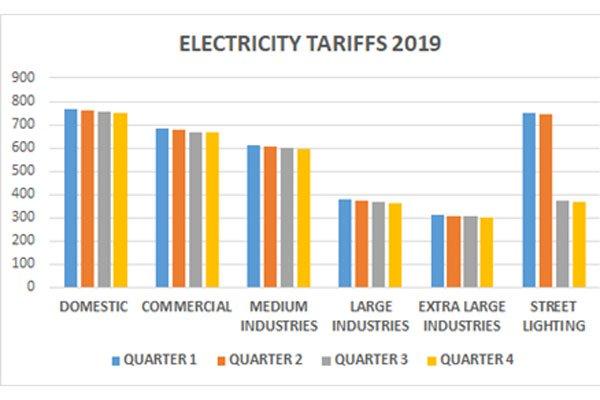

Electricity Regulatory Authority (ERA) has reduced power tariffs by an average of Ush2.4 from October to December quarter.

The tariff reduction will apply to all consumption categories including domestic and extra-large consumers.

The first 15 units for Ush250 with units from sixteen upwards now costing Ush752.5 per unit from Ush755.1 in September.

During this period, commercial consumers will enjoy Ush3.4 tariff reduction from Ush669.5 to Ush666.1 while medium industrial users will pay Ush595.6 per unit from Ush599.2, which has been reduced by Ush3.6. Large industries will pay Ush364 from Ush365.7, saving the industrialists Ush1.7.

Extra-large industries, on the other hand, will be paying Ush302.6 per unit from Ush304.7 in the previous quarter saving them Ush2.1 in the three months leading to December.

The Electricity Regulatory Authority has maintained its strategy to continue reducing tariffs on street lighting, which was reduced by almost a half last month to Ush371.4 per unit.…

Rwanda’s solar energy ambition received an endorsement of a financial instrument from the Global Innovation Lab for Climate Finance.

According to the Global Innovation Lab for Climate Finance, the first boost will be US$ 9 million and will enable the deployment of solar home systems for 175,000 households

The institution approved the piloting of solar securitisation, which seeks to improve the financial capacities of developers to enable them to expand and meet the demands in the local market.

Rwanda targets to connect 300,000 households annually to the off-grid energy solutions if it is to meet the 2024 access target which will contribute up to 48 per cent of national electrification.

Among the challenges include the fact that the systems are financed by customers whose sales have been relying on the solar developers’ ability to leverage their own balance sheets which are often constrained.

The firms have often found challenges …

Burundi’s central bank cracks down forex bureaus that have been selling dollars at twice the official rate.

This has led to small scale traders finding it difficult to find the foreign currency in the country to trade which is affecting their businesses.

In 2015 when the political crisis erupted, the forex rate almost doubled, with the dollar exchanging at Bfi3,050 ($1.65) against an official rate of between Bfi1,700 ($0.92) and Bfi1,800 ($0.97).

According to a trader in Bujumbura, the central bank’s move means that forex bureaus will not be readily selling dollars which will be creating scarcity leading to a higher black market rate.

In September, Bank of the Republic of Burundi (BRB) asked all forex bureau operators to purchase software worth $ 1,08. Which according to the central bank governor Jean Ciza,was supposed to help the central bank to follow closely the bureau’s activities in efforts to comply with …

Rwanda’s Mara Group launched two smartphones describing them as the first “Made in Africa” models.

The two smartphones which are, Mara X and Mara Z will use Google’s Android operating system and cost 175,750 Rwandan francs ($190) and 120,250 Rwandan francs ($130) respectively.

They two will compete with Samsung, whose cheapest smartphone costs around $54 and non-branded phones at around $37. Ashish Thakkar Mara Group CEO said it was targeting customers who are willing to pay more for quality.

Mara Group is the first smartphone manufacturer in Africa giving a boost to Rwanda’s ambitions to become a regional technology hub.

Thakkar said that other companies assemble smartphones in Egypt, Ethiopia, Algeria and South Africa, but import the components but they are the first smartphone manufacturers in Africa.

He said that they are making the motherboards the sub-boards during the entire process. He also said that plant had …

The Bank of Uganda has warned government against the accumulation of foreign debt, saying the central bank is under a lot of pressure to obtain foreign exchange to repay loans.

Speaking during the IMF and AfDB-organised conference in Kampala during the weekend, Bank of Uganda Governor Emmanuel Tumusiime Mutebile, said that the rising cost of servicing the debts is putting pressure on the Central Bank to accumulate foreign exchange reserved for future imports.

“The biggest challenge for Bank of Uganda (BoU) is how to accumulate foreign exchange reserves to service external debt. The forex reserves have to be purchased from the domestic market, without causing sharp exchange rate depreciation pressures that would eventually pass through to domestic inflation, thereby warranting tightening of monetary policy and later on impacting on economic growth,” said Mr Mutebile

Mr Mutebile revealed that for instance, in the 2019/20 financial year, the central bank has to …

Kenya Commercial Bank (KCB ) plans to venture into Ethiopia and the Democratic Republic of Congo (DRC) as it seeks to grow its regional footprint.

The bank is looking at additional markets for expansion while it awaits a licence to operate in Ethiopia, where it already has a representative office that was opened in 2015.

“We are talking about two markets in trying to scale up our businesses so the market we are looking at is Congo and Ethiopia because they are very much aligned to our business,” said Joshua Oigara chief executive.

“For us, there is a chance to really grow our business to reach the psychological height of Sh1 trillion of balance sheet size which is a strong size,” he added

Mr Oigara did not provide a timeline for when the bank will enter DRC. The bank also operates in Uganda, Tanzania, Rwanda, Burundi and South Sudan.

The …

Uganda oil firms which abandoned oil infrastructure projects following tax payment disagreements with the Uganda Revenue Authority, now say they are keen to resume operations.

The companies have caved in to pressure and proposed fresh dialogue to resolve the current standoff with the government, after a month of suspending all technical activities in Uganda’s budding oil and gas sector.

British multinational Tullow, French oil major Total and China National Offshore Oil Company (CNOOC), the joint venture partners in Uganda’s oil development, are expected to present their new position which will form a basis to start fresh negotiations.

“The idea is that we need to have continued communication with the authorities to understand each other. We respect the frustrations of government and we believe they can imagine our situation. We have spent a lot of money already, $3.2 billion jointly with our partners,” said Total E & P general manager …