- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

Southern Africa

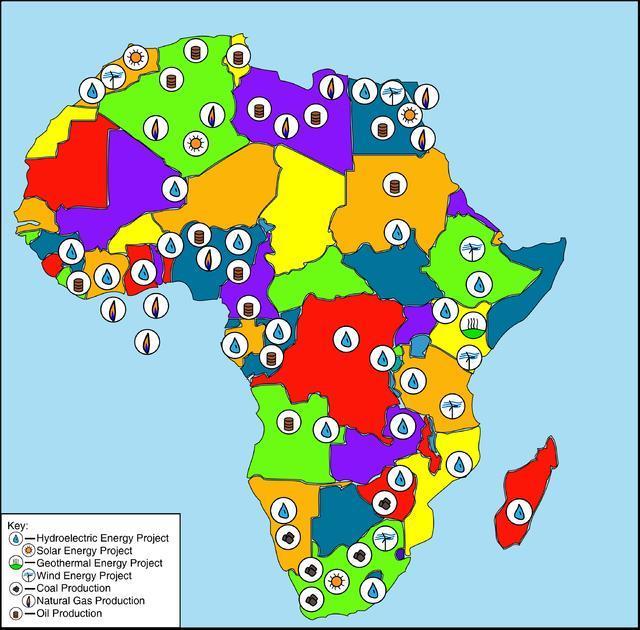

As Africa’s role in the global economy continues to garner prominence, it’s imperative for the continent to seal the gaping hole in its power supply.

Lack of universal power access remains a major roadblock that has retrogressed industrialization and socio-economic development. Statistics from the World Bank indicate that Africa remains the least electrified region in the world, with 568 million people lacking access to electricity.

The Bretton Woods institution, further notes that the Sub-Saharan Africa’s share of the global population without electricity, jumped to 77 per cent in 2020 from 71 per cent in 2018, whilst most regions saw declines in their share of access deficits. It has become a Hobson’s choice for African governments to prioritize the power sector, which is the epicenter of industrialization, working towards Goal 7 of the UN SDGs; which advocates for universal access to affordable, reliable and modern electricity services.

Currently, Africa’s power is …

Findings show that increasing costs in every market due to a year of supply disruption did not deter data centre demand in most markets including Nairobi and Johanessburg.

The two African capitals were among 44 other locations that were surveyed.

According to the study, despite the negative impact of the coronavirus pandemic, demand remained relatively steady when compared to other industries owing to governments’ decisions to make working and schooling from home mandatory. …

Given these enabling circumstances, KKR offered to buy out RJR and reorganize the business and optimize value from its operations. This initial attempt was not warmly received, and RJR sought other investment companies to purchase it. What then ensued was what members of the investment community call putting the company in play.

This describes a scenario where one company is actively pursued by several suitors who desire to purchase it. In the end KKR triumphed albeit having paid a massive premium for the company. Unfortunately, the company did not realize the gains that it had envisaged it would.

The Nabisco operation of the company was spun off into a separate entity and the tobacco interests were also kept separate. All the gains the company anticipated it would make were swallowed up by tobacco lawsuits so that by 1994 the KKR had all but written off its investment in RJR Nabisco.…

South Africa achieved independence in 1994, but years later, there has been little improvement in the general populace’s poverty levels. While the country remains one of Africa’s strongest economies, statistics indicate that close to 50% of the population lives in poverty. (Based on south African government poverty measure where the upper bound poverty line is approximately $70 per month.)

The covid-19 pandemics have exacerbated the issues of poverty in the country. South Africa has one of the highest infection rates in Africa and more recently has been dealing with a mutated version of the virus that has since been christened the South African variant. Lockdowns and covid 19 restrictions have pushed many out of employment, and businesses have been forced to shut down. Estimates indicate that close to 1million people may fall below the poverty line.

According to a World Bank Report, the inequality of apartheid lives on. The …

Through Zambia Consolidated Copper Mines Limited (ZCCM), the Zambian government will assume ownership in Mopani Copper Mines with a 73% stake. ZCCM takes over from Switzerland based Glencore mining company. The agreement entails the Zambian government, through ZCCM, taking over $1.5 billion in debt.

The deal further adds to an already cumbersome debt crisis. Zambia has already defaulted on debt obligations. A worsening debt crisis coupled with a pandemic has led the country to a precarious debt situation. The country became the first African nation to default on debt in the pandemic period, stoking fears that there could be a ripple effect of defaults across the continent.

As part of the agreement, ZCCM will pay Glencore creditors from Mopani Mine’s revenue. Initially, a payout of 3% of income will be paid up to 2023. After which revenue payouts will rise to 10 -17.5%.

The deal also stipulates a quarterly interest …

Zimbabwe’s Finance Minister Mthuli Ncube delivered an optimistic 2021 $426 billion worth national budget. The upcoming year’s budget under the theme: Building Resilience and Sustainable Economic Recovery, is meant to be a gateway for an economic revival in the struggling country.

The budget allocated a sizable proportion of the funds towards the health and education sectors.

Key Budget Highlights

- Budget size $421.6 billion

- Revenue collection projected at $390.8 billion

- Public debt $1.9 million

- The economy is expected to grow 7.4% in 2021 following a consecutive decline in the past two years.

- Year on year inflation is projected to end the year 2021 at 9%

- Upward review of tax-free threshold on salaries and 2% transaction levy and bonus.

- Foreign currency-denominated corporate tax payments.

- Tightening of Informal sector tax (Presumptive tax) collections.

Economic Recovery

The minister presented optimistic growth metrics. The budget projects an anticipated 7.4% economic growth trajectory following two …

South African Credit rating agencies, Moody’s and Fitch, have both downgraded South Africa’s credit rating. The country’s credit rating further plummeted into junk territory making debt issuance both difficult and expensive

Moody’s dropped the credit rating two steps below investment grade to Ba2 from the previous Ba1 level.

”The downgrade reflects the impact of the pandemic shock, both directly on the debt burden and indirectly by intensifying the country’s economic challenges and the social obstacles to reforms.

South Africa’s capacity to mitigate the shock over the medium term is lower than that of many sovereigns given significant fiscal, economic and social constraints and rising borrowing costs.” Moody rating action report

Additionally, Fitch stepped down the countries rating to a BB minus which is three positions below investment grade.

The ratings apply to both local and foreign borrowing.

Another credit rating agency S&P maintained South Africa’s rating which is currently …

South Africa’s unemployment soars have risen to levels last seen in 2008. According to the country’s National Statistics Agency, 30.8% of South Africans are now unemployed. This figure is the highest the country has experienced since 2008.

The statistics are mainly caused by the effects of COVID-19 on the economy. The southern African country, one of the most industrialized in Africa, was among the first to record a case of COVID-19 on the continent. It is also one of the most heavily affected countries in Africa.

In response to the pandemic

the government instituted a raft of measures to flatten the infection curve. The covid response involved a total lockdown which halted economic activity, affecting revenue for the industry and other productive sectors of the economy.

The lockdown hit businesses severely, prompting restructuring which has seen many employees losing their jobs. In addition, several SMEs will not survive the situation. …

A South African tech-based company FinChatBot has secured a funding round worth $1.6 million to drive expansion beyond South Africa. The fintech company is a provider of customer service AI bot technology in the financial services industry. Its bespoke technology connects with different operating systems and third-party systems allowing financial services firms smooth interaction with their customers. Their AI-based chat system operates independently of human interaction.

The company’s mission of guiding the customer experience will be supported by three funding partners. The participants in the funding round are:

- Compass Venture Capital, an early-stage focused investor that is based in Mauritius. It looks for strong propositions set to disrupt traditional ways.

- South African, Kalon Venture Capital which focuses on tech-based solution providers mostly in South Africa. It promotes investments in top companies with disruptive technologies

- Saviu Ventures an African-focused investment holding company from France which invests in established startups in both