- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

Southern Africa

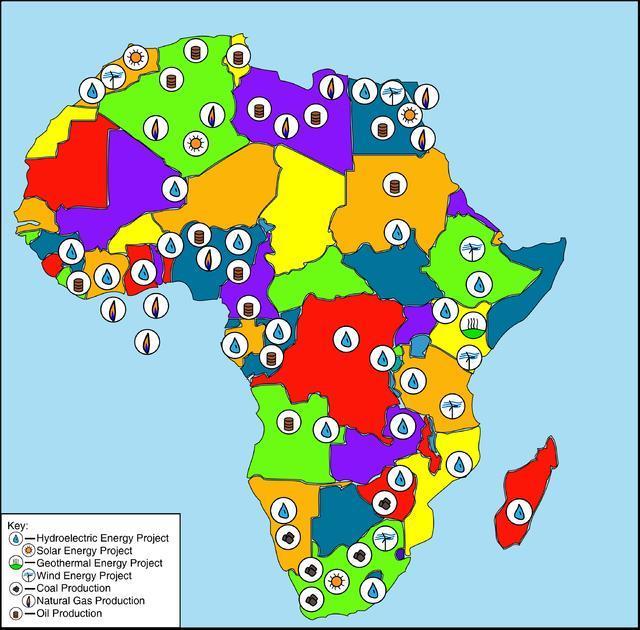

As Africa’s role in the global economy continues to garner prominence, it’s imperative for the continent to seal the gaping hole in its power supply.

Lack of universal power access remains a major roadblock that has retrogressed industrialization and socio-economic development. Statistics from the World Bank indicate that Africa remains the least electrified region in the world, with 568 million people lacking access to electricity.

The Bretton Woods institution, further notes that the Sub-Saharan Africa’s share of the global population without electricity, jumped to 77 per cent in 2020 from 71 per cent in 2018, whilst most regions saw declines in their share of access deficits. It has become a Hobson’s choice for African governments to prioritize the power sector, which is the epicenter of industrialization, working towards Goal 7 of the UN SDGs; which advocates for universal access to affordable, reliable and modern electricity services.

Currently, Africa’s power is …

Findings show that increasing costs in every market due to a year of supply disruption did not deter data centre demand in most markets including Nairobi and Johanessburg.

The two African capitals were among 44 other locations that were surveyed.

According to the study, despite the negative impact of the coronavirus pandemic, demand remained relatively steady when compared to other industries owing to governments’ decisions to make working and schooling from home mandatory. …

Given these enabling circumstances, KKR offered to buy out RJR and reorganize the business and optimize value from its operations. This initial attempt was not warmly received, and RJR sought other investment companies to purchase it. What then ensued was what members of the investment community call putting the company in play.

This describes a scenario where one company is actively pursued by several suitors who desire to purchase it. In the end KKR triumphed albeit having paid a massive premium for the company. Unfortunately, the company did not realize the gains that it had envisaged it would.

The Nabisco operation of the company was spun off into a separate entity and the tobacco interests were also kept separate. All the gains the company anticipated it would make were swallowed up by tobacco lawsuits so that by 1994 the KKR had all but written off its investment in RJR Nabisco.…

State power utility Eskom reported a loss amounting to ZAR 20.5 billion ($1.2bil) for the financial year 2020. The power producers generated revenue to the tune of R200billion($12.3bil) which failed to match up to the previous year’s revenue by 1.29%. The poor results were attributed to challenges in capacity and untenable economic climate.

The major contributing factor to the huge loss position can be traced to finance costs which came up at ZAR 31.3billion ($1.9bil). The costs in question were related to servicing a debt of ZAR 483 billion($25bil) which the company is struggling to reduce.

The heavy debt position for Eskom is particularly distressing for South Africa as the South African government is the largest guarantor for Eskom’s debt. Eskom has also been a recipient of government bailout funding set at ZAR138 billion($8.4bil) until 2022. This heavily places a burden on the country’s budget and is a significant threat …

GreenCo Power Services, a subsidiary of Africa GreenCo has received a total of USD 1.5 million through two deals. The Danish government’s Investment Fund for Developing Countries (IFU) has committed $1 million in funding. InfraCo Africa, the investment arm of the Private Infrastructure Development Group also put in $500 000 through a convertible loan.

The deal will see GreenCo Power services come to life to strengthen power generation capacity. Renewable energy generation will provide an innovative approach to electricity production which is set to drive Zambia’s power infrastructure significantly.

The Zambian government is on the path to scaling up energy which ties in with the country’s vision to be a prosperous middle-income country by 2030. As part of its vision, the country intends to shore up energy availability to drive productivity in the country. This deal will therefore see GreenCo acting as a complementary partner to the Zambian government’s vision. …

A South African health-tech company Udok has sealed $613 000 (ZAR 10 million) in Venture Capital funding from FinX capital.

The money raised will be used to spearhead expansion. The Capetown-based startup has partnered with Clicks Stores to provide consultations in Click’s pharmacy clinics. With Clicks being one of the largest pharmacy retailers in South Africa, this will give the firm access to a large clientele base.

The company also plans to roll out laboratory testing using the Clicks network to provide lower-cost testing services for patients. Currently, the costs of laboratory testing are above the reach of many.

Founded in 2018, Udok enables individuals to access healthcare services via a digital platform. This includes virtual consultations with doctors, receiving prescriptions, and getting access to remote admissions.

The company uses smart technology for examinations during the consultation and allows users to access their health records from anywhere. Leveraging a digital …

A pre-budgetary statement released by the Ministry of Finance projects a slowdown in inflation to an estimated 134% at the end of 2020 from 660%. The inflation slowdown will ride on the back of the foreign exchange auction system that has been adopted by Zimbabwe’s monetary regulators. There is anticipation that this system will lead to sustained exchange rate stability.

The Reserve Bank has also proffered a strong grip on money supply to curtail the inflation rate. Money supply growth has been one of the major reasons for the burgeoning rate of inflation.

source: tradingeconomics.com

The finance minister also projected economic growth of 7.4% in 2021 from a 2020 slowdown of 0.4%. The minister, in addition, promised to sharpen the investment climate and attract fresh capital to the struggling nation to realize these ambitious growth figures.

Recovery from the Covid-19 pandemic, resumption of global economic activity as well as …

Victoria Falls Stock Exchange

Zimbabwe’s newest stock exchange, The Victoria Falls Stock Exchange will open its doors to trading on Monday 26 October 2020. The VFEX will trade in foreign currency only.

The exchange will be a wholly-owned subsidiary of the Zimbabwe Stock Exchange, with reports indicating that there are plans to bring in an equity partner.

The launch and official opening to be graced by Zimbabwe’s Minister of Finance and Economic Development, former AfDB Vice-President Professor Mthuli Ncube is set to take place this Friday.

The Zimbabwe Stock Exchange experienced a hiatus from trading as instructed by the Finance ministry in a crackdown on parallel market activity earlier this year. It was to open its floors a month later but in the absence of fungible counters. The Victoria Falls Stock Exchange is therefore expected to start off trading with the fungible counters that were suspended from trading on …

Here, you will get information about Oil price by month

Oil price by month

It is good news for motorists as the energy sector pundits predict oil prices will decrease significantly in October.

As a matter of fact, the drop in oil prices may even have been much lower had it not been for the strengthening of international petroleum prices.

In South Africa, you have experts saying the prices will drop despite Rand’s poor performance against the US dollar.

In fact, SA media quotes data published by the Central Energy Fund (CEF), that indicated that the price of petrol will drop by a whopping 36 cents-per-litre come October. Its, even more, smiles for diesel consumers because the latter is expected to drop by as much as 85-cents-per-litre with some reports placing the price drop at an entire 93 cents per litre.

That is not it, paraffin is also anticipated …