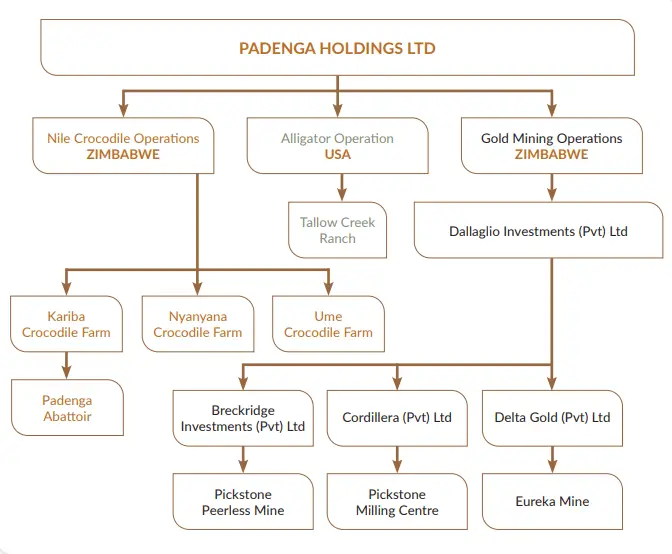

- Padenga Holdings Limited is a Victoria Falls Stock Exchange (VFEX) listed crocodilian skins, meat producer, and gold miner based in Zimbabwe.

- The company’s crocodile operation comprises crocodile farms in Zimbabwe and one crocodile farm in the United States of America in Texas.

- The company has a market capitalization of over US$ 100 million.

- Padenga Holdings recently entered the gold mining sector through the acquisition of a controlling interest in Dallaglio Investments.

- Gold operations now account for the bulk of revenues and profits for Padenga.

- The company projects that the crocodile side of its operations will remain subdued for the next four to five years.

Who would have thought that gold and crocodiles make good bed fellows?

A bizarre irony of sorts especially when one considers that this surprisingly lucrative business combination has made the formerly Zimbabwe Stock Exchange (ZSE) listed company Padenga Holdings a darling of the market.

The company is scheduled to hold its annual general meeting for shareholders in June where it will present a mixed set of results. Padenga Holdings Limited, a company listed on the Victoria Falls Stock Exchange (VFEX) is a producer of crocodile skins and meat for the export market. Padenga through its interest in Dallaglio Investments is also a commercial gold miner.

According to the company’s website, “Padenga Holdings Limited (Padenga) is a public company listed on the Victoria Falls Stock Exchange, as from the 9th of July 2021. Initially, Padenga was listed on the Zimbabwe Stock Exchange. In this respect, it was the first listed company in Africa whose sole business is the production and sale of crocodilian skins and meat. The company, formerly a division of the Innscor Africa Limited Group, was listed in November 2010.

Padenga has a long and rich heritage in Zimbabwe, with one of its three production farms being the first, and therefore oldest commercial crocodile farm ever established in the country. Kariba Crocodile Farm (KCF) was established in 1965 as a small, family-run farming operation. The establishment of this farm was a testament to the foresight and perseverance of the original owners as its development preceded any formal recognition of the value of sustainable utilization of wildlife species. From that inauspicious start, the Farms that constitute Padenga today have followed a long and sometimes challenging pathway to becoming the successful operation that exists today. Over that period the business has demonstrated its ability to adapt and flourish in the changing, and often trying circumstances resultant from organizational changes, political and economic difficulties, and more recently, the impact of the global financial crisis and the market recession that resulted from it.

Today, Padenga is one of the world’s leading suppliers of premium quality crocodilian skins, accounting for nearly 85% of the supply of Nile crocodile skins to high-end luxury brands globally. Padenga entered the alligator industry in the southern USA and is in partnership in an operation producing watchband size and medium size skins of premium quality for the top end luxury and fashion brands. Padenga also produces crocodile meat from its export approved abattoir for sale to European and Asian markets.”

Performance Overview

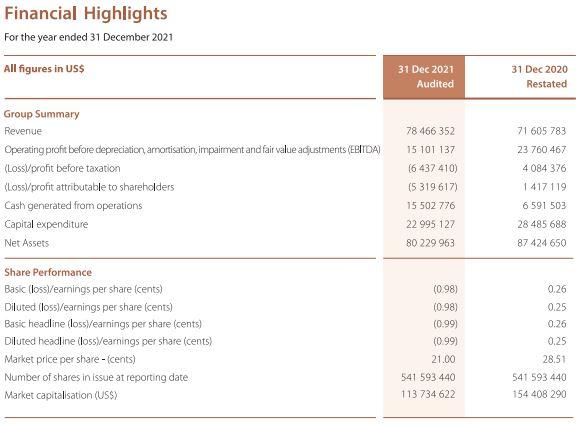

The company performed strongly in 2021 but also produced a mixed set of results. The company published its financial results in United States dollars which it said was its functional reporting currency.

The group recorded a turnover of US$ 78,466,352.00 compared to US$ 71,605,783.00 from the previous year representing a 10% increase. Revenues for the group comprised Dallaglio, Padenga’s gold mining operations which contributed 66% which is up from the 57% they contributed in 2020. The Zimbabwe crocodile operation contributed 31% and was down from the 38% it contributed in 2020. The company’s Texas Alligator operation contributed 3% to the group’s revenue down from 5% the previous year.

These revenues which the company described as solid, we’re driven by what the company also described as an “exceptional contribution from its mining operation”. The company successfully commissioned and bought on stream its new Eureka gold mine in Guruve in October 2021. The strong impetus in revenues came from the Eureka gold mine which achieved its plant nameplate capacity seven weeks ahead of schedule.

Despite the strong performance in top-line revenues, the company recorded fewer profits in 2021 than it did in 2020. In terms of Earnings, Before Interest Tax Depreciation and Amortization (EBITDA), Padenga Holdings Limited recorded US$ 15,101,137.00 for 2021 which was significantly less than what it achieved in the financial year 2020 at US$ 23,760,467.00.

The company’s flagship crocodile farming operation was adversely affected by the statutory foreign currency surrender requirement of 40%. Whenever companies in Zimbabwe earn receipts in foreign exchange, they are mandated by the monetary authorities to surrender a portion of their foreign exchange proceeds to the central bank at the official exchange rate. The portion to be surrendered varies according to sector and depends also on whether the company meets certain criteria set by the government. When a company meets these criteria, the government makes certain concessions by increasing the portion that it can retain in foreign exchange.

According to Padenga, this statutory position undermined its crocodile operation because by the end of the financial year 2021 there was a disparity of almost double between the official auction rate (at which companies are required to surrender their foreign exchange receipts) and the alternate rate. This disparity implied that at least 40% of the company’s revenue would be received at the official rate which was half the rate it would obtain if it sold its foreign exchange on the alternate market. Padenga Holdings Limited calculated that this loss of value in 2021 was US$ 9 million. This loss of value the company said “…negatively affects the viability of the business and is not sustainable,” according to the chairman’s statement accompanying the company’s end of year financial statements.

Interestingly if the US$9 million which the company said it lost from the statutory surrender requirement is added back to the top-line revenue, it will take the company’s revenues for the 2021 financial year to just above US$ 24 million which would be higher than what it achieved in 2020. This policy position which the company lamented needs revision by the authorities as it is inflicting real financial harm to companies that are Zimbabwe’s biggest exporters and earners of foreign exchange.

In the 2021 financial year, Padenga Holdings Limited incurred higher interest expenses at US$ 10,138,637 which was up from US$ 6,665,084.00 the previous year. The increase in this cost category was due to leverage and borrowings which Padenga employed in rehabilitating the Eureka gold mine which is now in full production and is also responsible for the increase in group revenues.

The company enjoyed increased production from its gold mining operations. The company sold a staggering 976 kilograms of gold which was higher than the 722 kilograms of gold sold in 2020. The increase in gold production came from the newly commissioned Eureka gold mine. From its crocodile operations, Padenga Holdings Limited sold a total of 55,341 skins which was less than the 72,244 skins it sold in 2020. The Zimbabwe crocodile operation sold 39,936 skins down from 43,254 skins that it sold in 2020.

Although the skins were sold at higher or elevated prices the company did not sell as many as it did in the previous year because the skins produced did not meet the required sizes demanded by the company’s premium brand customers.

This operational performance culminated in the group generating cash of US$ 15,502,776 which was more than double what the company generated in the 2020 financial year which was US$ 6,591,503.00. The company attributed this feat to what it called “efficiencies in working capital management”.

Dallaglio Investments

Padenga’s mining division made an operating profit of US$ 8.4 million which was significantly less than the US$ 18.1 million in profits it made in the 2020 financial year. Eureka’s coming on stream increased operating costs by 43%. This commissioning of the mine resulted in a loss of US$ 4.3 million compared to a profit of US$ 7.1 million in 2020. Despite the reduced operating profits in 2021 the mining operation generated healthy cash flows of US$ 10.1 million compared to US$ 6 million the year before. The improved cash flows provided much-needed working capital relief to the rest of the group.

Nile Crocodile

Padenga’s crocodile business increased its profits by 7% in 2021. The crocodile operation achieved profits of US$ 5.69 million. This increase in profits during the period under review was attributed to increases in the number of skins sold. The Zimbabwe crocodile operation generated US$ 5.2 million in cash while the Texas alligator operation reduced its losses in 2021 to US$ 541,189.00 from a loss of US$ 3,641,081.00.

Going forward

Padenga announced that it is prioritizing the reduction of debt and leverage on its balance sheet which is responsible for high-interest expenses which the company incurred in the same year. Padenga Holdings Limited has to date invested US$ 20 million into Dalaglio Investments, giving it an interest in 3 gold mining units which are expected to contribute significantly to the group’s revenues and profits in the coming years. The company’s gold mining activities have already eclipsed the crocodile farming activities in terms of financial performance. The gold mining unit comprises Eureka and Pickstone Peerless mines.

Gold volumes are expected to increase by 25% and costs are expected to reduce by 20% per ounce. The company expects margins and profits from its gold mining business to increase going forward. The alligator/crocodile skins market remains depressed and oversupplied Padenga expects the situation to remain for the next four to five years. The company 2021 did not declare a dividend to shareholders in 2021 opting instead to reduce the debt on its balance sheet.

The company is one of the few quality companies that were listed on the Zimbabwe Stock Exchange that migrated onto the US dollar-denominated Victoria Falls Stock Exchange where it hardly trades. Padenga’s share price is US$ .2304.

At this price level when compared to its net asset value per share of US$ .14813 appears overvalued. The company, however, offers a strong investment case due to its ability to generate foreign exchange. Padenga has a strong export business in its crocodile operations albeit subdued now and for the next four years. Its exposure to the mining and commodities sector stands it in good stead where foreign currency generation is concerned. The share possesses qualities that investors would gain from investing offshore. When the company’s directors eventually decide to reopen the dividend taps it will return cash to investors in hard currency which acts as a hedge against the volatility in the local currency unit the Zimbabwe dollar.