- TikTok Community Guidelines update aims to curb hate speech and misinformation

- Rwanda sees 39% surge in bank borrowers as Sacco and MFI loan uptake declines

- Kenya Ports Authority wins dispute case over cargo release

- Why Africa can reap billions from digital economy

- Africa private capital deals drop 28 per cent amid global economic turmoil

- Saudi Islamic Development Bank to the rescue of Uganda with $295 million loan

- Reshaping the future of sustainable food systems in Africa

- African Heads of State call for tripling of World Bank’s concessional financing

Search Results: Zimbabwe (637)

In May 2023, Zimbabwe released a gold-backed digital currency for peer-to-peer and business transactions. It acted as a store of value as the Zimbabwean dollar continued its steep depreciation. International gold prices controlled by the London Bullion Market Association will dictate the local pricing of Zimbabwe’s digital currency tokens.…

The first quarter of 2023 witnessed a significant shift in communication trends in Zimbabwe. Voice traffic experienced a sharp decline while mobile internet and data traffic continued to surge. According to the quarterly bulletin released by the Postal and Telecommunications Regulatory Authority of Zimbabwe (POTRAZ), the country’s mobile internet and data traffic witnessed a 12.3 per cent increase. It reached 37,690.4 Terabytes by the end of Q1 2023, compared to 33,576.4 in the previous quarter.…

- Zimbabwe has relaxed regulations barring importation of basic commodities to avert shortage of goods ahead of elections.

- The move not only bolsters the domestic market but also improves Zimbabwe’s exports with SADC and China.

- In March, South Africa emerged as Harare’s primary source of imports, contributing 37.6 percent of the total. China, Singapore, India, and Zambia followed accounting for 19.2 percent, 16.7 percent, 3.7 percent, and 3 percent respectively.

In a strategic move aiming to avert looming drought of essential goods ahead of 23 August 2023 elections, authorities in Harare have rolled out bold steps, relaxing rules that are choking the flow of Zimbabwe imports. The strategy further aims at countering escalating prices and ensuring smooth flow and access of essential goods in the country.

Minister of Finance and Economic Development, Mthuli Ncube, has announced the complete elimination of import restrictions on basic goods. The initiative will be complemented …

- Key staff in Eswatini and Zimbabwe have gained critical skills on how to harness Africa Continental Free Trade Area (AfCFTA).

- The training will be rolled out in Kenya, Seychelles, Rwanda, and DRC starting June, this year. It is critical for helping businesses identify and compare emerging opportunities in Africa.

- The programme equips staff with integrated and reliable trade intelligence on international market performance and opportunities as well as market access conditions.

Staff from over 80 companies and public agencies in Eswatini and Zimbabwe have gained critical skills on how to harness opportunities under Africa Continental Free Trade Area (AfCFTA). The training was undertaken by the African Trade Observatory, one of the five operational instruments of AfCFTA charged with driving intra regional trade of small businesses.

The online dashboard is critical for helping businesses identify and compare emerging opportunities across the continent. It provides integrated and reliable trade intelligence on international …

- Kenya’s Nairobi Securities Exchange posted drop in capitalization in April due to investor flight.

- Other poorly performing bourses were Uganda, Mauritius, Namibia, Morocco, Tanzania, Rwanda and Tunisia.

- Zambia, South Africa, Ghana and Egypt remained positive railing Zimbabwe and Malawi.

Zimbabwe has maintained the lead in the African equity markets returns by recording the highest gains at 112.33 percent year-to-date, the latest data shows. In the period under review, Malawi recorded the highest month-on-month value of 10.96 percent.

At the same time Kenya posted the highest drops both on year-to-date and month-on-month, Nairobi Securities Exchange (NSE) monthly barometer indicates, which stood at negative 15.56 percent and minus 3.52 percent, respectively.

Other poor performers across Africa were Uganda, Mauritius, Namibia, Morocco, Tanzania, Rwanda and Tunisia. In West Africa, Nigeria performed poorly on the month-on-month index but remained positive year-to-date. Zambia, South Africa, Ghana and Egypt remained positive railing Zimbabwe and Malawi.

Kenya’s …

- Econet Wireless Zimbabwe is Zimbabwe’s largest provider of telecommunications services.

- The financing is aimed at redeeming the outstanding debentures in the capital of both companies.

- EcoCash Holdings Zimbabwe is the ninth most traded stock on the Zimbabwe Stock Exchange over the past three months

Zimbabwe Stock Exchange (ZSE) listed Econet Zimbabwe and its subsidiary, EcoCash Holdings, have announced their intention to raise US$30.3 million through a renounceable rights issue. The move is aimed at redeeming the outstanding debentures in the capital of both companies.

The recent rights issue on the ZSE is similar to the 2020 offer made by retailer Edgar’s to its shareholders.

A renounceable rights issue is a type of share offering in which existing shareholders are given the opportunity to buy new shares in proportion to their existing holdings. This means that existing shareholders can choose to buy a certain number of additional shares at a …

- The Reserve Bank of Zimbabwe last month began to loosen the tight monetary policy it had in place over the last 2 years to act against inflation.

- The hawkish stance of the central bank began to change when the RBZ announced that it would reduce interest rates by 50% to 150%.

- Zimbabwe’s central bank’s hawkish stance has resulted in a weakening economy and rising unemployment.

The Reserve Bank of Zimbabwe held the global record for highest interest rates, reaching a staggering 200%. The central bank has lowered this to 150% on the grounds that the inflationary conditions that required the significant increase have subsided. As is typical with hawkish monetary policy approaches, Zimbabwe’s central bank’s hawkish stance has resulted in a weakening economy and rising unemployment.

On 3 February 2023, the Zimbabwean monetary authorities issued the country’s first Monetary Policy Statement via the central bank. Twice a year, the Reserve …

- The VFEX or Victoria Falls Stock Exchange is Zimbabwe’s exclusively United States dollar only stock market which was launched 3 years ago.

- The Zimbabwe Stock Exchange or ZSE’s main board has been shrinking because of companies migrating to the VFEX.

- Companies in Zimbabwe constantly experience a shortage of foreign exchange to support their increasingly import reliant businesses.

The number of companies that are delisting from the main board of the Zimbabwe Stock Exchange, often known as the ZSE, and moving their operations to the ZSE’s hard currency equivalent, the Victoria Falls Stock Exchange (VFEX), has been growing. When the central bank eliminated the favorable foreign exchange retention levels that had been the primary draw of the VFEX, it is anticipated that the outflow from the ZSE will slow down in 2023. This comes after the central bank eliminated the foreign exchange retention thresholds.

- Zimbabwe’s banking and financial industry reflects the overall health of the economy.

- The country has broadly experienced capital flight and negligible foreign direct investment during the last 2 decades.

- Policy inconsistency has undermined Zimbabwe’s banking and financial industry together with its capital account.

Thungela Resources set to diversify beyond coal in South Africa

Zimbabwe has been dubbed the sick man of southern Africa for the past 25 years. The country has seen capital flight and an outflow of foreign investment. There are numerous causes for this result. The primary cause has been policy blunders and so-called “flip-flopping” by government gatekeepers.

Like to the rest of the world, Zimbabwe’s banking system reflects the activity of the actual economy. Banks and other financial services institutions serve as financial mediators for real economy players. This indicates that banks serve as a vital link between surplus and deficit units.

In economic terms, this means …

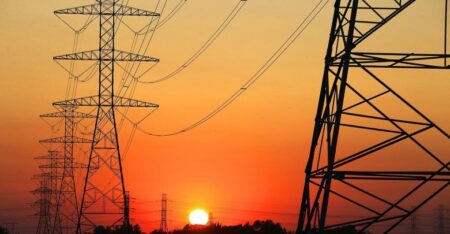

- Zimbabwe is experiencing crippling power outages characterized by black-outs that can extend to as much as 19 hours a day.

- The electricity shortage is now common place with South Africa recently announcing Stage 6 power cuts.

- The debt capital markets, specifically the issuance of green bonds is a possible solution to rolling black-outs.

Zimbabwe is in the middle of a power crisis that can be attributed to the low water levels at the country’s Kariba Dam which has in times past been used to supplement the country’s power needs. Power outages are a part of every day living in the country.

However, the latest power crisis seems to be more intense threatening to scupper economic growth. Businesses and citizens have had to adjust to erratic power supply schedules. It is now commonplace for people to wake up at midnight to iron their clothes and use their electric appliances as this …