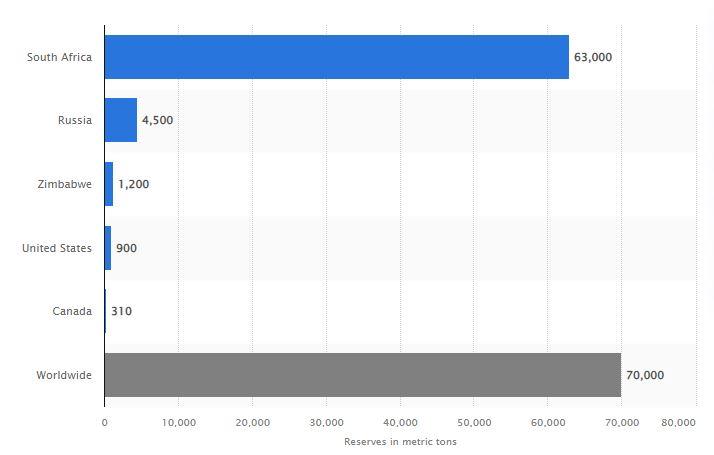

- Platinum mining is where Loucas Pouroulis, the chairman of mining outfit Tharisa PLC made and then lost money and then made it again in South Africa. He is looking to make another fortune digging for platinum on the Great Dyke in Zimbabwe

- A look at the rise, fall and rise again of storied platinum mining entrepreneur Loucas Pouroulis.

- Tharisa PLC and Karo Mining Holdings, both Loucas Pourolis backed vehicles are the latest companies to venture into Zimbabwe’s rich Great Dyke platinum field

- Platinum mining is where Loucas Pouroulis and his family have made their wealth however the same mining sector nearly ruined his career 35 years ago

- Tharisa PLC through Karo Mining Holdings is developing a 150,000 platinum ounces a year project in Zimbabwe on the Great Dyke

Loucas Pourolis, the South African Greek-born mining entrepreneur knows a thing or two about rising from the obscurity of humble beginnings to wealth and prominence, falling when the disaster of failure strikes, and rising yet again.

The reticent mining tycoon prefers to keep a low profile. A search of his name in the Pot Stirrers publication by mining industry journal Mining MX does not turn up his profile. You would instead find his son Phoevos Pouroulis’ profile. The younger scion is a chip from the old block in that he has followed in his father’s footsteps by pursuing a career in the mining industry. Phoevos Pouroulis is the chief executive of the Johannesburg listed Tharisa PLC. The company styles itself as an integrated platinum and chrome resource in the company and has operations in South Africa, Cyprus, and Zimbabwe. His father Loucas is the executive chairman of the company. The term “executive chairman” incorporates lexicon as a euphemism for the person who calls the shot in that company.

https://theexchange.africa/investing/investment-in-africa-2022/

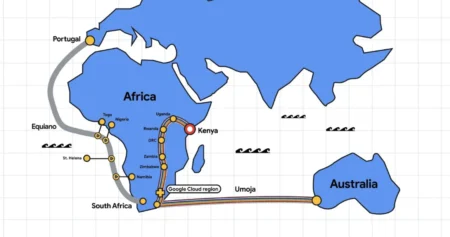

Pouroulis [Loucas] and his company have been thrust into the limelight after Tharisa PLC the mining company they control decided to enter the Zimbabwe platinum mining sector through the purchase of an 85% interest in the Karo Platinum Project. The government of the southern African country is said to be the holder of the 15% interest. Zimbabwe is fast becoming the next big thing when it comes to mining and exploration of platinum group metals. The project which Tharisa is engaging in has an estimated resource of 35 million tons or about 2.6 million ounces. Through this move, Tharisa has secured itself a sweet spot on the Great Dyke. The project according to the company is said to have a net present value of around US$ 770 million.

Once the Karo Platinum comes on stream it will be a game-changer for Tharisa PLC. Karo once fully operational will double Tharisa’s platinum production to about 400,000 ounces. Tharisa is not the only company looking to make a fortune from the Great Dyke. The largest platinum miner in Zimbabwe is Zimbabwe Platinum Mines which is a subsidiary of Impala Platinum Holdings. That company’s top brass was in the press recently for praising the government of Zimbabwe for giving it support in terms of its investment. Unki Mines is the second-largest operator in Zimbabwe, and it’s owned by Anglo Platinum which is owned by the Anglo-American group. Sibanye Stillwater is another player in the Zimbabwean platinum space and its investment is by way of a joint venture in Mimosa. The other party to the joint venture is Impala Platinum.

It has not always been smooth sailing, good news, and fanfare for Loucas Pouroulis. This man has seen it all, from the worst of times to the best of times. Tharisa’s website describes him as, “…the Executive Chairman of the Group, with responsibility for the development of strategy and the identification of new opportunities for the Group. He began his career in Cyprus in 1962, and his initial post-graduate training took place in Germany, Sweden, and Cyprus. Loucas is trained as a mining and metallurgical engineer and has 50 years of experience in mining exploration, project management, financing, and production in open pit and underground mining operations, including PGM and gold mines. He immigrated to South Africa in 1964 and joined Anglo American, where he rose rapidly through the management ranks and received extensive training and experience. In 1971, Loucas began to pursue his mining interests, initially focusing on gold mining opportunities considered uneconomical by the majors. By the 1990s, he had established Petra Diamonds and, since 2000, has established Eland Platinum, Tharisa Minerals, Kameni, Keaton Energy, and TransAfrika Resources.”

https://www.tharisa.com/board-of-directors.php

Pouroulis fits the description of a serial entrepreneur down to the letter. However, in some circles, he cuts somewhat of a dark figure and mining opportunist. This view is held especially by those who recall him from the 1980s when he started and promoted a venture called Lefkochrysos Platinum. The name of the venture translates from the Greek language to mean “white gold” which is a phrase commonly used to describe platinum. The Lefkochrysos or “Lefkocrisis” as it was then unkindly nick-named left Pouroulis’ reputation in tatters when the platinum venture collapsed.

Through Lefkochrysos, Pouroulis hoped to develop the Crocodile River mine. In 1987, Pouroulis just as he was about to close on ZAR 200 million of funding for his project Black Tuesday occurred and the Dow Jones lost 22% of its value. That day 19th October 1987 went down in history as the crash of 1987. What began in the United States of America cascaded to the rest of the world and the Johannesburg Stock Exchange lost 11% of its value in the aftermath of the crash. Lefkochrysos which was listed on the JSE saw its share price fall from ZAR 26 to ZAR 5 a share. When the share price tumbled all the bankers who had initially backed the project withdrew their financial support. Shareholders in the venture who had been relatively unsophisticated began to sell their shares en masse.

The JSE after the crash of 1987 did recover however, the same could not be said of Lefko. The company was heavily indebted and not properly capitalized and ended up folding. This is when Pouroulis lost his halo. He was after this episode and for many years viewed as a dark Machiavellian operator. One of the leading tabloids described him then as, “A golden Greek who made and lost a billion.” In his own words, Pouroulis says that he lost a fortune and was dragged to court for 3 years until 1990 on charges of ZAR 65 million fraud from companies that were associated with Lefkochrysos. He and fellow directors of the defunct company were acquitted in 1990. This harrowing ordeal is perhaps the best reason Mr. Pouroulis prefers to keep a low profile and vanished from the public view in 1990.

https://theexchange.africa/investing/global-mining-industry-report-2022-how-will-countries-fare/

Resilience and persistence are some of the hallmarks of a successful entrepreneur. Pouroulis is no exception to this rule. Even after the Lefko debacle he continued with his mining ventures and ran a company called Consolidated Modderfontein or Cons Modder. This was a gold mining company that operated on the East Rand and was a forerunner of the modern-day Harmony Gold. Interestingly veteran financial journalists like Michael Coulson reflecting on the Lefko days say that the company had a market capitalization of nearly ZAR 2 billion attached to a highly speculative venture and one in which the original promoters had invested a minuscule amount of cash. This is according to a report on Loucas Pourolis carried in FinWeek a leading South African investment journal published in October 2007.

This corporate financing strategy seems to be a favorite of Pouroulis and his companies. Starting ventures in the mining space that have little of their own money at stake and saddling them with debt. A similar funding model has been touted with its venture into Zimbabwe through Karo Mining Holdings which is developing the Karo Platinum Project. Tharisa needs between US$ 250 million and US$ 310 million to develop the 150,000 ounces per year asset. It is mulling the idea of floating a Eurobond on the Victoria Falls Stock Exchange or VFEX to raise at least US$ 50 million of the funding needed to develop the mine. According to Tharisa’s head of investor relations, the company’s equity contribution will come from what she called “internal sources and facilities” without giving further details.

Pouroulis won redemption for the Lefko debacle in 2007 on the eve, ironically of the collapse of his initial foray into platinum when he sold Eland Platinum to Xstrata, now part of Glencore in a US$ 1 billion transaction. He and his management team netted a cool ZAR 100 million from the deal which in those days would have been around US$ 14 million. Now 84 years old, Loucas Pouroulis has done very well for himself and his family. He has come a long way from being viewed as the archetypical outsider when he emigrated from Greece and arrived on South African shores with a degree in metallurgy and engineering from the National Technical University of Greece. He worked as an underground manager at Anglo American’s Western Deep Levels between 1965 and 1971. From that point onward he struck out on his own which was taboo in those days because at that time Anglo and Gencor had a stranglehold on South Africa’s mineral resources.

https://theexchange.africa/business/northam-platinum-holdings-reaping-the-fruit-of-ambition/