- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

Browsing: Business in Africa

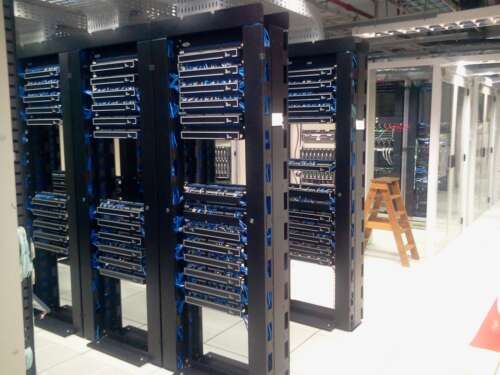

Data centers are Information Technology (IT) facilities responsible for the management of data in an organization. Data centers house state-of-the-art computing infrastructure with very powerful machines. Traditionally, data centers were associated with extensive use of space and a lot of hardware components to support big data storage and management services.

As technology evolves, the use and development of software-based data centers requiring less space are increasingly becoming more common.

Cloud computing, a modern model used for data centers is growing in popularity in Africa. This technological innovation allows for an integrated approach to data management services such as storage, applications, and servers. Cloud-based data centers have lower costs compared to traditional physical data centers. Most cloud computing services are outsourced from well-established companies that have the resources and experience to do so. Companies such as Microsoft, Amazon, and Teraco continue to invest significantly in cloud infrastructure, globally.

High growth

…The Energy sector has received substantial capital commitments. In the course of the continent’s growth, the sector has seen lucrative returns and enormous risks and losses. The energy sector’s main upside has been the increased economic growth and development witnessed on the continent.

The story has not been an absolute success, however, with some huge losses incurred. The government mainly monopolizes the energy sector in Africa as it provides a critical service to the economy. Failure of the sector could result in a catastrophic collapse of the economy across all fronts.

The impact of mergers in the Energy Sector

Operational cost-efficiency

South Africa has recently welcomed a major energy merger that is effective 1 April 2021. PetroSA, iGas, and Strategic Fuel Fund are set to become one entity called the South African National Petroleum Company. A deal has the potential to produce high-value returns for investors and substantial developments in …

Africa’s financial potential has become an interesting prospect for emerging market investors. Three decades ago a proposal to invest in Africa would have been considered ridiculous, but this is no longer the case. In fact, between 2006 and 2011, the continent was registering the highest returns on FDI at 11.4 percent, even higher than Asia at 9.1 percent, while the global average was 7.1 percent. To add to that according to the World Economic Forum, since 2000 “half of the world’s fastest-growing economies have been in Africa. As western markets mature and foreign investments saturate in Asia, Latin America, Central and Eastern Europe, and India, Africa is fast becoming the most lucrative investment destination. The inefficient African markets are an excellent source of excess returns, given the level of perceived risks. …

The pandemic has shown the globe that more is needed to fortify our systems, as nearly 95 million people have contracted the virus and more than two million people have succumbed to it, while millions face the economic shocks of the virus, particularly those located in developing economies.

A World Economic Forum (WEF) publication which is part of The Davos Agenda (a virtual global leaders’ meeting on sustaining an inclusive and cohesive future) noted that the pandemic has exposed several threats to the world. …

Africa, the continent of more than 1.3 billion people has experienced its share of the coronavirus (COVID-19), which shaved off crucial portions of the continent’s economy (tourism, trade and travel) leading to funding holes, debt burden and propelling unemployment and inequalities.

There are several projections laid out benching on Africa’s economic trend. According to UN estimates, African countries have so far lost an estimated US$29 billion due to the pandemic.

Meanwhile the United Nations Economic Commission for Africa (ECA) pinned its forecast noting the virus will shave 1.4 per cent off Africa’s $2.1 trillion GDP, hurting the continent’s business landscape.

Despite the pandemic eviscerating this year’s plans of enhancing tourism and travel horizons for East Africa’s hotbed Tanzania and Kenya, the African Development Bank (AfDB) finds the region undeterred in the face of the pandemic , as it becomes …