- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

Browsing: inflation

Because of erratic economic policy, Zimbabwe continues to be the sick man of the Southern African Development Community (SADC) region.

The country perennially goes from one economic crisis to the next. Presently Zimbabwe is battling with resurgent inflation after managing to rein it in from the hyperinflationary levels reached in the years 2019 to 2020 and during the early months of 2021, peaking at over 837%.

Currently, Zimbabwe’s inflation stands at approximately 257%. Conventionally, the origins of inflation have been and always will be excessive money supply that outstrips the rate of growth in an economy resulting in too much money chasing too few goods and services. In the case of Zimbabwe, the inflation malaise was compounded by the fact that the economy is virtually stagnant, growing only marginally.

- Zimbabwe’s economic policy has been erratic.

- The government in Zimbabwe has recently adopted a scorched earth policy against inflation by tightening

Countries must continue to work to mitigate their vulnerabilities over time. This involves minimizing balance-sheet misalignments, establishing money and foreign exchange markets, and lowering exchange rate passthrough by increasing monetary policy credibility.

However, in the short term—while vulnerabilities remain high—the use of extra instruments may assist relieve short-term policy trade-offs when certain shocks occur. In particular, foreign exchange intervention, macroprudential policy measures, and capital flow controls may help increase monetary and fiscal policy autonomy, promote financial and price stability, and minimize output volatility if reserves are enough and these instruments are available.…

Changes in monetary policy may have a substantial influence on all asset classes. However, by understanding the subtleties of monetary policy, investors may position their portfolios to profit from policy shifts and increase returns.…

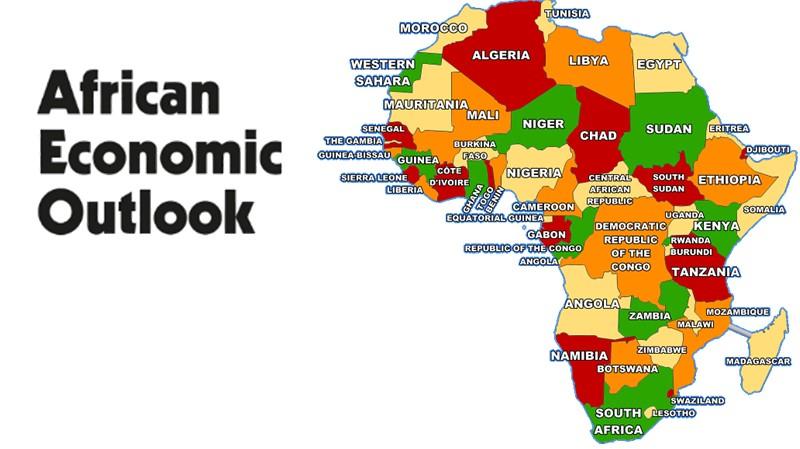

The continent in the near future will have the largest population in the world. The population of Africa is urbanizing as citizens of the nations of the continent migrate from rural to urban areas.

This addition to its vast natural resources is a potent combination for its rapid economic expansion. The world witnessed first-hand the economic miracle where China transformed itself from a rural backwater in 1949 when the modern Chinese state was founded to an economic and military superpower by 2019. The year 2019 is significant to China because the country celebrated 70 years of its founding as a communist state, and the Asian country gained worldwide recognition as a military superpower.

China put on a military parade that displayed a weapons arsenal that made the United States sit up and take notice. How was this possible? China’s economic transformation was because of several factors. One of the most …

Zambia has dealt with the legacy of years of economic mismanagement, with an especially inefficient public investment drive. Zambia has been in debt distress. Therefore, the country needed a deep and comprehensive debt treatment to place public debt on a sustainable path.…

Other reasons that can best explain the origins of stagflation include falling productivity when an economy experience falling productivity. This could be because workers becoming less efficient. The consequence of this will be falling productivity and rising costs. Structural unemployment is another cause in cases where there is a decline in traditional industries.

This creates a tendency for unemployment to rise while productivity falls. Zimbabwe, during its lost decade from 2000 to 2010, experienced this kind of stagflation.

More generally and more contextually, stagflation comes from supply shocks. These result from supply chain disruptions. Where demand for goods and services increases or is unchanged, the result is rising prices and lower productivity.

Stagflation is not desirable in an economy because citizens of a country are generally happy when prices are low and the economy is booming.…

Due to globalization, countries worldwide are increasingly interdependent. This is why a conflict between two countries in Europe will cause ripple effects that the rest of the world feels. On this basis, the World Bank projects that economic growth in 2022 will slump. Not slow down but slump. The choice of words is intentional.

Malpass now believes that the world is in for several years of above-average inflation and below-average growth. This projection will most likely lead to destabilizing consequences for low- and middle-income economies. These low- and middle-income countries are largely on the African continent. Stagflation which the world last saw in the 1970s, will have a devastating effect on countries in Africa. Most countries in the continent do not have the resources like Germany to muster multibillion Euro or multi-billion United States dollar packages to subsidize the economic plight of their citizens.

World Bank forecasts a sharp downgrade …

According to the EIU graphic, much of the external debt stock of African countries consists of public medium- and long-term borrowings. This form of borrowing has been on the rise since 2000.

Private medium- and long-term debt stock in Africa has also been on the increase but not at the same scale and magnitude as the public debt. In short, governments, through their finance ministries, have been on a borrowing binge since 2000, whereas the private sector has marginally increased its borrowings in United States-denominated debt.

The increased levels of borrowing in hard currency badly expose governments to movements in interest rates and exchange rates. South Africa has the most external debt exposure of any country in Africa, followed by Egypt and Nigeria. With these facts in mind, it is no surprise to how much the Rand, the South African currency unit, has depreciated against the dollar.…

McKinsey’s report notes that the wages of consumers are steadily being eroded. Wages in the largest economies reportedly flatlined; in other words, no significant change in their levels was recorded. Prior to the pandemic, the same wages were said to have increased, giving workers the upper hand in negotiations. The pandemic, however, drastically altered that state of affairs. Wages in developed markets post the pandemic are also related, but the advent of inflation has checked that growth and, in some instances, set the trend backwards.

In the United Kingdom, there have been reports of wages being lower year on year.

The culmination of these factors is that the outlook for global economic growth will be lower this year than last. McKinsey expects central banks to increase interest rates more assertively to deal with inflationary pressure. The risk of recession is becoming more and more prevalent.…

If it so happens that the said stimulus package is financed by increasing the money supply. It may have unintended and unpleasant consequences.

Economists have a phrase that means the same as “in a perfect world”. Economists will often say “ceteris paribus”. In a perfect world, government expenditure would have been all that is necessary to fix the lingering economic problems confronting the world post-COVID. However, reality would beg us to consider that government expenditures of money that they did not have to jump-start economies that were in a prolonged period of stasis would invariably lead to inflationary pressures. The United States has been grappling with the problem of inflation throughout 2021.

Its inflation figures are the highest they have been in decades. The fascinating thing about this current brand of inflation is that it is multi-faceted. Granted, it began when governments decided to spend their way out of an …