- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

- Powering Africa: Africa’s Path to Universal Electricity Access

- Global investment trends at AIM Congress 2024: a spotlight on the keynote speakers

- South Africa’s deepening investment ties in South Sudan oil industry

- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

Browsing: inflation

Côte d’Ivoire’s economy remains on a favourable trajectory. The economy needs bolstering to expedite the structural change of its economy as envisioned by the new 2030 plan. To achieve this, the nation needs to raise its investments in new sectors with considerable potential for wealth generation and improvement in quality of life. These sectors would enable the inclusion and realisation of benefits for women and the most disadvantaged populations in society, especially those residing in the most isolated rural areas.…

- More than half of some of the world’s wealthiest individuals are managing their wealth and making changes to their investment strategies, given current economic challenges, including inflation

- In response to rising global inflation, two-thirds of investors are changing their investment strategies, with some spending less while others have made new decisions around their portfolios

- Gold continues to be of high interest, with 2 in 5 saying they have invested as a result of inflation, and there is interest in bonds at a lower 22% to combat inflation

A new survey has indicated that more than half of some of the world’s wealthiest individuals are managing their wealth and making changes to their investment strategies, given current economic challenges, including inflation.

The Standard Chartered’s Wealth Expectancy Report 2022 reveals a shift in investor decisions for over 15,000 emerging affluent, affluent, and high net worth (HNW) investors in 14 markets.

The results …

Uganda Bureau of Statistics has indicated that the country’s inflation has for the first time since 2012 hit double digits, rising to 10 per cent in September 2022 from 2.7 per cent in January 2022 and 4.9 per cent in April 2022.

It is said that inflation above an annual average of 5 per cent retards economic growth and derails economic development.

According to an article titled Uganda grapples with soaring inflation amid persistent global uncertainties, the rise in inflation has been brought about by issues such as tightening of global financial conditions, which triggered investors’ exit from the domestic debt market, thus stoking depreciation pressures on the Uganda Shilling; the Russia-Ukraine conflict, which disrupted global production and supply chains; extended drought in some regions of the country; and increased global commodity prices.…

In terms of the fiscus, South Africa expects to run a deficit of -4.1 per cent in 2023, however, the deficit is expected to narrow for the next 3 years closing 2026 at -3.6 per cent. This demonstrates significant fiscal consolidation.

Over the next 3 years the South African government expects to consolidate its public finances and reduce its deficit by inter alia increasing revenues and or managing or containing costs. According to Investec, “The current fiscal year (2022/23) has seen a substantial boost to nominal (actual) GDP due to high inflation, which has eased both the fiscal debt and deficit projections as a per cent of GDP, although does not boost real GDP, which is the measure of the country’s growth and has the distorting effect of inflation removed.”

Among countries in Africa, South Africa is getting its public financial act together. The country is paying down its debts, …

African countries looking to anchor their currencies on either gold, or a combination of gold, precious metals, and other minerals would need to start with legislation which would make it legal for the governments of those countries to redeem paper currency with either those minerals or a derivative of those minerals.

Zimbabwe in late August began an initiative where it sold actual gold coins to its citizens which had been minted by that country’s central bank. This move was initiated to halt the slide of the currency on the parallel and official markets. This county’s policy so far has been successful in slowing down the trend of inflation which had begun to run amok.

It would be remiss to attribute the slowdown inflation to the gold coins. The country dramatically tightened its monetary policy by increasing interest rates to over 200 per cent in May 2022 and temporarily banned commercial …

Time is running out for Africa to guarantee food security for its population. As the saying goes, it is not very reasonable to keep doing the same things and expect different results.

Africa needs crops that can withstand pests and disease, withstand drought, flourish without excessive pesticides and fertilizers, and produce healthy food. Africa needs crops to enable smallholder farmers to prosper. GMOs provide a powerful instrument for Africa to address these demands when other choices fail over time.…

Sierra Leone’s government may have to impose severe austerity measures. These measures will address inefficiencies and inadequacies in allocating and administrating public resources. However, all hands must be on deck within these economic management measures. This will secure the ring-fencing of money for essential objectives like education, livelihood preservation, and health. These objectives remain critical to maintaining social stability and a rapid return to the economic recovery path.…

African governments must consider strategies to optimise the effective use of imported oil. The optimisation will reduce net oil import proportions to minimise expenses. More generally, African nations must explore these strategies to minimise their reliance on oil as their only energy source.

Reducing oil consumption by shifting to renewable resources represents a long-term or short-term solution. In contrast, if Africa is to benefit or gain from the imminent possibility of an increase in oil prices, these few oil-producing nations must expand their crude oil production and refinery capacity.…

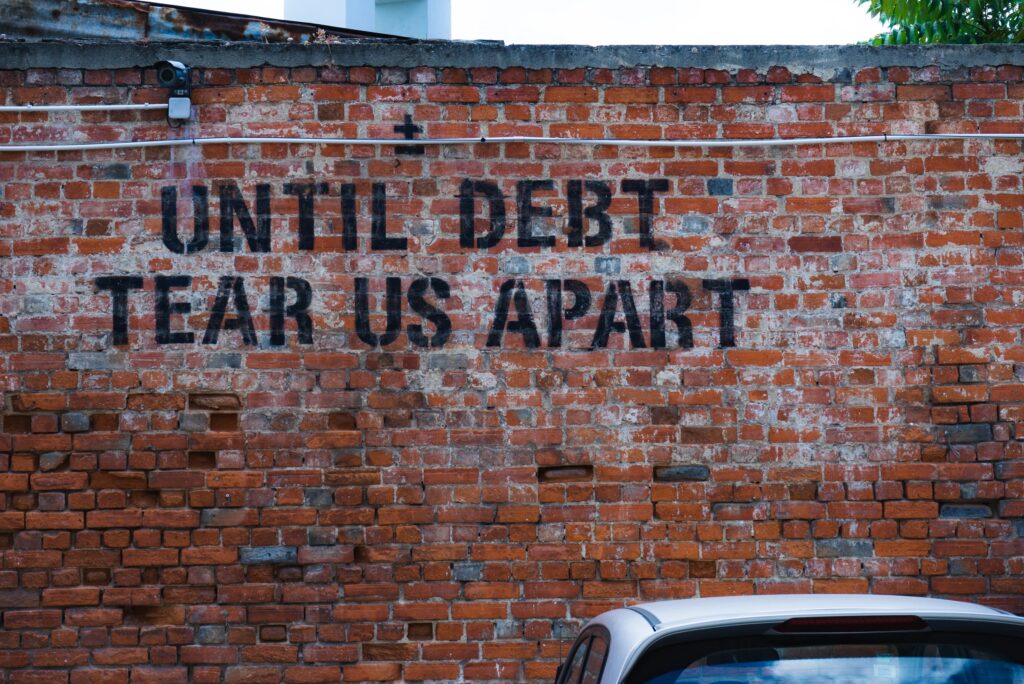

The high-interest rates have made the United States dollar more appealing to investors who are piling into the greenback. The value of other currencies has tumbled: the pound, yuan, euro, and the yen. This depreciation in other currencies makes imports for these countries more expensive in United States dollars. The case for a recession caused by a strong dollar is grimmer in Africa where just about every country on the continent is overextended in terms of United States dollar-denominated borrowings.

Repaying loans in hard currency will be more expensive, especially where their currencies are rapidly depreciating.

The strong US dollar according to CNN has a destabilizing effect on Wall Street.

Companies listed on that bourse conduct business internationally, and a strong dollar will negatively impact their earnings. The second marker of the global economic recession is that US economy is slowing down or stalling. The world’s largest economy is driven …

A currency crisis is defined as a quick and abrupt depreciation of a country’s currency. Currency depreciation goes in tandem with turbulent markets and a loss of confidence in the country’s economy. Historically, crises have arisen when market expectations induce significant movements in the value of currencies.

The global economy is now in turmoil. As the world economy enters another era of a currency crisis, the value of the US dollar keeps rising. Over half of all international trade is billed in dollars. A stronger dollar thus hurts consumers globally, particularly in Africa, who rely on dollars to pay for imports.

The US Federal Reserve’s hawkish approach to increasing interest rates more aggressively than central banks in other major countries has contributed to the dollar’s appreciation. The fact that investors generally see the dollar as a “safe haven” asset during times of economic turmoil has added to its resilience.…