- How transition finance can catalyse Africa’s green industrial revolution

- Stanbic PMI Report: Mixed performance as Kenya’s agriculture, construction offset manufacturing decline

- Uganda’s land management gets a tech makeover to boost transparency

- Nigeria’s output dips fastest in 19 months on a sharp rise in costs

- Apple faces growing backlash over Congo exploitation

- Why East Africa is staring at higher wheat prices in 2025

- Nairobi Gate SEZ pumps $7 million into Kenya’s agro-processing industry

- What impact will the US election have on Africa?

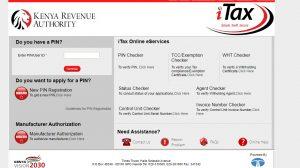

Browsing: Kenya Revenue Authority (KRA)

Kenya Revenue Authority has reached a new record of revenue collection to hit Sh1.669 Trillion in the 2020/21 financial year, compared to Sh1.607 Trillion collected in FY 2019/20.

In a statement, the Authority’s Director-General Githii Mburu says that this is in spite of the challenging operating economic environment brought about by the COVID-19 Pandemic.

“Kenya Revenue Authority (KRA) has defied all odds to surpass its revenue target after eight (8) years, since FY 2013/14,” the Authority said.

The FY 2020/2021 revenue target as reflected in the 2021 Budget Policy Statement was Sh1.652 Trillion which KRA says it surpassed with a surplus of Sh16.808 Billion.

This represents a performance rate of 101 percent and revenue growth of 3.9 percent compared to the last Financial Year.

KRA says the performance is consistent with the prevailing economic indicators, especially the projected GDP growth of 0.6 percent in 2020.

During the period under review, …

How to File nil returns in Kenya

A nil income tax return is filed to show the Income Tax Department that you fall below the taxable income and therefore did not pay taxes during the year, according to ClearTax.

According to the Kenya Revenue Authority (KRA) by the end of June 2019, it collected Ksh 1.580 trillion as opposed to the targeted Ksh 1.435 trillion projected by the Treasury.

Requirements for filling KRA Nile Returns

Your KRA pin and your iTax account.

How to file nil returns in Kenya

- Log in to iTax

Visit https://itax.kra.go.ke/KRA-Portal. On the left, you will see an empty tab, enter your KRA pin or your ID and click on continue.

Enter your password and a key to answer the Security Stamp question. In case you have forgotten your password click on the forgotten password and follow the steps to reset it.

…

Tanzania has released reprinted versions of several denominations of the country’s banknotes. The new banknotes are meant to be more secure against duplication and forgery.

The new security features include the removal of the classic thin stripe in the old banknote, called the motion thread and replacing it with a rolling star.

The former security feature (the motion thread) used a motion image that had special colour effects when the note is moved side to side.

The new feature now, the rolling star, also has a movement and color change trait, but makes wavy motions when the note is tilted.

The central bank, the Bank of Tanzania (BoT) announced early April that the change affects denominations of TZS 2000, 5000 and 10000.

The last time the BoT changed the country’s banknotes was in 2010. The central bank’s Governor Professor Florens Luoga explained in a press statement that the re-printed banknotes …

Commercial banks in Kenya have been on the limelight with accusations of abetting money laundering and being involved in national corruption scandals. Such was the case several banks which in 2018, CBK accused them of participating in payments for the National Youth Services (NYS) scandal.,

In this case, the director of public prosecution announced that he was considering prosecuting 20 senior officials in five banks, which they believe aided the laundering of at least Ksh1 billion ($10 million) looted from the National Youth Service (NYS) between January 2016 and April 2018.

These commercial banks have however developed mechanisms to conform to anti-money laundering laws developed in Kenya.

The law requires all financial institutions including banks, insurance companies, and SACCOs to file with the Financial Reporting Centre daily reports on transactions above Sh1 million and those deemed suspect. This is under the Proceeds of Crime and Anti-Money Laundering Act (POCAMLA).

Bank

Kenya has become one of the latest countries to strengthen the fight on tax evasion and profit shifting with signing of a tax treaty, in the wake of rising malpractices by global multi-nationals.

The national efforts to strengthen the country’s bilateral tax treaties, have received a boost with the signing of a multilateral convention to end tax avoidance in France.

This week, the country signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting Convention at the 10th Anniversary Meeting of the Global Forum on Transparency and Exchange of Information for Tax Purposes (the Global Forum) in Paris.

The Convention is the first multilateral treaty of its kind, allowing international collaboration initiatives to end tax avoidance among multinational firms under the OECD/G20 BEPS Project.

READ ALSO:Kenya’s tax evaders put on notice by President Kenyatta

The OECD/G20 BEPS Project delivers solutions for governments …

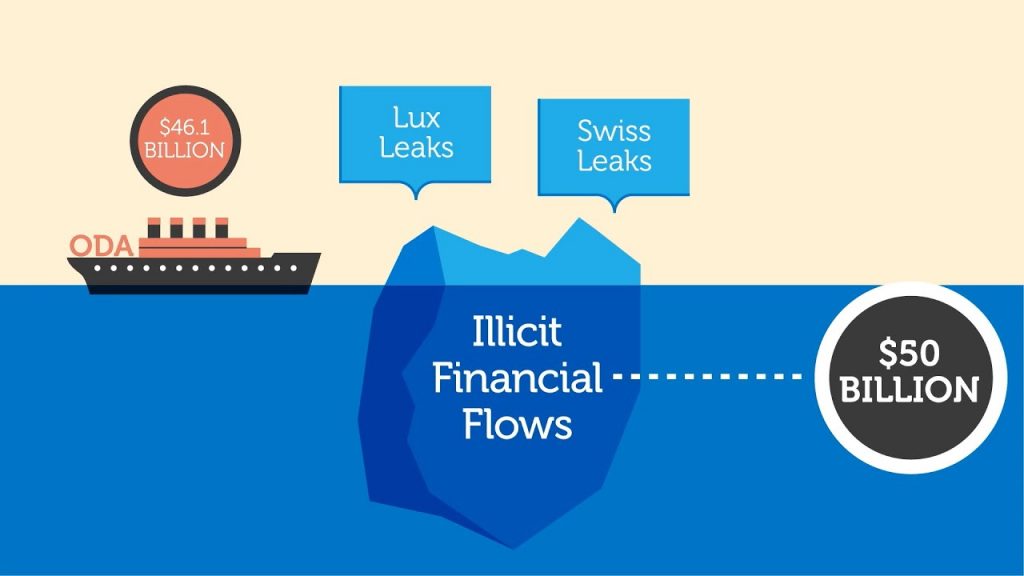

Kenya has stepped up efforts to curb illicit financial flows (IFFs) through the signing of theYaoundé Declaration, with Africa losing $50 to $60 billion annually through illicit financial flows.

The National Treasury Acting Cabinet Secretary Ukur Yatani has provided the much needed shot in the arm for the Kenya Revenue Authority (KRA) efforts to tackle illicit financial flows through the Yaoundé Declaration.

While welcoming the commitment by the Government, KRA Commissioner General Githii Mburu said the instrument focuses on improving international tax cooperation through enhanced information sharing among the African Union (AU) member states to curb illicit financial flows.

READ ALSO:Corruption fueling illicit flow of money from Africa, delegates in Nairobi discuss

“KRA is encouraged by the Government’s swift moves to prioritize the signing of international treaties that will accelerate efforts to curb international tax evasion,” Githii said.

In a communique to the Chairperson of the Global Forum on …

Kenya is keen to boost its trade with Ethiopia through the One Stop Border Post initiative, even as Lamu Port South Sudan-Ethiopia Transport (LAPSSET) corridor starts to take shape.

Acting Cabinet Secretary for National Treasury and Planning Ambassador Ukur Yatani has called on residents of the upper eastern region at the Kenya-Ethiopia border to take advantage of recently established One Stop Border Point (OSBP) in Moyale to boost trade between Kenya and Ethiopia.

READ ALSO:Ethiopia beats Kenya in Foreign investments

The CS said that the modern facility which is among other six in the country was underutilized.

“We should see more trade volumes passing through the OSBP at Moyale- an indication of a robust business activity between Kenya and Ethiopia. Unfortunately, we are not witnessing this. I wish to urge residents in this region to make use of this exemplary facility for their good and the good of both …

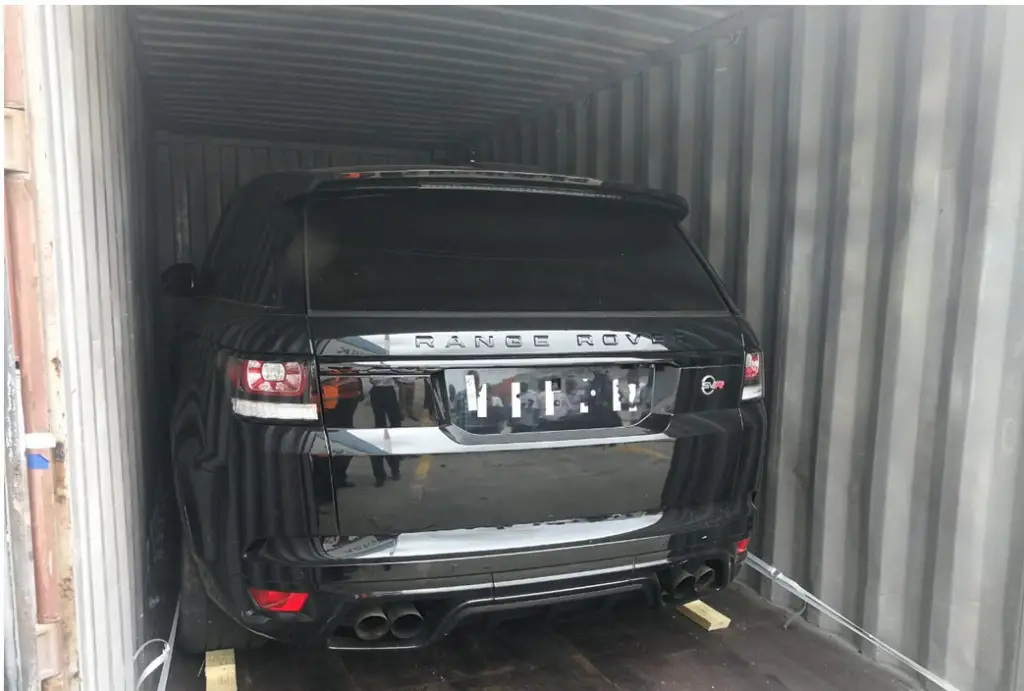

Barely a month after intercepting a consignment of contrabands and illegal imports at the Port of Mombasa, Kenyan authorities have yet again seized another multi-million shipment by rogue importers in Kenya.

Kenya Revenue Authority (KRA) seized 144 drums of imported Ethanol at the Port of Mombasa, which had been mis-declared as 1,000 bags of cement.

Customs officers have also seized another high end motor-vehicle, a Range Rover Sports suspected to have been stolen from the United Kingdom which had been mis-declared as second hand window frames, doors, folding chairs, stools and wall pictures.

READ ALSO:KRA intercepts narcotics disguised as candy at JKIA

The Ethanol was imported in two by twenty feet containers while the vehicle was in a twenty-foot container. The two were intercepted following intelligence reports; they were scanned through KRA’s non-intrusive scanners and the images showed inconsistency with what had been manifested.

A multi-agency team lead by …

Kenyan authorities have unearthed an international car smuggling racket targeting the East Africa region, one in many that have been busted in recent times.

On May 9, 2019, Customs officers in Mombasa received intelligence to the effect that two 20-foot containers on board a ship sailing to the Port of Mombasa was suspected to be stolen motor vehicles from the United Kingdom.

The containers arrived at the Port of Mombasa on May 11, 2019 aboard MV. MSC Positano from Oman and had not been declared.

Authorities subjected the two containers to x-ray cargo scanning where the images revealed the presence of top of the range motor vehicles.

According to import documents, the Range Rover Sport cars, which were subject of an international motor vehicle crime and smuggling investigation, were on transit to Uganda.

“a multi-agency team led by Customs officials undertook a verification exercise on May 28, 2019 confirming the …

The Kenyan government has now resorted to vetting of importers and exporters of consolidated cargo in the latest move to curb tax evasion.

This comes in the wake of recent piling of cargo at the Nairobi Inland Container Deport (ICD) as authorities opted for 100 per cent verification on containers with consolidated goods.

This is on suspicion of under-declaration and misdeclaration by traders in a tax evasion racket that has been denying the government revenues amounting to billions of shillings.

Rogue state officials have been accused of colluding with unscrupulous traders to facilitate false declarations, denying the Kenya Revenue Authority (KRA) requisite taxes, such as import duty, a move said to have led to a loss of over Ksh100 billion(US$987.8million) in the recent past.

They are also said to allow in counterfeits into the market and through the transit route into the hinterland in exchange for kickbacks.

The verification process …