- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

- State of journalism survey 2024 shows media houses are lagging in AI adoption

- Forum sets the stage to unleash global potential for startups during AIM Congress 2024

Browsing: Kenya Revenue Authority (KRA)

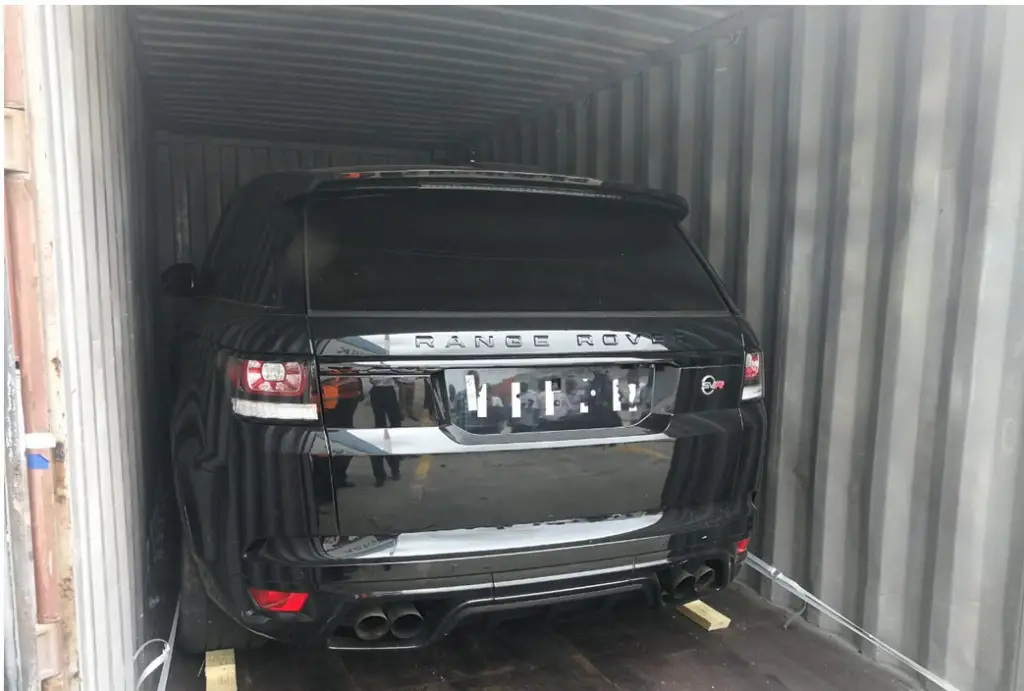

Kenyan authorities have unearthed an international car smuggling racket targeting the East Africa region, one in many that have been busted in recent times.

On May 9, 2019, Customs officers in Mombasa received intelligence to the effect that two 20-foot containers on board a ship sailing to the Port of Mombasa was suspected to be stolen motor vehicles from the United Kingdom.

The containers arrived at the Port of Mombasa on May 11, 2019 aboard MV. MSC Positano from Oman and had not been declared.

Authorities subjected the two containers to x-ray cargo scanning where the images revealed the presence of top of the range motor vehicles.

According to import documents, the Range Rover Sport cars, which were subject of an international motor vehicle crime and smuggling investigation, were on transit to Uganda.

“a multi-agency team led by Customs officials undertook a verification exercise on May 28, 2019 confirming the …

The Kenyan government has now resorted to vetting of importers and exporters of consolidated cargo in the latest move to curb tax evasion.

This comes in the wake of recent piling of cargo at the Nairobi Inland Container Deport (ICD) as authorities opted for 100 per cent verification on containers with consolidated goods.

This is on suspicion of under-declaration and misdeclaration by traders in a tax evasion racket that has been denying the government revenues amounting to billions of shillings.

Rogue state officials have been accused of colluding with unscrupulous traders to facilitate false declarations, denying the Kenya Revenue Authority (KRA) requisite taxes, such as import duty, a move said to have led to a loss of over Ksh100 billion(US$987.8million) in the recent past.

They are also said to allow in counterfeits into the market and through the transit route into the hinterland in exchange for kickbacks.

The verification process …

Kenya has moved to rein in betting companies in what has been described as an ‘increasing political opposition into the industry as a whole.’

The industry has been thriving in the country until the government in late 2017 embarked on different measures to control gambling.

Top on the onslaught has been Kenya Revenue Authority, Cabinet Secretary of Interior Dr Fred Matiang’i and Betting Control and Licensing Board (BCLB) which has either objected in the manner betting companies were operating or complained of tax evasion.

Dr Matiang’i made good his threat to deport foreign operatives of these betting companies by signing deportation letters of 17 workers of different companies on charges of working in Kenya illegally as well as evading taxes.

He said betting companies owe KRA huge sums of money in revenue and their presence in Kenya was making the situation worse.

“Poignantly, attempts to recover this amount have not …

The two have agreed to implement a Single Customs Territory (SCT) to enhance clearance of goods and promote trade

After close to two years of a trade tension between Kenya and Tanzania on free market access of locally produced goods, the two neighbours have agreed to call a truce.

Back-to-back trade talks have seen the two agree to open their borders for trade while they move to jointly implement a Single Customs Territory (SCT), as agreed, to enhance the process of clearance of goods.

The SCT is a step towards a full customs union, achievable by the removal of restrictive regulations and reducing internal border controls on goods moving between partner states. The ultimate goal is the free circulation of goods.

The tiff

The two East Africa Community (EAC) member states have recently been entangled in a trade raw on local content which led to a tit-for-tat ban on some …

Delivery has become the in-thing in the market. Customers nowadays don’t have to go to the shops but can just order, make a payment (either before or on delivery) and receive their orders at home, in the office or have them delivered wherever they want. The Exchange spoke to Glovo, a startup founded in 2015 in Barcelona, and launched in Kenya in February this year. The service is present in over 20 countries and more than 100 cities. With over 10 years in business development, seven of which have been in the tech world, Glovo Market Lead (Sub-Saharan Africa) Priscila Muhiu divulges into the logistics business in Kenya and the region.

What makes the logistics space in Kenya an attractive prospect and why is Glovo in this business?

Logistics is the key driver to any economy. Without logistics, businesses will not be able to get their goods to their …

The Kenya Revenue Authority (KRA) has hit a technical snag in its efforts to collect taxes amounting to more than Ksh2.7 billion (USD26.6 million) per month, accruing from betting wins.

This follows a court order issued by a magistrate’s court barring the taxman from accessing the monies.

The orders issued by Senior Resident Magistrate D.M. Kivuti sitting at the Milimani Commercial Courts (Nairobi) have stopped the operations of crucial Income Tax Act sections (Sections 2, 10, 34 and 35), effectively rendering KRA unable to collect the levies, earmarked for national development projects.

This is per the budget for the current financial year ending June 30, where National Treasury Cabinet Secretary, Henry Rotich, had planned to have taxes drawn from betting activities finance sports, art, cultural developments and the rollout of the Universal Health programmes.

The order issued by Senior Resident Magistrate Kivuti follows the 2014 filing of a suit by …

Wealthy Kenyans are hoarding nearly two times Kenya’s 2018-19 Sh3 trillion (USD 30 billion) budget representing about 65 per cent of Kenya’s GDP.…

The government expects private sector to contribute 60% of the development

International property developers are angling themselves to tap into the housing projects in Kenya’s Big Four Agenda, a boost to President Uhuru Kenyatta’s ambition to deliver 500,000 units by 2022.

This came out at the sixth East Africa Property Investment Summit (EAPI) held in Nairobi this week, where the government called on the private sector to support the projects, assuring them of offtake.

An offtake assurance or agreement is a commitment between a producer and a buyer to purchase or sell portions of the producer’s future production.

“We want to assure the developers that whatever they build, we will buy,” Charles Hinga, Kenya’s Principal Secretary -State Department of Housing and Urban Development.

He spoke during the event which saw Nairobi host some of the largest international and regional developers and financial investors such as USA’s Echostone housing, South Africa’s …