- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

- Powering Africa: Africa’s Path to Universal Electricity Access

- Global investment trends at AIM Congress 2024: a spotlight on the keynote speakers

- South Africa’s deepening investment ties in South Sudan oil industry

- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

Browsing: Kenya Revenue Authority (KRA)

Kenya Revenue Authority has reached a new record of revenue collection to hit Sh1.669 Trillion in the 2020/21 financial year, compared to Sh1.607 Trillion collected in FY 2019/20.

In a statement, the Authority’s Director-General Githii Mburu says that this is in spite of the challenging operating economic environment brought about by the COVID-19 Pandemic.

“Kenya Revenue Authority (KRA) has defied all odds to surpass its revenue target after eight (8) years, since FY 2013/14,” the Authority said.

The FY 2020/2021 revenue target as reflected in the 2021 Budget Policy Statement was Sh1.652 Trillion which KRA says it surpassed with a surplus of Sh16.808 Billion.

This represents a performance rate of 101 percent and revenue growth of 3.9 percent compared to the last Financial Year.

KRA says the performance is consistent with the prevailing economic indicators, especially the projected GDP growth of 0.6 percent in 2020.

During the period under review, …

Kenyan businesses can now heave a sigh of relief after court has finally granted an injunction on minimum tax case.

In January this year, eight business associations representing the business community in Kenya have come together to call for the abolishment of the 1 per cent minimum tax introduced by the government.

The new bill which was to take effect on 1st January this year was introduced through the Finance Bill, 2020 (the Bill).

The bill was tabled in the National Assembly for debate and approval on 6 May 2020. This was a departure from previous years where finance bills would be introduced to the National Assembly after the reading of the national budget in June. This change was necessitated by recent constitutional interpretations issued by the court which barred the government from collecting taxes before the relevant tax provisions are approved by the …

How to File nil returns in Kenya

A nil income tax return is filed to show the Income Tax Department that you fall below the taxable income and therefore did not pay taxes during the year, according to ClearTax.

According to the Kenya Revenue Authority (KRA) by the end of June 2019, it collected Ksh 1.580 trillion as opposed to the targeted Ksh 1.435 trillion projected by the Treasury.

Requirements for filling KRA Nile Returns

Your KRA pin and your iTax account.

How to file nil returns in Kenya

- Log in to iTax

Visit https://itax.kra.go.ke/KRA-Portal. On the left, you will see an empty tab, enter your KRA pin or your ID and click on continue.

Enter your password and a key to answer the Security Stamp question. In case you have forgotten your password click on the forgotten password and follow the steps to reset it.

- Select File

Tanzania has released reprinted versions of several denominations of the country’s banknotes. The new banknotes are meant to be more secure against duplication and forgery.

The new security features include the removal of the classic thin stripe in the old banknote, called the motion thread and replacing it with a rolling star.

The former security feature (the motion thread) used a motion image that had special colour effects when the note is moved side to side.

The new feature now, the rolling star, also has a movement and color change trait, but makes wavy motions when the note is tilted.

The central bank, the Bank of Tanzania (BoT) announced early April that the change affects denominations of TZS 2000, 5000 and 10000.

The last time the BoT changed the country’s banknotes was in 2010. The central bank’s Governor Professor Florens Luoga explained in a press statement that the re-printed banknotes …

Commercial banks in Kenya have been on the limelight with accusations of abetting money laundering and being involved in national corruption scandals. Such was the case several banks which in 2018, CBK accused them of participating in payments for the National Youth Services (NYS) scandal.,

In this case, the director of public prosecution announced that he was considering prosecuting 20 senior officials in five banks, which they believe aided the laundering of at least Ksh1 billion ($10 million) looted from the National Youth Service (NYS) between January 2016 and April 2018.

These commercial banks have however developed mechanisms to conform to anti-money laundering laws developed in Kenya.

The law requires all financial institutions including banks, insurance companies, and SACCOs to file with the Financial Reporting Centre daily reports on transactions above Sh1 million and those deemed suspect. This is under the Proceeds of Crime and Anti-Money Laundering Act (POCAMLA).

Bank

Kenya has become one of the latest countries to strengthen the fight on tax evasion and profit shifting with signing of a tax treaty, in the wake of rising malpractices by global multi-nationals.

The national efforts to strengthen the country’s bilateral tax treaties, have received a boost with the signing of a multilateral convention to end tax avoidance in France.

This week, the country signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting Convention at the 10th Anniversary Meeting of the Global Forum on Transparency and Exchange of Information for Tax Purposes (the Global Forum) in Paris.

The Convention is the first multilateral treaty of its kind, allowing international collaboration initiatives to end tax avoidance among multinational firms under the OECD/G20 BEPS Project.

READ ALSO:Kenya’s tax evaders put on notice by President Kenyatta

The OECD/G20 BEPS Project delivers solutions for governments …

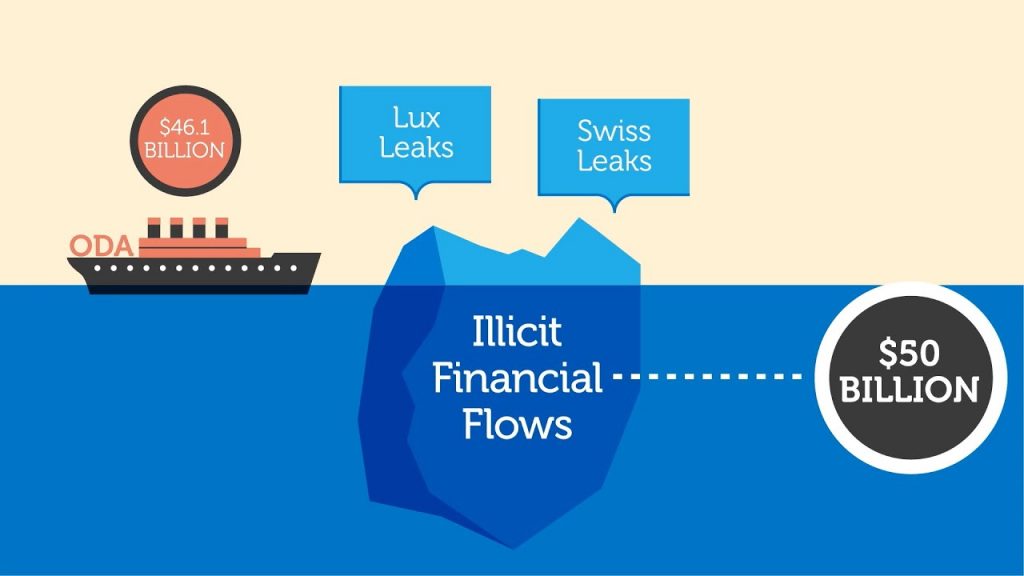

Kenya has stepped up efforts to curb illicit financial flows (IFFs) through the signing of theYaoundé Declaration, with Africa losing $50 to $60 billion annually through illicit financial flows.

The National Treasury Acting Cabinet Secretary Ukur Yatani has provided the much needed shot in the arm for the Kenya Revenue Authority (KRA) efforts to tackle illicit financial flows through the Yaoundé Declaration.

While welcoming the commitment by the Government, KRA Commissioner General Githii Mburu said the instrument focuses on improving international tax cooperation through enhanced information sharing among the African Union (AU) member states to curb illicit financial flows.

READ ALSO:Corruption fueling illicit flow of money from Africa, delegates in Nairobi discuss

“KRA is encouraged by the Government’s swift moves to prioritize the signing of international treaties that will accelerate efforts to curb international tax evasion,” Githii said.

In a communique to the Chairperson of the Global Forum on …

Kenya is keen to boost its trade with Ethiopia through the One Stop Border Post initiative, even as Lamu Port South Sudan-Ethiopia Transport (LAPSSET) corridor starts to take shape.

Acting Cabinet Secretary for National Treasury and Planning Ambassador Ukur Yatani has called on residents of the upper eastern region at the Kenya-Ethiopia border to take advantage of recently established One Stop Border Point (OSBP) in Moyale to boost trade between Kenya and Ethiopia.

READ ALSO:Ethiopia beats Kenya in Foreign investments

The CS said that the modern facility which is among other six in the country was underutilized.

“We should see more trade volumes passing through the OSBP at Moyale- an indication of a robust business activity between Kenya and Ethiopia. Unfortunately, we are not witnessing this. I wish to urge residents in this region to make use of this exemplary facility for their good and the good of both …

Barely a month after intercepting a consignment of contrabands and illegal imports at the Port of Mombasa, Kenyan authorities have yet again seized another multi-million shipment by rogue importers in Kenya.

Kenya Revenue Authority (KRA) seized 144 drums of imported Ethanol at the Port of Mombasa, which had been mis-declared as 1,000 bags of cement.

Customs officers have also seized another high end motor-vehicle, a Range Rover Sports suspected to have been stolen from the United Kingdom which had been mis-declared as second hand window frames, doors, folding chairs, stools and wall pictures.

READ ALSO:KRA intercepts narcotics disguised as candy at JKIA

The Ethanol was imported in two by twenty feet containers while the vehicle was in a twenty-foot container. The two were intercepted following intelligence reports; they were scanned through KRA’s non-intrusive scanners and the images showed inconsistency with what had been manifested.

A multi-agency team lead by …

Kenya Airways is launching new routes to new destinations as it seeks to turn around years of loss-making despite the airlines’ losses prediction worsening its situation.…