- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

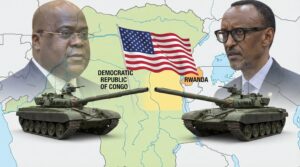

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Browsing: inflation

McKinsey’s report notes that the wages of consumers are steadily being eroded. Wages in the largest economies reportedly flatlined; in other words, no significant change in their levels was recorded. Prior to the pandemic, the same wages were said to have increased, giving workers the upper hand in negotiations. The pandemic, however, drastically altered that state of affairs. Wages in developed markets post the pandemic are also related, but the advent of inflation has checked that growth and, in some instances, set the trend backwards.

In the United Kingdom, there have been reports of wages being lower year on year.

The culmination of these factors is that the outlook for global economic growth will be lower this year than last. McKinsey expects central banks to increase interest rates more assertively to deal with inflationary pressure. The risk of recession is becoming more and more prevalent.

If it so happens that the said stimulus package is financed by increasing the money supply. It may have unintended and unpleasant consequences.

Economists have a phrase that means the same as “in a perfect world”. Economists will often say “ceteris paribus”. In a perfect world, government expenditure would have been all that is necessary to fix the lingering economic problems confronting the world post-COVID. However, reality would beg us to consider that government expenditures of money that they did not have to jump-start economies that were in a prolonged period of stasis would invariably lead to inflationary pressures. The United States has been grappling with the problem of inflation throughout 2021.

Its inflation figures are the highest they have been in decades. The fascinating thing about this current brand of inflation is that it is multi-faceted. Granted, it began when governments decided to spend their way out of an economic slump and introduced inflationary pressure on the global economy.

According to the Armed Conflict Location & Event Data Project, North Africa has been rocked by protests more than any other region on the continent, even though it recorded the greatest improvements in wealth. The continent started experiencing unrest during the 2007-2008 global financial crunch. In North Africa, human development is dwarfed by the demand for greater political, civil and economic freedom. Governments in these regions have been accused of being authoritarian.

Have the protests been successful? In Tunisia, for instance, the country has transitioned to democracy. However, people’s expectations have not been met fully as the new democracy is more electoral than substantive and real institutional reform is yet to occur. Notable reforms have taken place in Algeria and Egypt, but Libya, brought down to its knees by the Arab spring, has yet to recover and has fallen into civil strife.

In Sierra Leone, the New York Times reported that demonstrations over the high cost of living had turned deadly.

In July, food street vendors organised peaceful demonstrations over the crisis but have since been joined by political protesters. They demanded the resignation of the country’s president Julius Maada Bio over his government’s failure to address the rising food and fuel prices. They clashed with the police leading to the death of 11 officers and an unknown number of protesters.

Every African region has felt the effects of Russia’s invasion of Ukraine, with West Africa also bearing the burden of…

The practical implementation of the AfCFTA, the expanding middle class, the evolving consumer market, enhanced use of financial technology and services, and the efficiency of the vibrant private sector will all be enablers of African export diversification and long-term economic growth.

The economy is now projected to grow by 4.6% during 2022, a downward revision from the original 5.5% projection Reserve…

The most significant concern is Africa’s susceptibility to growing inflation in developed and developing economies, given the continent’s reliance on imports.

President Mnangagwa said his Government is convinced that the recent exchange rate movements were driven by negative sentiments by economic agents as opposed to economic fundamentals.

“These negative sentiments have been propagating adverse expectations on future inflation and exchange rate movements, thus giving rise to artificially high demand for foreign currency as economic agents hedge against expected high inflation,” he added.

The Government listed measures that are expected to restore macroeconomic stability, support the current robust economic recovery trajectory, boost economic confidence, increase the appeal of the local currency, preserve value for depositors and investors and deal with market indiscipline.

The global economy has come back strongly. So has inflation. Commodity prices are also making a strong comeback; however, their…

If you received your salary on the 1st of January in ZWL, you would struggle to pay for goods and services in February. This volatile situation results in consumers seeing value eroded from their bank balances at an astonishing rate.

We see wages struggle to keep up with inflation, a phenomenon similar to 2008. Most people buy USD from the black market to retain some semblance of value in these balances.

Zimbabwe has a currency crisis, and the Authorities seem to be struggling to deal with it. The rate at which the Zimbabwe dollar is depreciating signifies the state of the economy. Much of this is being blamed on the countries foreign currency auction system.